Asian, European firms dominate Libya’s Round 2

Aggressive bidding rewarded international oil companies from Asia and Europe when Libya’s National Oil Corp. opened bids Oct. 2 in Round 2 of its EPSA IV (exploration and production-sharing agreement) program.

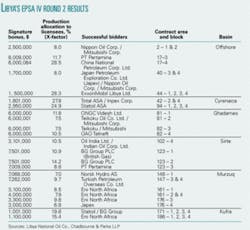

Fifty companies bid on contract areas involving 40 blocks, which in aggregate would equal an area the size of Switzerland. Four blocks on three contract areas received no bids.

Libya will receive more than $103 million in signature grants, which formed part of the criteria for selection.

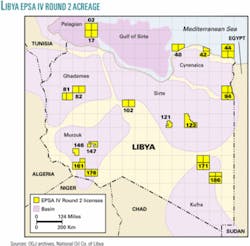

NOC selected 19 companies to participate in exploration and production in five basins and several offshore areas under the program (see table and map).

Asian winners

Ten Asian companies, solely or in consortia, acquired 10 of the 23 contract areas tendered and one joint venture with France’s Total ASA. Successful Japanese companies included Nippon Oil Corp., Mitsubishi Corp., Japan Petroleum Exploration Co. Ltd. (Japex), Inpex Corp., and Teikoku Oil Co. Ltd. (OGJ, Oct. 10, 2005, Newsletter). These companies bid in consortia, mostly for offshore and Ghadames basin properties, and Japex won a second, independent, contract area in the Murzuq basin in southern Libya.

Indonesia’s Pertamina secured two areas, one offshore (one block) and one in the Sirte basin (one block). It said Block 17-3 is estimated to have 75 million bbl of oil reserves and 3.5 tcf of gas. Block 123-3 is estimated to have 400 million bbl of oil reserves.

China National Petroleum Corp. Ltd. acquired Block 4 of offshore area 17.

India also had three successful companies: Oil India Ltd. and Indian Oil Corp. Ltd. in a joint venture secured area 102 (one block) in the Sirte basin, and ONGC Videsh Ltd., a production area with one block in the Ghadames basin.

European, US awards

Six European exploration and production companies also secured a total of 10 contract areas plus the Total-Inpex joint venture area, which won two blocks totaling 3,400 sq km in the Cyrenaica basin. Total will be operator with 60% interest.

Successful bidders, in addition to Total, were Norsk Hydro AS (one block) and Statoil ASA of Norway (eight blocks).

BG Group PLC of the UK won two independent contract areas with two blocks total and a JV with Statoil (four blocks), and Italy’s Eni North Africa was successful in scoring four contract areas with a total of eight blocks. It will drill six exploration wells and shoot 7,500 km of seismic survey.

Russia’s OAO Tatneft secured area 82 (one block of about 2,000 sq km) in the Ghadames basin. The company will shoot 2D and 3D seismic surveys and drill two exploration wells.

In addition, Turkish Petroleum Overseas Co. Ltd. acquired two blocks in a license area in the Murzuq basin.

In stark contrast to the first round of bids in January, in which US firms won 11 of the 15 available leases, only one US company-ExxonMobil Libya Ltd.-was successful in acquiring a license area in Round 2. It acquired four offshore blocks in the 2.5 million-acre contract area 44 in the Mediterranean Cyrenaica basin. The property lies in water 100-10,000 ft deep.

The licenses are subject to ratification by the General People’s Committee of Libya, following which the nonrecoverable cash signature bonuses will be paid. Winning bidders are expected to sign EPSAs by the end of November.

NOC said the agreements include an exploration period of 5 years, which could be extended under certain circumstances, followed by an exploitation term of 25 years.

Libya’s potential

The bid round follows the awards earlier this year of Round 1, which had been made possible after the lifting of US economic sanctions in 2004. Since then, Libya has been positioning itself to become a major oil producer and exporter.

“Over the last few years Libya has gone from international pariah to one of the most sought-after destinations for upstream oil and gas investment,” said Nabil Khodadad, a partner in the London office of Chadbourne & Parke.

“With the successful conclusion of the first licensing round and the launch of a second round, Libya is well on its way to regaining its former position as one of the world’s key petroleum producers,” he said.

The tightness of the bids in Round 2 shows that the aggressive bidding in Round 1 “was not a fluke,” said Khodadad. “Because this time around, the bidding was even more aggressive.”

In the first round, for example, the average winning X factor share of production for the international oil companies was 19.5%, whereas in this round, it was about 13.2%. And 11 of the 23 successful bidders had an X factor of less than 10%.

“That’s pretty remarkable,” he said.

The X factor is the percentage share that is available for cost recovery and the profit oil split. It is the primary bidding criterion, along with consideration of the amount of the signature bonus, in determining the winners.

“The X factor is a bit misleading,” said Khodadad. “It actually understates the amount of production going to the government or overstates the amount of production going to the international oil company, because the government gets part of the profit oil split.

“So really, the true take for the foreign company is actually less than the percentage bid” (OGJ, Apr. 18, 2005, p. 29).

High oil price impact

The aggressive bids reflect an expectation that oil prices are likely to remain high, Khodadad said. When the first round winners were announced in January, oil prices were much lower.

Khodadad said: “The fact that Japanese, Indian, and Chinese companies are so successful this round also may be foreshadowing their growing importance in upstream oil and gas. They are looking offshore more and more for oil and gas reserves. Japanese and Chinese companies in particular are competing with each other in the Middle East, Africa, and South America. I think that is a trend that will continue. The Chinese have been particularly interested in the former Soviet Union. They’ve been very active in Kazakhstan, for example.

“Japan seems to be slowly recovering from its very long slump, and this may also foreshadow Japanese companies’ assuming a larger role on the international stage when it comes to upstream oil and gas.”

Future exploration

Libya is for the most part underexplored, with only about one fourth of the country surveyed. And the areas explored generally were developed with old technology, so mature fields could greatly benefit from newer, enhanced recovery methods. About 80% of Libya’s proved oil reserves are in the Sirte basin, which accounts for 90% of its current production.

“Libya is really one of the few major countries that has the capacity to dramatically increase its production over the next decade,” said Khodadad. “Iraq is the other one, but Iraq is in a mess, and it will take a long time for it to do so. With the removal of US sanctions, Libya saw it as an opportunity to start anew with competitive tenders,” he added. Before that, the country awarded contract areas through bilateral negotiations.

Libya has oil reserves of 39 billion bbl and gas reserves of 52 tcf. Its current production is about 1.7 million b/d, which it hopes to increase to 3 million b/d by 2010-11, Libyan officials said.

Libya’s plans for the next 5 years call for drilling 50 wildcat wells/year, conducting 4,000 sq km/year of 3D seismic surveys, and 20,000 km/year of 2D seismic, an NOC official said.

The company plans a third bidding round late this year or in early 2006 and eventually expects to hold five or six additional rounds.

Libya is achieving greater financial benefit in the EPSA IV competitive bids where negotiations are not required than it was with negotiating EPSA 3 agreements, Khodadad said. There are companies that have been negotiating for years and have not yet reached agreements.

“The senior management of NOC are quite keen to attract US investment, and not only for exploration. NOC has announced that it wants to attract companies to help with enhanced oil recovery, and there is a lot of expectation in the market that this will happen-hopefully soon.”

There are three or four fields in which Libya wants to enhance oil recovery. “It probably won’t tender this work in the same way but will probably approach a few companies that they think have the technical capacity to significantly increase oil recovery,” Khodadad said.

“It is not entirely clear how they will accomplish this. They may offer some kind of closed tender when they approach just a few companies, but it is not very clear. I suspect that if they do have open tenders, the qualification requirements will be more rigorous.”✦