Rystad Energy: US oil production has limited downside risk in the short term

US oil production has gained significant momentum and downside risk of US oil production in the short term is limited, even if oil prices collapse to $40/bbl or even $30/bbl, according to Rystad Energy, a Norway-based industry consultant.

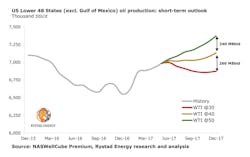

Looking at the recent evolution of oil production in the Lower 48 states excluding the Gulf of Mexico, Rystad Energy observes a continuous expansion, with a 430,000-b/d growth from December 2016 to May 2017. Even though late-2016 production levels were adversely exposed to winter storms in several states, the growth from the average level in 2016 fourth quarter to May 2017 is still significant, about 340,000 b/d.

In this year’s first quarter, the majority of shale-dedicated operators were able to achieve oil production levels about the high-end of guidance or beat it on several occasions.

According to Rystad Energy, despite growing concerns about service cost inflation in the most active basins, completion activity is set for a steep expansion throughout the remainder of this year. US Lower 48 oil production is set to expand by an additional 390,000 b/d from May to December assuming a WTI price of $50/bbl, Rystad Energy forecasts.

The recovery in rig counts has been outpacing the growth in completion activity since the second half of 2016, resulting in a strong build-up of new high-quality inventory of drilled uncompleted (DUC) wells. Should the prices collapse to $40/bbl or even $30/bbl level, a major part of these DUCs can still be completed commercially given that drilling costs are sunk. Therefore, a drastic downward shift in the market conditions will not lead to a rapid collapse of the US oil production. No more than 500,000 b/d of December 2017 volumes are at risk in the $30/bbl scenario, according to Rystad Energy.

“If the prices go down to $30/bbl and we assume that operators behave rationally, we should observe relatively quick adjustment of activity, which will result in a temporary contraction of output with stabilization in the fourth quarter at the level 100,000 b/d lower than the current output as base production gets more mature,” says Artem Abramov, vice-president, analysis, at Rystad Energy. “In reality, history tells us that many operators will rely on hedging gains or simply outspend more, so short-term evolution of supply in the $30/bbl world might end up much closer to the rational $40/bbl or even $50/bbl scenarios.”