Rystad: US Gulf crude exports to hit record high in second-quarter 2022

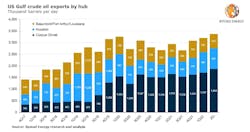

Oil exports from the US Gulf Coast (USGC) will hit an all-time high of 3.3 million b/d in second-quarter 2022 as refining capacity disruptions limit operators' ability to meet demand and the US government's Strategic Petroleum Reserve (SPR) release boosts supply, Rystad Energy research shows.

More than 95% of US crude oil exports transit through the USGC Texas ports of Corpus Christi, Houston, Beaumont, Port Arthur, and Louisiana.

The Biden Administration is exploring ways to rein in gasoline prices for US consumers and is reportedly considering a full or partial ban on crude exports. Many industry leaders and politicians, however, argue such a move would not necessarily reduce prices and would hurt key allies.

The government’s unprecedented support for the domestic crude system has accelerated US supply, with levels expected to hit 13 million b/d this summer for the first time since November 2019. But the unintended consequence of federal intervention is that more barrels than ever before are being sold to international buyers, according to Rystad Energy.

Crude exports through USGC ports are expected to top 3.3 million b/d during this year’s second quarter, exceeding the previous record of 3.2 million b/d in first-quarter 2020, before the global pandemic took its toll on international markets. The Port of Corpus Christi is a major driver of the growth, with throughput increasing by more than 150,000 b/d to reach 1.86 million b/d, up from a total 1.7 million in first-quarter 2022, far surpassing pre-pandemic levels. Port of Houston exports have also been rising since the third quarter of last year but still fall short of their pre-pandemic levels.

“Domestic refining capacity in the US remains depressed compared to pre-Covid levels, so it’s no surprise that government intervention to support crude supplies has resulted in an increase in exports of domestically produced light barrels. It means the US is able to support global markets amid the most challenging energy crisis in at least 30 years,” says Artem Abramov, head of shale research at Rystad Energy.

USGC oil exports stayed relatively resilient throughout the pandemic-induced downturn, generally fluctuating between 2.7 million-3.1 million b/d. The new growth trend was established in late 2021 following a domestic supply recovery and support given to domestic consumption from a moderate SPR release.

The future looks bright for USGC exports, with volumes transiting through the hubs of Corpus Christi, Houston and Beaumont, Port Arthur, and Louisiana expected to accelerate in the coming years. Under Rystad Energy’s base case scenario, crude exports will approach 4 million b/d in the first three months of 2023 and break the 4 million b/d barrier by second-quarter 2023, thanks to strong SPR draws and a rosy domestic supply outlook.

“While a quicker expansion is not off the cards from the perspective of loading and port inbound flow capacity, the growth outlook could be tempered by bottlenecks in the upstream and basin midstream side, including the new public E&P business model, supply chain constraints, and schedules for gas takeaway capacity expansion in the Permian basin. The likelihood of soaring exports could be deemed unrealistic as there is little that the nationwide US supply chain can do to resolve existing labor and capacity challenges faster. However, should supply chain challenges alleviate even somewhat in the first half of 2023, exports could rise beyond current forecasts,” Abramov said.