EQT forms $3.5-billion midstream joint venture with Blackstone

EQT Corp. has formed a new midstream joint venture (JV) with Blackstone Credit & Insurance (BXCI) consisting of EQT's ownership interest in certain contracted infrastructure assets.

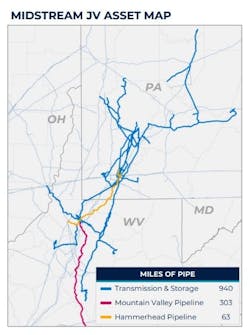

Under the terms of the agreement, BXCI will provide $3.5 billion of cash consideration to the Appalachian basin-focused company in exchange for a non-controlling common equity interest in the new JV, which will include Mountain Valley Pipeline LLC (MVP) series A (49%), FERC regulated transmission and storage assets, and the 1.6-bcfd Hammerhead pipeline. The gathering header pipeline is primarily designed to connect natural gas produced in Pennsylvania and West Virginia to MVP, Texas Eastern Transmission and Eastern Gas Transmission.

EQT will retain the rights to growth projects associated with the assets contributed to the JV, including the planned MVP expansion and the MVP Southgate project.

EQT plans to use proceeds from the deal to pay down its term loan and revolving credit facility and redeem and tender for senior notes. Pro-forma for this transaction, along with the company’s noted plan to divest its remaining non-operated assets in northeast Pennsylvania, EQT expects to exit 2024 with about $9 billion of net debt.

EQT chief financial officer Jeremy Knop said the transaction is a “tailor-made equity financing solution at a price significantly below EQT's equity cost of capital,” that aids in the debt reduction plans the company committed to following its Equitrans acquisition earlier this year (OGJ Online, Apr. 9, 2024).

“We have now delivered on that promise, with announced divestitures to date totaling $5.25 billion of projected cash proceeds, above the high-end of our $3-5 billion asset sale target, and several quarters ahead of schedule,” he said.

The transaction is subject to customary closing adjustments, required regulatory approvals and clearances, and is expected to close in fourth-quarter 2024.