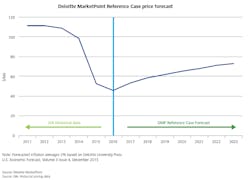

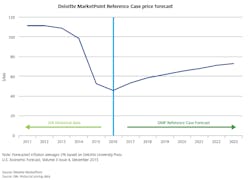

Deloitte: Supply shortfall to set $58/bbl oil in 2018

Deloitte Marketpoint forecasts a step up in oil prices from the mid-$40s in 2016 to increase to about $58/bbl by 2018 due to a supply shortage of more than 1 million b/d.

In its recent report, “The Balancing Act: A Look at Oil Market Fundamentals Over the Next Five Years,” Deloitte Marketpoint attributes the price increase to the eventual flattening of oil production from members of the Organization of Petroleum Exporting Countries in the near term, as well as canceled or delayed investments, investment carryovers, and excess storage drawdowns. The report forecasts prices to steadily rise beyond 2019, buoyed by supply decline and rising demand growth.

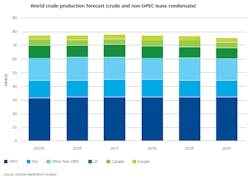

Supply outlook for 2016-20

The steep decline in oil prices over 2015 and the “new reality” of low prices for a longer period of time have led to the deferral of many high-cost projects. Based on research of public data and news releases, Deloitte Marketpoint estimates that non-OPEC cancellations and postponements include 1.3 million b/d of production over the next 5 years. A sizable portion, or nearly 1 million b/d, is related to high-cost Canadian oil sands projects that are not too late to be stopped.

The report identified 90 non-OPEC projects that were commissioned when oil was higher than $100/bbl and are now too far along to be stopped that will result in nearly 6.4 million b/d of new crude production over the next 5 years.

Three regions—the former Soviet Union, Europe, and Brazil—are expected to contribute more than 65% of the growth, with FSU leading with almost 1.6 million b/d expected to come online through 2020.

Canadian oil sands projects already under construction will add an estimated 800,000 b/d through 2020 with nearly 300,000 b/d coming online this year.

US tight oil production, specifically in three major basins—the Permian, Bakken, and Eagle Ford—is a main “supply wild card.” Deloitte MarketPoint projects average 2016 production for the Permian, Bakken, and Eagle Ford to reach 2.1 million b/d, 1 million b/d, and 1 million b/d, respectively.

In total, Deloitte MarketPoint estimates US tight oil production in 2016 will decline by 700,000 b/d. Total US crude production for 2016 is estimated at 8.7 million b/d.

An additional uncertainty regarding future production volumes is related to stripper well production. As cited by the report, according to the National Stripper Well Association, there are more than 400,000 stripper wells in the US accounting for an estimated 1 million b/d of production. These wells require crude prices in the low $30s in order to cover operating costs for these low volume wells.

Collectively, Deloitte MarketPoint forecasts non-OPEC crude oil production to decline 600,000 b/d to 44.5 million b/d in 2016.

On the other hand, near-term production growth from OPEC (including Indonesia, but excluding Iran) may be limited.

“As for Saudi Arabia, there is some question whether current production levels can continue despite the estimated spare capacity of roughly 2 million b/d. For Iraq, the current low price environment is impacting its coffers and capex budget,” Deloitte MarketPoint said.

Iran production is another main “supply wild card” impacting oil markets. Compared with the International Energy Agency’s expectation that Iran is capable of returning to its pre-sanction output level of 3.6 million b/d within 6 months of the sanctions being lifted, Deloitte MarketPoint’s reference case analysis uses a conservative estimate that Iranian production will increase by 500,000 b/d in 2016 and continue upward thereafter.

Deloitte MarketPoint estimates OPEC’s production to rise only 1.6% in 2016 compared with a 3.2% rise in 2015. Deloitte MarketPoint also assumes OPEC, with the exception of Iran, will continue to produce at current levels through 2020, and assumes Iran will produce an incremental 500,000 b/d in 2016 and grow an additional 300,000 b/d in 2017, putting Iran roughly back at pre-sanction production levels by yearend 2017.

“For 2017 through 2020, we apply decline rate estimates for existing production. Leveraging analysis discussed in the EIA’s World Energy Outlook 2013, we estimate non-OPEC annual decline rates at 4%. This reflects our estimate of an overall global average including both high-decline rate regions (e.g., US tight oil) as well as low-decline rate regions. We then added the new projects remaining in development. The net effect is 2017 should see production growth of 600,000 b/d. By 2018, we finally see production declining back to 2016 levels, which then continues downward, resulting in a nearly 2 million b/d decline from 2018 to 2020,” Deloitte MarketPoint said.

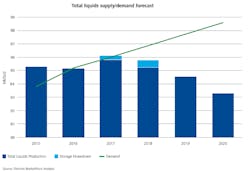

Demand, storage outlook

Deloitte Marketpoint uses the US Energy Information Administration’s expectations for 2016 liquids consumption as a starting point and apply the 2010-15 average compound annual growth rate (CAGR) for developing consumption growth rates for 2017 through 2020. The calculation leads to a 0.22% growth rate for countries from the Organization for Economic Cooperation and Development and 2.28% for non-OECD countries. Given the slowdown in China, Deloitte MarketPoint has assumed a slightly more conservative growth rate for non-OECD countries of 1.5%.

Based on these assumptions, total world liquids demand growth for 2016 reflects the EIA’s growth rate of 1.5% while Deloitte Marketpoint’s calculated total liquids growth rate for 2017 through 2020 is only 0.9%.

“Comparing the total liquids supply forecast with our liquids demand forecast, we show annual volumes are roughly in balance by the end of 2016, but we would see a supply shortage of around 0.29 million b/d by 2017—without available drawdowns from inventory. Presently, the 300 million bbl of excess storage could cover the entire 2017 shortfall by using only about one third of the current excess. The remaining excess storage could be drawn down for 2018, which reduces the overall shortage to 1.14 million b/d. As one can see, the shortfall of production is projected to widen beyond 2017. By 2020, the shortfall could reach over 5 million b/d,” Deloitte Marketpoint said.

A ‘checkmark’ recovery of oil prices

“Considering today’s price environment with many sources of crude oil at or near their ‘cash cost’ or variable lifting cost level, one could argue that a sustained period of low prices can’t continue for long unless future demand becomes materially weaker than we expect,” Deloitte Marketpoint said.

Deloitte Marketpoint presents a conceptual oil price outlook following a “checkmark” recovery: current low prices (Phase 1) (near cash-cost levels) will switch to a rapid step-up (Phase 2) in the second half of 2016, which boosts prices more rapidly, but not to the levels seen pre-crisis as efficiencies have increased and production costs have been reduced. Phase 3 will begin in the second half of 2017 as increases in higher cost elastic supply are needed to keep up with production decline and demand growth.

According to Deloitte MarketPoint’s reference case price forecast, prices will eventually rise more quickly from the mid $40s in 2016 to about $58/bbl in 2018.

“US tight oil production should return to some level of pre-crisis growth at these higher price levels. This shores up the production shortfall in 2018, but the larger shortfall expected in 2019 will need to be resolved by additional investment and production from Iran, Iraq, Brazil, and possibly Russia, and potentially even more growth in US tight oil,” Deloitte MarketPoint said.