According to the International Energy Agency’s World Energy Outlook 2017, up until the mid-2020s, oil demand growth remains robust in the New Policies Scenario (NPS) but slows markedly thereafter as greater efficiency and fuel-switching bring down oil use for passenger vehicles. IEA’s NPS models current and announced energy policies, including those from the Paris Climate Agreement.

Powerful impetus from other sectors, however, is enough to keep oil demand on a rising trajectory to 105 million b/d by 2040. Oil used for petrochemical production is the largest source of growth, followed closely by rising consumption for trucks (fuel-efficiency policies cover 80% of global car sales today, but only 50% of global truck sales), for aviation, and for shipping.

“The world’s consumers are not yet ready to say goodbye to the era of oil,” IEA said.

IEA said once US tight oil plateaus in the late 2020s and non-OPEC production falls back, the market becomes increasingly reliant on the Middle East to balance the market. There is a continued large-scale need for investment to develop a total of 670 billion bbl of new resources to 2040, mostly to make up for declines at existing fields rather than to meet the increase in demand.

Meanwhile, with projected demand growth appearing robust—at least for the near term—a third straight year in 2017 of low investment in new conventional projects remains a worrying indicator for the future market balance, creating a substantial risk of a shortfall of new supply in the 2020s, IEA said.

US shale

IEA’s forecasts an 8 million-b/d rise in US tight oil output from 2010 to 2025 would match the highest sustained period of oil output growth by a single country in the history of oil markets. A 630 billion-cu m increase in US shale gas production over the 15 years from 2008 would comfortably exceed the previous record for gas.

“Expansion on this scale is having wide-ranging impacts within North America, fueling major investments in petrochemicals and other energy-intensive industries. It is also reordering international trade flows and challenging incumbent suppliers and business models,” IEA said.

By the mid-2020s, IEA says the US becomes the world’s largest LNG exporter and a few years later a net exporter of oil—still a major importer of heavier crudes that suit the configuration of its refineries, but a larger exporter of light crude and refined products.

Natural gas markets

Meantime, natural gas becomes the second-largest fuel in the global mix after oil by 2040, accounting for a quarter of global energy demand in the NPS.

Gas consumption rises 45% to 2040. With more limited room to expand in the power sector, industrial gas demand becomes the largest area for growth.

Eighty percent of the projected growth in gas demand is from developing economies, led by China, India, and other Asian countries. This reflects the fact that gas looks a good fit for policy priorities in this region due to widespread concerns over air quality.

However, the competitive landscape is formidable, not just due to coal but also to renewables, which in some countries become a cheaper form of new power generation than gas by the mid-2020s, pushing gas-fired plants towards a balancing rather than a baseload role.

Efficiency policies also play a part in constraining gas use: while the electricity generated from gas grows by more than half to 2040, related gas use rises by only one-third, due to more reliance on highly efficient plants.

On the supply side, IEA noted that ensuring that gas remains affordable and secure, beyond the current period of ample supply and lower prices, is critical for its long-term prospects.

Gas supply also becomes more diverse: the amount of liquefaction sites worldwide doubles to 2040, with the main additions coming from the US and Australia, followed by Russia, Qatar, Mozambique, and Canada. Price formation is based increasingly on competition between various sources of gas, rather than indexation to oil.

Over the longer term, a larger and more liquid LNG market can compensate for reduced flexibility elsewhere in the energy system, such as lower fuel-switching capacity in some countries as coal-fired generation is retired. According to IEA’s estimates, in 2040, it would take around ten days for major importing regions to raise their import levels by 10%, a week less than it might take today in Europe, Japan, and South Korea.

LNG accounts for almost 90% of the projected growth in long-distance gas trade to 2040: with few exceptions, most notably the route that opens between Russia and China, major new pipelines struggle in a world that prizes the optionality of LNG, IEA said.

Energy demand overview

This year, the outlook highlights four “large-scale shifts in the global energy system: the rapid deployment and falling costs of clean energy technologies, the growing electrification of energy, the shift to a more services-oriented economy, and a cleaner energy mix in China, and the resilience of shale gas and tight oil in the US.

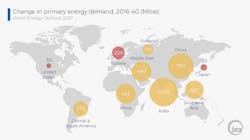

IEA expects global energy needs to rise more slowly than in the past but still expand 30% between today and 2040. This is the equivalent of adding another China and India to today’s global demand.

India will contribute most, almost 30%, to demand growth. India’s share of global energy use rises to 11% by 2040, though still well below its 18% share in the anticipated global population.

Southeast Asia is another rising heavyweight in global energy, with demand growing at twice the pace of China. Overall, developing countries in Asia account for two-thirds of global energy growth, with the rest coming mainly from the Middle East, Africa, and Latin America.

The emphasis in China’s energy policy is now firmly on electricity, natural gas and cleaner, high-efficiency and digital technologies, as the president’s call for an “energy revolution”, the “fight against pollution” and the transition towards a more services-based economic model. China’s choices will play a huge role in determining global trends, and could spark a faster clean energy transition, IEA said.

According to the outlook, as they become the least-cost source of new generation for many countries, renewable sources of energy meet 40% of the increase in primary demand and their explosive growth in the power sector marks the end of the boom years for coal.

Also, “the future is electrifying,” IEA said. Electricity is the rising force among worldwide end-uses of energy, making up 40% of the rise in final consumption to 2040—the same share of growth that oil took for the last 25 years.

The forecast for nuclear power has dimmed since last year’s outlook, but China continues to lead a gradual rise in output, overtaking the US by 2030 to become the largest producer of nuclear-based electric power.