BP: Fossil fuels to remain ‘dominant form of energy’ through 2035

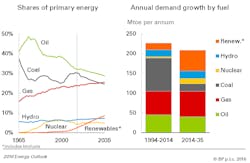

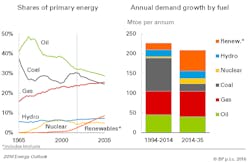

Global energy demand between 2014 and 2035 is expected to rise 34%, an average of 1.4%/year, with fossil fuels remaining “the dominant form of energy over the period,” according to the 2016 edition of the BP Energy Outlook.

Despite the rapid growth of other energy sources, the firm projects that fossil fuels will fulfill 60% of the expected demand increase and account for almost 80% of the world’s total energy supplies in 2035.

Demand for natural gas will increase the fastest among the fossil fuels, rising 1.8%/year while oil demand will rise steadily at 0.9%/year, although its share of the energy mix continues to decline, the outlook indicates.

Global shale gas production is projected to increase at 5.6%/year, with the share of shale gas in total gas production rising to 25% by 2035 from 10% in 2014.

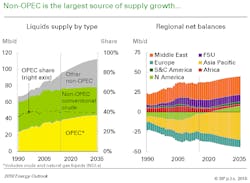

Meanwhile, BP sees the global oil market gradually rebalancing, with the current low level of prices boosting demand and dampening supply.

Global liquids demand is forecast to increase 20 million b/d to 112 million b/d by 2035, while global liquids supply is seen rising 19 million b/d by 2035, led by growth in non-OPEC supply.

US shale, tight oil elsewhere, Brazilian deepwater, Canadian oil sands, and biofuels together rise by 16 million b/d, accounting for about half of non-OPEC production in 2035. OPEC is likely to act to maintain its market share of 40%, lifting output by 7 million b/d to 44 million b/d by 2035, BP says.

By 2035, coal’s share in the energy mix is expected at an all-time low, with gas replacing it as the second-largest fuel source.

Non-fossil fuels are projected to grow even faster than anticipated in last year’s outlook. Renewables, including biofuels, are projected to grow at 6.6%/year, with their share in the energy mix up to 9% by 2035 from 3% currently.

Income, population growth key drivers

“The outlook for the next 20 years is for continuing growth of energy demand as the world economy expands and more energy is required to power higher levels of activity,” said Spencer Dale, BP’s group chief economist.

Income and population are the key drivers behind the growth. By 2035, the world’s population is expected to reach 8.8 billion, meaning an additional 1.5 billion people will need energy, the outlook notes. Over that same period, gross domestic product is expected to more than double, with China and India accounting for half of the projected increase.

“The continuing reform of China’s economy towards a more sustainable pattern of growth causes growth in its energy demand to slow sharply, weighing most heavily on global coal, which grows at less than a fifth of the rate seen over the past 20 years,” Dale explained.

More than half of the increase in global energy is used for power generation, with much of that increase taking place in regions where a large part of the population have limited access to electricity.

Electric power generation is a segment where all fuels compete and it will play a major role in the evolution of the fuel mix as renewables and gas replace coal-fired power stations. BP sees renewables accounting for more than a third of the expected growth in power generation.

Strong growth in emerging economies will drive a rise in world oil demand by 20 million b/d, with China and India accounting for more than half of the increase, as the number of vehicles on the planet more than doubles.

The growth rate of carbon emissions over the period, meanwhile, is expected to more than halve relative to the past 20 years, up 0.9%/year, down from 2.1%/year. The sharp reduction in the rate of emissions growth reflects, in almost equal parts, faster improvements in energy efficiency and a reduction in the carbon intensity of energy, BP says.