First-quarter 2023 earnings benefit from higher refining margins

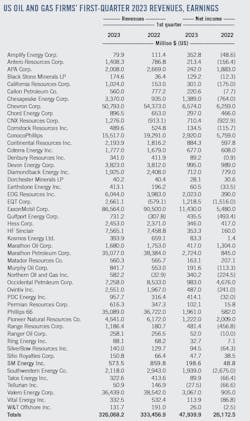

A group of 49 US-based oil and gas producers and refiners had total net earnings of $47.94 billion in first-quarter 2023, compared with earnings of $26.17 billion in first-quarter 2022. Total revenues were $326.07 billion for the quarter, compared with $333.46 billion a year ago.

In first-quarter 2023, upstream operating income was negatively impacted by lower crude oil and natural gas prices. In contrast, downstream operating income rose sharply as refining margins soared compared with year-ago levels.

Brent crude oil prices averaged $81.17/bbl in first-quarter 2023, compared with $101.20/bbl in first-quarter 2022 and $88.56/bbl in fourth-quarter 2022. West Texas Intermediate (WTI) averaged $76.08/bbl in first-quarter 2023, compared with $95.18/bbl in first-quarter 2022 and $82.69/bbl in fourth-quarter 2022.

In this year’s first quarter, US crude oil production averaged 12.54 million b/d, compared with 11.46 million b/d in first-quarter 2022, according to US Energy Information Administration (EIA) data. US natural gas liquids (NGL) production averaged 5.96 million b/d during the quarter, compared with 5.61 million b/d a year ago.

According to Baker Hughes, the number of active oil rigs in the US fell to 592 at end-March from 621 at end-December, reflecting declining oil prices. This also compared with 531 rigs at end-March 2022.

US commercial crude oil stock at the end of March was 470 million bbl, compared with 414 million bbl at the end of first-quarter 2022 and a 5-year average of 463 million bbl. US Strategic Petroleum Reserve (SPR) at the end of March was 370 million bbl, compared with 566 million bbl at the end of first-quarter 2022 and a 5-year average of 627 million bbl.

US oil product stock at the end of March was 757 million bbl, compared with 739 million bbl at the end of the same quarter a year ago and a 5-year average of 792.4 million bbl.

For first-quarter 2023, US refinery inputs were 15.78 million b/d, compared with 16.06 million b/d in the same period in 2022 and 16.35 million b/d for the previous quarter, reflecting planned maintenance. The refinery utilization rate was 87.5%, compared with 89.5% a year earlier and 90.8% in fourth-quarter 2022.

According to Muse, Stancil & Co., refining cash margins in first-quarter 2023 averaged $31.11/bbl for Middle-West refiners, $26.98/bbl for West Coast refiners, $30.31/bbl for Gulf Coast refiners, and $17.47/bbl for East Coast refiners. In the same quarter of the prior year, these refining margins were $15.44/bbl, $21.90/bbl, $16.67/bbl, and $8.76/bbl, respectively.

Natural gas prices at Henry Hub averaged $2.65/MMbtu in first-quarter 2023, compared with $4.66/MMbtu for the same quarter a year ago and $5.55/MMbtu in fourth-quarter 2022. Henry Hub prices fell as a result of significantly warmer-than-normal weather in the first quarter that led to less-than-normal consumption of natural gas for space heating and pushed inventories above the 5-year average. Natural gas inventory ended the quarter at 1,856.7 bcf, compared to a 5-year average of 1,519.8 bcf.

US marketed gas production increased to 110.68 bcfd from 103.25 bcfd for the same quarter a year ago, according to EIA.

US LNG exports averaged 11.61 bcfd during the quarter, compared with 11.49 bcfd in the previous quarter. The number of active gas rigs in the US grew to 160 at end-March from 156 at end-December. This also compared with 137 rigs at end-March 2022.

A sample of 12 oil and gas producers and pipeline companies with headquarters in Canada reported combined net earnings of $10.04 billion (Canadian dollar) in first-quarter 2023, compared with net earnings of $11.46 billion in the prior year’s first quarter.

Prices for Western Canada Select (WCS) decreased to $51.42/bbl in first-quarter 2023, from $80.50/bbl in the prior year quarter. WTI/WCS spread widened to $24.56/bbl in first-quarter 2023 from $14.55/bbl in first-quarter 2022. Bitumen prices decreased to $50.33/bbl from $89.30/bbl a year ago.

In first-quarter 2023, the average exchange rate of the Canadian dollar against the US dollar decreased to $0.74 from $0.79 in the prior year quarter.

US oil, gas producers

ExxonMobil Corp. had first-quarter 2023 earnings of $11.4 billion, compared with $12.8 billion in fourth-quarter 2022 and $5.48 billion in first-quarter 2022. Excluding the identified item associated with additional European taxes on the energy sector, adjusted earnings of first-quarter 2023 were $11.6 billion compared with $14 billion in the prior quarter.

Capital and exploration expenditures for first-quarter 2023 were $6.4 billion, on track to meet the company’s full year guidance of $23-25 billion. The company’s debt-to-capital ratio remained at 17% and the net-debt-to-capital ratio declined to about 4%, reflecting a period-end cash balance of $32.7 billion. ExxonMobil reiterated share repurchases of $35 billion in 2023-24.

ExxonMobil’s upstream earnings were $6.5 billion in first-quarter 2023, a drop of $1.7 billion from fourth-quarter 2022. The main drivers were lower prices, with crude and natural gas realizations down 10% and 23%, respectively, and unfavorable unsettled derivatives mark-to-market effects of $2 billion. These impacts were partially offset by robust cost control and seasonally lower expenses, the absence of yearend inventory effects, and favorable mix effects from advantaged growth in the Permian basin, Guyana, and in LNG. Adjusted earnings excluding identified items were $6.6 billion, down from $8.8 billion in the prior quarter.

Net production in the first quarter was 3.8 MMboe/d, an increase of nearly 160,000 boe/d compared with the same quarter last year. Excluding divestments, entitlements, and the Sakhalin-1 expropriation, net production increased nearly 300,000 boe/d driven by advantaged projects in Guyana and the Permian basin.

The company also noted sanction of the Uaru development in Guyana. This is the fifth offshore project and is expected to provide an additional 250,000 boe/d of gross capacity with start-up targeted for 2026.

Chevron Corp. had first-quarter earnings of $6.6 billion compared with $6.3 billion in first-quarter 2022. Adjusted earnings of $6.7 billion in first-quarter 2023 compared with adjusted earnings of $6.5 billion in first-quarter 2022.

First-quarter 2023 earnings increased compared with first-quarter 2022 primarily due to higher margins on refined product sales, partially offset by lower upstream realizations. Capital spending in the first 3 months of 2023 was up 55% from a year ago primarily due to higher investment in the US.

Chevron’s US upstream earnings were $1.78 billion in first-quarter 2023, lower than the $3.24 billion reported for first-quarter 2022, primarily on lower realizations. Chevron’s liquids realization averaged $59/bbl in first-quarter 2023, down from $77/bbl in first-quarter 2022. Net oil-equivalent production was down slightly from first-quarter 2022, primarily due to the Eagle Ford asset sale.

International upstream earnings were $3.38 billion, compared with $3.7 billion a year ago primarily due to lower realizations, lower sales volumes, and higher tax charges related to changes in the energy profits levy in the UK, partially offset by lower operating expenses. Net oil-equivalent production was down 64,000 b/d from a year earlier primarily due to the end of the Erawan concession in Thailand.

US downstream earnings were $977 million for first-quarter 2023, higher than the $488 million a year ago primarily due to higher margins on refined product sales, partially offset by higher operating expenses and lower earnings from the 50%-owned Chevron Phillips Chemical Co. Refinery crude oil input decreased 3% compared with a year ago, primarily due to planned turnaround impacts at the El Segundo, Calif. refinery. Refinery product sales were up 3% from a year ago, primarily due to higher renewable fuel sales following the Renewable Energy Group Inc. acquisition and higher jet fuel demand. International downstream earnings also increased primarily due to higher margins on refined product sales, partially offset by higher operating expenses.

ConocoPhillips had first-quarter 2023 earnings and adjusted earnings of $2.9 billion, compared with first-quarter 2022 earnings of $5.8 billion, and first-quarter 2022 adjusted earnings of $4.3 billion.

First-quarter 2023 earnings decreased from the year ago period primarily due to lower realized prices, partially offset by commercial performance and timing, as well as the absence of special items in the prior year’s first quarter. The company’s total average realized price was $60.86/boe in first-quarter 2023, 21% lower than the $76.99/boe realized in first-quarter 2022.

Production for the first quarter was 1.79 MMboe/d, slightly up from the same period a year ago. After adjusting for impacts from closed acquisitions and dispositions, first-quarter 2023 production increased by 65,000 boe/d or 4% from the same period a year ago. This was primarily driven by new wells online in the Lower 48 and improved well performance across the portfolio, partially offset by normal field decline and downtime.

In the Lower 48, first-quarter production averaged 1.04 MMboe/d, including 694,000 boe/d from the Permian basin, 227,000 boe/d from the Eagle Ford shale, and 98,000 boe/d from the Bakken shale. Operationally, a stabilizer expansion in the Eagle Ford and a planned turnaround at QatarGas 3 were successfully completed.

Occidental Petroleum Corp. had net income for first-quarter 2023 of $983 million, and adjusted income of $1.1 billion. The results compared to net incomes of $4.67 billion for first-quarter 2022 and $1.73 billion for fourth-quarter 2022. Oil and gas income declined due to lower worldwide crude oil, NGL and domestic natural gas prices, and lower crude oil volumes.

Hess Corp. had net income of $346 million in first-quarter 2023, compared with net income of $417 million in first-quarter 2022. Adjusted net incomes in first-quarter 2023 and first-quarter 2022 were $346 million and $404 million, respectively. The decrease in after-tax results compared with the prior-year quarter reflects lower realized selling prices partially offset by the net impact of higher production volumes in first-quarter 2023.

The corporation’s exploration and production net income was $405 million in first-quarter 2023, compared with $460 million in first-quarter 2022. Average realized crude oil selling price, including the effect of hedging, was $74.23/bbl in first-quarter 2023, compared with $86.75/bbl in the prior-year quarter. The average realized NGL selling price in first-quarter 2023 was $24.25/bbl, compared with $39.79/bbl in the prior-year quarter. Net production was 374,000 boe/d in first-quarter 2023, compared with 276,000 boe/d, proforma for asset sold, in first-quarter 2022, primarily due to higher production in Guyana and the US Bakken shale.

Southwestern Energy Co. recorded net income of $1.9 billion, including a gain on mark-to-market of unsettled derivatives. Excluding this and other one-time items, adjusted net income was $346 million. In the prior year’s first quarter, the company had a loss on derivatives of $3.9 billion. Adjusted net income was $447 million for first-quarter 2022.

US independent refiners

Marathon Petroleum Corp. had net earnings of $2.7 billion for first-quarter 2023, compared with earnings of $845 million for first-quarter 2022. Adjusted EBITDA was $5.2 billion for first-quarter 2023, versus $2.6 billion for first-quarter 2022.

The company’s refining and marketing margin was $26.15/bbl for first-quarter 2023, versus $15.31/bbl for first-quarter 2022. Crude capacity utilization was about 89%, driven by planned maintenance activity in the Gulf Coast region, resulting in total throughput of 2.8 million b/d for first-quarter 2023.

Refining operating costs were $5.68/bbl for first-quarter 2023, versus $5.22/bbl for first-quarter 2022. This increase was primarily driven by higher expenses for projects conducted during turnaround activity.

Phillips 66 had net earnings of $2 billion for first-quarter 2023, compared with earnings of $1.9 billion for fourth-quarter 2022.

Refining had adjusted pre-tax income of $1.6 billion in first-quarter 2023, compared with adjusted pretax income of $1.6 billion in fourth-quarter 2022. Results in the fourth quarter included hurricane-related insurance recovery benefits of $14 million.

The impact of lower volumes from turnaround activity was mostly offset by higher realized margins and lower utility costs. Realized margins increased to $20.72/bbl in first-quarter 2023 from $19.73/bbl in fourth-quarter 2022, as lower market crack spreads were more than offset by higher clean product differentials, improved feedstock advantage, and secondary products.

Valero Energy Corp. had a net profit of $3.1 billion for first-quarter 2023, compared with $905 million for first-quarter 2022.

Valero’s refining segment reported $4.1 billion of operating income in first-quarter 2023, compared with $1.5 billion in first-quarter 2022. Refining throughput volumes averaged 2.9 million b/d in first-quarter 2023. Refineries operated at a 93% capacity utilization rate. Refining margin increased to $22.37/bbl in first-quarter 2023 from $12.74/bbl in first-quarter 2022.

Valero’s renewable diesel segment, which consists of the Diamond Green Diesel (DGD) joint venture, had $205 million of operating income for first-quarter 2023, compared with $149 million for first-quarter 2022. Segment sales volumes averaged 3 million gal/d in first-quarter 2023, which was 1.3 million gal/d higher than first-quarter 2022. The higher sales volumes were due to the impact of additional volumes from the startup of the DGD Port Arthur plant in fourth-quarter 2022.

Canadian firms

All financial figures are presented in Canadian dollars unless noted otherwise.

Suncor Energy Inc. recorded a profit of $2.05 billion for first-quarter 2023, compared with $2.95 billion in the prior year quarter. Suncor’s adjusted operating earnings were $1.81 billion in first-quarter 2023, compared with $2.76 billion in the prior year quarter, primarily due to decreased crude oil realizations, increased operating expenses, and lower upstream production and refinery throughput, partially offset by increased refined product realizations, decreased royalties, and income taxes.

Suncor’s total upstream production was 742,100 boe/d in first-quarter 2023, compared with 766,100 boe/d in the prior year quarter. The company’s net SCO production was 497,800 b/d in the first quarter of 2023, compared with 515,300 b/d in the prior year quarter, driven by combined upgrader utilization of 93% in first-quarter 2023, reflecting the impact of unplanned maintenance in the quarter, compared with 96% in the prior year quarter.

Refinery crude throughput was 367,700 b/d and refinery utilization was 79% in first-quarter 2023, compared with 436,500 b/d and 94% in the prior year quarter, with the decrease primarily due to the completion of repairs and subsequent progressive restart activities at the company’s Commerce City refinery, as the asset returned to operations by the end of the quarter.

Cenovus Energy Inc. posted net income of $636 million for first-quarter 2023, compared with $784 million in the previous quarter and $1.63 billion in first-quarter 2022. The decline in net earnings was primarily due to lower operating margin and lower foreign exchange gains.

The upstream operating margin was $1.7 billion, down from $2.2 billion in the prior quarter, primarily driven by lower Brent and WTI crude oil prices, a wider light-heavy differential, as well as slightly lower production volumes. Total upstream production was 779,000 boe/d in the first quarter, a slight decrease from the fourth quarter.

The downstream operating margin was $391 million, compared with $558 million in the fourth quarter. The US operating margin was impacted by higher operating costs at the Superior refinery, unit outage at the Wood River refinery, and others.

Imperial Oil had estimated net income in first-quarter 2023 of $1.25 billion, compared with net income of $1.73 billion in fourth-quarter 2022 and $1.17 billion in first-quarter 2022.

Imperial Oil’s upstream production averaged 413,000 boe/d in first-quarter 2023, up from 380,000 boe/d in the same period of 2022. At Kearl, quarterly total gross production averaged 259,000 b/d, the highest first quarter production in the asset’s history. Downstream quarterly refinery capacity utilization was 96%, and petroleum product sales were 455,000 b/d.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.

Laura Bell-Hammer

Statistics Editor

Laura Bell-Hammer is the Statistics Editor for Oil & Gas Journal, where she has led the publication’s global data coverage and analytical reporting for more than three decades. She previously served as OGJ’s Survey Editor and had contributed to Oil & Gas Financial Journal before publication ceased in 2017. Before joining OGJ, she developed her industry foundation at Vintage Petroleum in Tulsa. Laura is a graduate of Oklahoma State University with a Bachelor of Science in Business Administration.