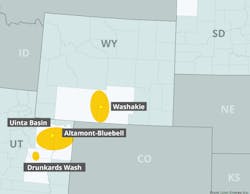

Linn to sell its interest in Wyoming’s Washakie field

Linn Energy Inc., Houston, has agreed to sell its interest in 163,000 net acres in Washakie field of Wyoming to an undisclosed buyer for $200 million in the latest deal of its ongoing divestiture program.

The properties’ second-quarter net production averaged 66 MMcfd of gas equivalent, flowing from 7,500-11,500 ft. Their proved reserves total 226 bcf of gas equivalent with proved developed PV-10 of $102 million.

Annualized field level cash flow on the properties is $35 million, which does not include estimated annual general and administrative expense of $4-5 million. For the fourth quarter, the firm had budgeted $3 million of capital for the properties.

The deal, effective Aug. 1, is expected to close in the fourth quarter. Linn also says it will increase its previously announced share repurchase program to $400 million of the firm's outstanding shares of Class A common stock. Through Sept. 30, Linn has repurchased 4.6 million shares for $157 million at an average price of $34.06/share.

“This latest sale of noncore assets is another step forward in the ongoing transformation of Linn from a highly levered production-based [master limited partnership] to a low cost, streamlined growth-oriented enterprise,” said Linn Chairman Evan Lederman.

Linn says it continues to market its remaining assets in the Permian and Williston basins. The firm also plans to sell its interests in Altamont Bluebell field in Utah and its mature waterfloods in Oklahoma. Year-to-date, Linn has announced sale agreements totaling more than $1.3 billion.

In Wyoming alone this year, the firm has sold its interests in Jonah and Pinedale fields as well as its interest in Salt Creek field in two separate deals. Linn also has exited California and South Texas and sold some interests in the Permian.

Linn emerged from bankruptcy earlier this year and has since shifted its focus onto the Anadarko basin’s Merge-SCOOP-STACK play, forming the 50-50-owned Roan Resources LLC alongside Citizen Energy II LLC this summer (OGJ Online, June 28, 2017).

Contact Matt Zborowski at [email protected].