BP: World oil, gas reserves growing at healthy pace

BP PLC tried recently to quell renewed concerns by some industry observers that world oil reserves are running out sooner than expected.

"[Last year] was a turbulent year in the world's energy markets, with supply disruptions, strong growth in both demand and production of oil and coal, and the highest prices in the oil and [natural] gas markets for 20 years," said BP Chief Economist Peter Davies. However, he said, "The high prices were not driven by fundamental resource shortages; in 2003 the world's reserves of oil and natural gas continued their long-term trend of growing faster than production."

Davies's comments were part of presentations June 15 in New York City and June 16 in Washington, DC, that highlighted BP's 2003 Annual Statistical Review.

"Despite those who say we are about to run out of oil and gas, the figures in the review confirm there is no shortage of reserves. Production in some provinces may have peaked, but this is no reason for current high prices," he said.

Supply outlook

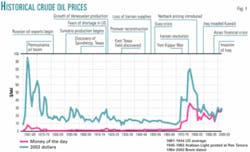

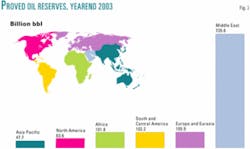

The new data estimate total world oil reserves at 1.15 trillion bbl in 2003, about 10% higher than reported for 2002. Additionally, global oil reserves have increased almost continuously over the past 30 years, BP officials said. World reserves now represent 41 years of production at current rates. By comparison, in 1980 reserves equivalent to only 29 years of production were known. The world now has produced some 80% of the oil reserves that were known in 1980, yet exploration success and application of technology has led to current reserves that are 70% higher, BP said.

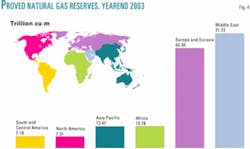

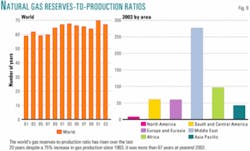

Looking at natural gas, BP reported global reserves of 176 trillion cu m, 13% higher than those previously reported for 2002. The company said that gas reserves have more than doubled since 1980 as a result of exploration, new technology, and the "unstranding" of gas reserves through liquefied natural gas and other technologies.

BP Group Chief Executive John Browne emphasized that oil and gas are not being depleted at an accelerated rate. "The data [illustrate] the continued growth in reserve volumes across the world," Browne wrote in the review's introduction. "At current levels of consumption, there are sufficient reserves to meet oil demand for some 40 years and to meet natural gas demand for well over 60 years."

He added that there appears to be considerable scope for proved reserves and production to keep rising in Russia and elsewhere: "Reserves, globally, have grown over time, and it is clear that the issue of energy security, which has been so prominent over the last year, is driven not by a physical shortage of supply but by the challenges of ensuring, in a world where demand and supply are not colocated, that there will be sufficient traded oil and gas to meet rising demand."

BP said that this year's review includes a new and improved data series for proved oil and natural gas reserves. However, the new series does not necessarily meet US Securities and Exchange Commission definitions and guidelines for determining proved reserves, nor does it necessarily represent BP's view of proved reserves by country.

Data for the latest review were compiled using a combination of primary official sources and third-party data to provide more-complete and timely series than published previously, BP said. Historic data also have been revised, and oil reserves include more-comprehensive data on condensate and natural gas liquids. For example, Canadian oil sands "under active development" have been included in proved oil reserves.

Price snapshots

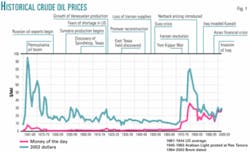

BP wanted to address concerns about an imminent peak in global oil production raised recently by some petroleum industry researchers (OGJ series of special reports on future energy supply, July 7-Aug. 18, 2003). It also sought to put recent higher energy prices in an historical context.

Oil prices in 2003 were the highest in 20 years, with North Sea Brent dated crude averaging $28.83/bbl, despite world oil production rising by 3.8%, higher than the 2.1% increase in demand. High prices were largely the result of strong oil consumption growth and the need to maintain inventory levels, BP officials said.

"Even at $40/bbl, the price of crude oil in real terms is still only half the level reached in 1980. An effective global market and continued advances in technology have enabled the world to absorb a 25% increase in daily oil demand in the intervening period," Browne said.

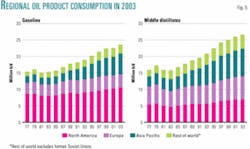

And despite those high prices, oil consumption grew strongly in 2003, increasing by 1.5 million b/d to 78.1 million b/d, with the strongest growth coming in the Asia Pacific region. This happened even with supply disruptions in Venezuela and Iraq.

Also of note is the fact that oil production from the Organization of Petroleum Exporting Countries grew by 1.9 million b/d to reach 30.4 million b/d in 2003. Saudi Arabia alone increased production by over 1 million b/d to a 22-year high. Non-OPEC production grew by 830,000 b/d, with the majority by far coming from Russia.

The company sees Russia and China as two countries that were particularly influential in global energy markets in 2003. BP already has significant interests in Russia; China holds large promise.

China showed a surge of 13.8% in total energy demand as GDP growth of 9% increased the county's energy intensity. Meanwhile, China's consumption of oil, gas, coal, and nuclear power all increased by more than 10% in 2003. China alone accounted for 41% of the growth in total world oil demand, some 600,000 b/d, and its oil imports rose 32% to 2.6 million b/d, the 2003 review found.

"China has now overtaken Japan as the world's second-largest consumer of oil behind the US. Chinese decisions on imports and trading links, for both oil and natural gas, will be a major influence on the world energy scene from now on," Browne said.

Russia continues to be a dominant source of growth in non-OPEC oil supply growth, BP said. Since 1998, total energy production has climbed by almost 18%, with oil production in particular growing. Since 1998, Russia has been the largest supplier of non-OPEC oil, accommodating 46% of the world's oil consumption growth between 1998 and 2003. In 2003 Russian oil production grew by 845,000 b/d to 8.5 million b/d.

Natural gas picture

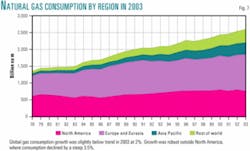

Global natural gas consumption grew by a relatively weak 2% as demand in the US, the world's largest market, contracted by 5%. Outside the US, demand growth averaged over 4%. Meanwhile, sales of LNG grew quickly in 2003, rising by over 12%. US LNG imports more than doubled, and sales to the world's largest LNG markets, Japan and South Korea, rose by more than 9%, BP said.

Global gas production rose 3.4% in 2003. As in 2002, North America was the only region in which gas production fell, led by reductions in Canadian output. Russian gas production continued to expand, rising over 4%. Production in Europe fell with declines coming from the UK, Italy, and the Netherlands, but production in Norway rose strongly, up 12%.

Other fuels

BP also tracked supply and demand of coal, nuclear, and hydroelectric power. World coal consumption rose 6.9%, BP said. This was again dominated by surging demand in China, up over 15%, but other regions also saw strong demand, with North American coal use climbing to a record high.

Nuclear power generation fell by 2% globally, led by a 27% decline in the world's third-largest nuclear generator, Japan, where safety concerns shut in 17 of the country's 54 nuclear plants. Only two new nuclear reactors were brought on line in 2003, the lowest number in 35 years.

Hydroelectric power generation only increased by 0.4%, as Latin American and Asia Pacific gains were offset by falls in Europe and North America.