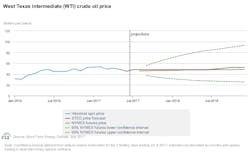

The US Energy Information Administration expects Brent crude oil prices to average $51/bbl in 2017 and $52/bbl in 2018, down $2/bbl and $4/bbl, respectively, from last month’s Short-Term Energy Outlook.

In its July STEO, the agency forecasts West Texas Intermediate crude prices to average $2/bbl lower than the Brent price in both 2017 and 2018.

Global oil inventories are forecast to be relatively unchanged in this year’s second half before returning to average inventory builds of 200,000 b/d in 2018. Given the expectation of relative balance in the global oil market through the forecast period, Brent crude prices are expected to remain fairly flat in the coming months. Brent is projected to average $50/bbl during this year’s second half as well as first-half 2018.

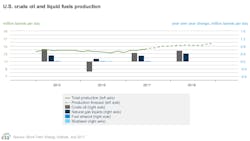

Given lower prices, EIA reduced its forecast for US crude production in 2018 by 100,000 b/d to 9.9 million b/d, which would still be the highest annual average in US history. The record is 9.6 million b/d in 1970. EIA maintains US output this year will average 9.3 million b/d.

EIA expects production from nonmembers of the Organization of Petroleum Exporting Countries to rise 1 million b/d in 2017 and 1.2 million b/d in 2018. In addition to the US, production growth will come from Canada, Brazil, and Kazakhstan.

OPEC crude production is expected to fall by 200,000 b/d in 2017 as members have limited production based on their November 2016 agreement to collectively curb output. EIA’s forecast assumes a further extension of the agreement in 2018 but with lower compliance. Without a further extension of the agreement, EIA would expect larger inventory builds in 2018 than are included in this forecast.

EIA projects OPEC crude output will rise 500,000 b/d in 2018, driven by an increase in output in Iraq. The increase in Iraq’s production in 2018 is expected to result from production coming online that was previously scheduled for 2017.

In both 2017 and 2018, EIA expects crude production to increase in Libya and Nigeria, which are countries not covered by the supply-reduction agreement. In Libya, previously shut-in fields have seen rapid increases in output since third-quarter 2016. Libya’s production, meanwhile, reached more than 1 million b/d in early July.