Bonanza Creek Energy Inc. and Extraction Oil & Gas Inc. have agreed to merge. The all-stock deal would create a pure-play Colorado Denver-Julesburg (DJ) basin producer—Civitas Resources Inc.—with an aggregate enterprise value of about $2.6 billion based on May 7 closing share prices.

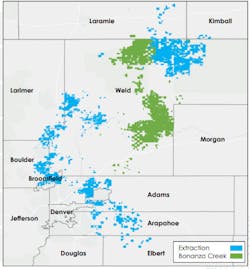

The combine will operate across 425,000 net acres with a production base of 117,000 boe/d (on a pro forma first-quarter 2021 production basis). These operations are geographically diversified across rural, less regulatory-intensive areas, as well as more prospective suburban acreage, Bonanza Creek said in a release May 10.

Civitas expects to achieve annual expense and capital savings of $25 million.

Bonanza Creek president and chief executive officer, Eric Greager, will serve as president and chief executive officer of the newly-combined company. Matt Owens will serve as executive vice-president and chief operating officer, and Marianella Foschi will serve as executive vice-president and chief financial officer.

Upon completion of the deal, Bonanza Creek and Extraction shareholders will each own about 50% of Civitas, both on a fully diluted basis.

The deal is expected to close in third-quarter 2021, subject to customary closing conditions and approval by shareholders of both companies. Funds managed by Kimmeridge Energy own about 38% of the outstanding shares of Extraction and have entered into a support agreement to vote in favor of the transaction.

As of Apr. 1, 2021, Bonanza Creek and Extraction had combined cash on hand of $127 million and combined undrawn capacity under their credit facilities of $651 million.

Extraction emerged from bankruptcy in January of this year (OGJ Online, Jan. 20, 2021).