IHS Markit: Apache’s Alpine High discovery in ‘historically underperforming area’

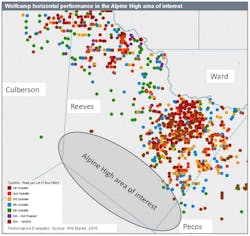

Analysis from IHS Markit indicates Apache Corp.’s southern Delaware basin Alpine High oil and gas discovery sits in a “historically underperforming area” where previous well results from other operators have been poor.

Apache has secured more than 300,000 contiguous acres, mainly in Reeves County, Tex., that it says hold an estimated 75 tcf of gas and 3 billion bbl of oil in the Barnett and Woodford shales alone (OGJ Online, Sept. 7, 2016). The firm also sees oil potential in the shallower Pennsylvanian, Bone Springs, and Wolfcamp formations.

“Nearly 10 years ago, several Permian basin specialist companies left the area after drilling a handful of unsuccessful wells,” explained Imre Kugler, senior consultant, energy research, at IHS Markit, and lead author of a new report entitled IHS Energy Plays & Basins Analysis—Apache’s Alpine High: An Early Look.

“Admittedly, unconventional drilling and completion technology has advanced a good bit since then, but well performance is critical, particularly in the current oil-price environment,” Kugler said. “You don’t have as much of a cushion or tolerance for failure or poor performance at today’s prices as you did at $120[/bbl].”

Kugler said some quality Wolfcamp wells owned by a variety of operators sit within 10 miles of the Apache acreage. However, there are also some poor performing wells nearby, so “it remains to be seen whether Apache’s initial success in the play will carry over into the Wolfcamp formation,” he said. “It’s too early to tell, but more drilling and appraisal will be necessary.”

According to the IHS Markit analysis, early economics for the area indicate gas production breaks even near $2.50/Mcf, and oil production breaks even at $55/bbl assuming a constrained 24-hr initial production rate equates to peak-month production and a $5-million well cost, the midrange guidance. If recently published IP rates indicate true 24-hr rates, then breakevens for the play will be closer to $65/bbl and $3/Mcf.

Kugler also noted interest in the Woodford gas play where the ratio of oil at peak is about 15%, but a six-well sample shows a wide variance of 1-19%. The projections only consider Woodford as there is just one Barnett well drilled in the area to date.

Kugler said “to make this part of the play viable, gathering infrastructure will need to be built out,” adding that “the play’s proximity to the nearby Waha hub helps.” He noted that associated gas production has doubled from 0.5 bcfd to nearly 1 bcfd during 2014-16 with Wolfcamp and Bone Spring development. “To fully monetize production from this gas and NGL play, additional takeaway capacity may be required,” he said.

Apache is increasing its 2016 capital spending by $200 million, more than 25% of Apache’s total capital spending program, to accelerate the delineation and development of Alpine High.