Parsley Energy to buy Midland basin assets for $400 million

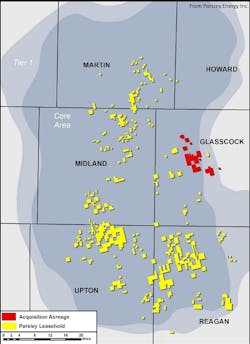

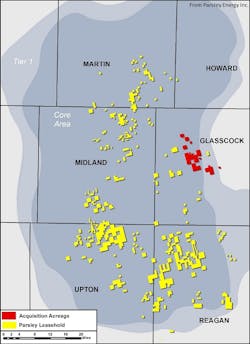

Parsley Energy Inc., Austin, has agreed to acquire undeveloped acreage and producing oil and gas properties in Glasscock County, Tex., along with associated mineral and overriding royalty interests, for $400 million in cash. Expected to close on or before Oct. 4, the deal will be financed through debt and equity issuances.

The assets cover 11,672 gross (9,140 net) acres near existing Parsley leasehold, with estimated current net production of 270 boe/d from 67 gross (60 net) vertical wells. Preexisting facilities and infrastructure on the acreage include five saltwater disposal wells.

The acreage features 240 gross (215 net) horizontal drilling locations in the Lower Spraberry, Wolfcamp A, and Wolfcamp B formations, based on 660-ft between-well spacing, with an estimated average lateral length of 7,500 ft. Parsley notes the presence of additional horizontal drilling locations on those formations. Average working interest from the identified drilling locations is 92%.

Separately, the firm says its first producing horizontal well on its Glasscock County acreage acquired in May has shown encouraging results. The Dwight Gooden 6-7-01AH well, 2.5 miles west of the acreage to be acquired, completed in the Wolfcamp A interval with a 5,890-ft stimulated lateral, registering a peak 30-day initial production rate of 1,161 boe/d, or 197 boe/d/1,000 stimulated ft.

Normalized to 7,000 lateral ft, the well is outperforming the firm’s 1 million boe EUR type curve for Midland basin Wolfcamp A/B wells by 10% after almost 90 days of production, generating 82% oil during that timeframe.

“Offset well performance and initial results on our first horizontal well in the area suggest that the properties to be acquired may compete with the best of our existing horizontal drilling inventory, and the acquisition of associated royalty interests boosts the return profile of these properties,” commented Bryan Sheffield, Parsley chief executive officer.

“We continue to build a high-quality acreage footprint consisting of favorably distributed development areas that can accommodate significant rig count additions, and we believe this acquisition represents an important step toward a large-scale, basin-wide development program that can generate sustainably strong production and cash flow growth,” Sheffield said.

Parsley’s previous deal for Midland basin acreage, first reported in April and completed in May, covered 8,711 net acres in Midland, Upton, Reagan, and Glasscock counties, Tex., with estimated net production of 1,100 boe/d from two horizontal wells and 77 vertical wells. It added 257 net horizontal drilling locations, and cost $215 million.

The firm in April also expanded its presence in the southern Delaware basin by agreeing to acquire 14,197 net acres in Reeves and Ward counties, Tex., for $144 million. That deal covered estimated net production of 1,200 boe/d from seven horizontal wells and 20 vertical wells. The following month, Parsley agreed to take another 29,813 acres in the basin with 17.5% average royalty interest for $280.5 million (OGJ Online, May 24, 2016).