Mubadala Petroleum to acquire stake in Tamar field offshore Israel

Mubadala Petroleum has agreed to acquire Delek Drilling’s 22% non-operated stake in Tamar gas field offshore Israel for $1.025 billion, subject to certain adjustments.

The sale and purchase agreement follows an April non-binding memorandum of understanding between the two companies for the sale (OGJ Online, Apr. 26, 2021).

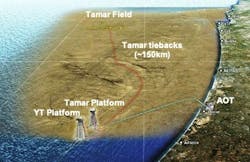

The field, which lies 90 km west of Haifa about 5,000 m below sea level in water depth of 1,700 m, was discovered in 2009. Production began in 2013. Natural gas is extracted through five production wells and gas flows through two 140-km pipelines to the Tamar platform where most of the gas processing takes place. The gas is then transmitted through a pipeline to the onshore terminal in Ashdod, and into the Israeli market through the INGL national gas pipeline with a proportion being exported on to Jordan and Egypt.

2P reserves in the Tamar lease, after production of more than 69.3 billion cu m, is about 300 billion cu m of natural gas and 14 million bbl of condensate. Under the gas framework, outlined by the Israeli government, Delek Drilling is obliged to sell all holdings in Tamar by end 2021.

Chrevron is operator of the Tamar project with 25% interest. Current partners are Delek Drilling (22%), Isramco (28.75%), Tamar Petroleum (16.75%), Dor Gas (4%), and Everest (3.5%).