Construction costs continue decline in third-quarter 2020

Pritesh Patel

IHS Markit

Houston

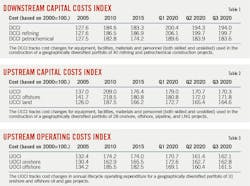

IHS Markit indices are proprietary measures of cost changes similar in concept to the Consumer Price Index (CPI) and draw upon proprietary IHS Markit tools to provide a benchmark for comparing construction costs around the world. Construction costs are tracked on a quarterly basis and then reported as an index value to show how upstream and downstream project cost have changed. The base year is 2000, therefore, an index of 170.3 represents that construction costs have increased 70.3% compared to the year 2000.

During third-quarter 2020, capital costs for downstream projects decreased 0.1% compared to the second quarter. The Downstream Capital Costs Index (DCCI) is now at its lowest point since fourth-quarter 2017. The largest decline in the DCCI this quarter was for steel at 1%. However, portfolio costs rose for electricals and instrumentation as well as construction and civils materials. Both markets have small weightings within the DCCI, at 8% and 6%, respectively. Costs of these markets rose due to the weakening of the US dollar.

The year 2020 has not been kind to project activity. The year has been marred by project delays and cancellations. While existing facilities have returned to normal operations, the same cannot be said for projects under construction. Delays have occurred due to lockdown measures and social distancing requirements. Future construction start-dates have been wrecked by financial distress and weak demand figures. Construction costs have declined but the impact on project costs is minimal. Bottlenecks within the supply chain are causing delays, leading to higher project costs. Labor productivity is another issue within the downstream sector. While wage growth has not changed much, hands on tools time has shifted. These are issues on site as well as at manufacturing facilities of vendors.

The DCCI refining index decreased by 0.02% during third-quarter 2020 compared to the second quarter level. Refining portfolio project costs declined for steel and equipment. Costs rose for electrical and instrumentation as well as construction and civils material. Demand for these markets from infrastructure projects has increased.

Refineries have come under heavy pressure in 2020 due to weak product demand. Utilization rates have declined, leading operators to question the need for capacity expansion moving forward. Regionally, the largest cost increases occurred in Europe and the CIS region. Project costs in these regions were higher due to currency exchange movements and inflation. Asia had a 0.2% project cost increase for refineries. Equipment costs declined in the region, but rising labor costs offset the decline. Project activity in the region has returned to normal after shutting down at the start of 2020 due to COVID-19.

The DCCI petrochemical index decreased by 0.15% during third-quarter 2020 quarter-on-quarter. Equipment and labor costs declined during the third quarter, while costs rose for all other markets. The portfolio index trended negative due to high weightings for labor (15%) and equipment (57%). Steel costs for petrochemical projects rose 1.5%, due to higher nickel prices during the quarter which were passed through to stainless steel end users. Petrochemical project costs declined in all regions, except for Europe. Costs in Europe were influenced by currency exchange rates and inflation. The largest regional decline was in North America. Project activity has been adversely impacted by weak end user demand triggered by COVID-19.

The IHS Markit Upstream Capital Costs Index (UCCI), which tracks the costs associated with the development of oil and gas fields, fell by 5.7% in third-quarter 2020 compared to fourth-quarter 2019, down to a value of 170.3.

Upstream markets experienced major disruptions due to COVID-19 and its concomitant low oil prices. In the UCCI portfolio, the largest drops were in the steel and offshore rig markets, both declining by around 8% this year. For the offshore rig market, an oversupply of rigs coupled with falling demand kept negotiating power squarely in buyers’ hands, which led to lower rates. Offshore rig contracts are being renegotiated, and several contracts have been suspended, canceled, or deferred. The cost decline in the steel market was driven by lower line pipe and oil country tubular goods (OCTG) prices, as mills and distributors struggled to sell-off inventory to maintain cash. Most products generally reached bottom in May, but recovery has been difficult. Falling scrap prices, weak demand, idle capacity, and a rise in COVID-19 infections have combined to keep prices flat instead of rising.

EPM charge-out rates fell, but much of the decline was due to foreign exchange effects, and the local currency index only declined by 1-3% year-to-date. The same can be said for the construction labor market, which fell by 5% in the US dollar but just 1-3% in local currencies year-to-date. Global bulk material prices improved this quarter but still have much to make up for as April was one of the worst months for economic growth in over a century.

The UCCI’s counterpart, the IHS Markit Upstream Operating Costs Index (UOCI), which measures the operating costs for those projects and their facilities, has fallen by 6.2% year-to-date, to an index value of 162.

However, the third quarter movement represents an increase of 0.4% on the second quarter index value. The increase was predominantly due to depreciation of the US dollar against local currencies since the second quarter. Underlying market conditions remain poor and removing the impact of currency exchange results in a third-quarter index decrease of 0.8%. Despite the increase in Brent pricing, operators continue to look for cost savings, whether through cuts or postponement of works. As a result, activity in the third quarter remained depressed in most regions and with little demand to support price increases, the index remained constrained.

The onshore index has fallen by 6.6% year-to-date in third-quarter 2020, and the offshore UOCI has fallen by 6.0% over the same period.

In third-quarter 2020, the diesel index increased 5% as Brent price saw an uplift, the facilities inspection and maintenance index stabilized, suggesting a floor may have been reached. The support vessels index grew by 0.8% driven by Asia, the Middle East, and North America, but with day rates so low, the benefit to vessels owners will be limited.

The UOCI is expected to recover to fourth-quarter 2019 levels in 2023.