Special Report: Asia petchem expansions to 2015 increase demand for naphtha

A wave of ethylene investment will take place in Asia during 2009-11 with distinct peaks in early and late 2009. A wave of aromatics investments will take place in 2008-09.

The scale of new petrochemical capacity will support pricing for Asian naphtha through at least 2011 because new ethylene capacity is predominantly naphtha based.

Both production and investments in the petrochemical industry have grown significantly in recent years. Investment is taking place predominantly in China, despite easier access to feedstocks, such as natural gas and naphtha, giving Middle East producers a significant competitive edge. Much of this Middle East capacity is furthermore targeting China. By 2015, China will have as much ethylene capacity as Japan, South Korea, and Taiwan combined.

Asian petrochemicals

The petrochemical sector in Asia is undergoing fundamental change due to three key forces.

The first is the massive expansion of Asian petrochemicals currently under way. The second is the rapid emergence of China as the largest petrochemical producer in Asia. The third is the sharp rise in production capacity in the Middle East.

China Petroleum & Chemical Corp. (Sinopec) and PetroChina are the largest producers in Asia. They both have an ambitious program of ethylene and aromatics investments. Joint ventures have been formed in China to further develop the industry.

Sinopec is not only entering into petrochemical ventures with foreign partners, it is also building integrated refining-petrochemical complexes in partnership with ExxonMobil and Saudi Aramco in Fujian and with Kuwait Petroleum Corp. (KPC) in Nansha, Guangzhou. In fact, joint-venture petrochemical investments in Asia are predominantly in China.

Condensate splitters will provide a new increment of Asian naphtha supply. The massive growth in Asian petrochemicals will support future naphtha markets in Asia as petrochemicals depend more on naphtha supplies from outside the region, primarily from the Middle East. The naphtha market will be strong despite competition for petrochemicals in Asian markets from low cost, gas-based Middle East production.

Asian ethylene

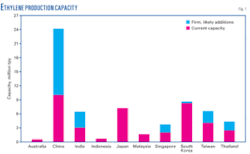

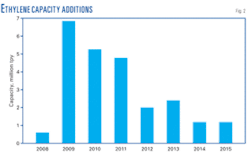

Already a significant region in the global ethylene sector, Asia is adding capacity at an unprecedented rate. Asia has 40 million tonnes/year (tpy) of ethylene capacity currently and is adding 24 million tpy during 2008-15 (Table 1).

This is equivalent to adding more than 50% of base capacity during an 8-year period. A wave of addition takes place during 2009-11 with strong peaks in first and fourth-quarters 2009.

Figs. 1 and 2 show Asia-Pacific ethylene capacity additions by country and year, respectively.

China will add most of the new ethylene production capacity. In 2005, China for the first time passed Japan to rank second in the world in terms of ethylene production capacity, behind the US. China’s gap with the US is narrowing.

China already has 10 million tpy of capacity, now the most in Asia, and is adding 14 million tpy of ethylene capacity during 2008-15. Much of the addition takes place in 2009 (4.95 million tpy) and 2011 (3.8 million tpy).

China, furthermore, could add another 5.5 million tpy of ethylene capacity with projects that are not currently considered firm. The scale of the Chinese industry will then dwarf that of the traditional Asian leader, Japan, and of South Korea, which built a world-scale ethylene industry in the last 2 decades. By 2015, China could have as much capacity as Japan, South Korea, and Taiwan combined.

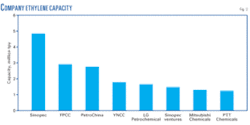

Fig. 3 shows that Sinopec owns the most ethylene production capacity in China with 4.855 million tpy (48%) and with a share in another 1.5 million tpy of joint-venture capacity (15%). Sinopec’s current joint-venture partners are BP and BASF.

The capacity of PetroChina, by contrast, is much lower at 2.78 million tpy (27%). PetroChina has not participated in joint ventures.

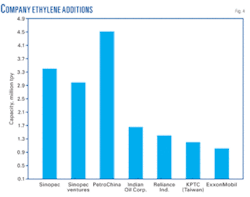

Fig. 4 shows that Sinopec will add another 3.4 million tpy on its own and another 2.99 million tpy with joint-venture partners including ExxonMobil, Saudi Aramco, KPC, and SABIC.

PetroChina will build another 4.52 million tpy during 2008-15. PetroChina’s new capacity exceeds its current capacity of 2.78 million tpy.

Formosa Plastics Corp. (FPC) had planned to build a 1.2 million tpy ethylene facility at Ningbo in 2014. This project is questionable because the private Taiwanese company may switch the project to Taiwan after the change of government in May 2008.

Many of the new facilities in China are world-scale projects with seven plants of more than 1 million tpy of capacity. China National Offshore Oil Corp. has a joint venture with Shell for an ethylene plant. Predominantly a crude producer, CNOOC built its ethylene and aromatics venture before it built its refinery, which is due to start up in fourth-quarter 2008.

China looks to emerge as the leader in Asian petrochemical production by 2015, with almost three times the capacity of South Korea, the next-largest country. China petrochemicals is growing much faster than China refining; therefore, China will emerge as a major naphtha importer.

India’s ownership is much more dispersed as compared to China. Gas Authority of India Ltd. (GAIL), Haldia Petrochemicals Ltd., Indian Petrochemicals Corp. Ltd., and Reliance Industries Ltd. are all ethylene producers. India’s planned expansions are predominantly the Reliance expansion of 1.4 million tpy in 2010, Indian Oil Corp.’s (IOC) expansions at Panipat, 857,000 tpy in 2010, and Paradeep, 800,000 tpy in 2013.

The Indian petrochemical industry is growing more slowly than the refining industry, which will remain a small but important supplier of naphtha exports. India, nevertheless, will still double petrochemical capacity.

Asia’s ethylene industry continues to be naphtha based rather than gas based. Even though India, Indonesia, Australia, Malaysia, and Thailand are all able to establish a gas-based industry, nearly all of Asian petrochemicals are based on naphtha or LPG. Thailand’s 1-million tpy PTT polyethylene project, however, is ethane based.

Singapore will double its capacity because Shell and ExxonMobil will commission crackers during 2009-11. These projects in Singapore are the only ethylene investments in Asia by the majors other than joint ventures in China with Sinopec.

Expansion of naphtha crackers means greater production of pyrolysis gasoline, most of which will find its way into aromatics production, while a portion will be blended into Asian gasoline.

Aromatics trends

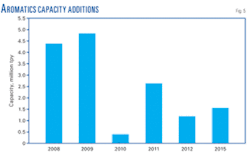

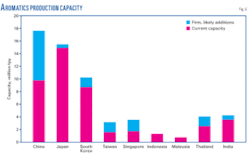

Aromatics capacity growth is slower than ethylene capacity growth (Table 2). Asian aromatics capacity will nevertheless increase more than one-third vs. current levels. Most capacity additions will occur during 2008-09 (Fig. 5).

China will be responsible for half of the expansion in 2008 and nearly all the additions in 2009 (Fig. 6). In fact, China will almost double its capacity and will be responsible for more than half of all the capacity additions in Asia through 2015.

Japan is not expanding ethylene but is expanding aromatics through the Kashima condensate splitter-based project. The concept of the Mizushima condensate splitter project is different; it seeks to feed an existing aromatics complex more efficiently.

Petrochemical projects in Asia outside of Japan target the demand in growing markets. Projects in Japan have a different rationale. They aim to tighten integration between refining and petrochemicals to meet declining fuel demand.

Singapore will double its capacity mainly through the Jurong Aromatics Corp. plant but also through the ExxonMobil expansion. Elsewhere in Asia, South Korea will add capacity at Hyundai-Cepsa and S-Oil. Taiwan will double its capacity through the KPTC project starting up in 2015; Thailand will increase its capacity by 60%.

Petchem investment trends

Asian refining is becoming increasingly integrated with petrochemicals. Refiners will try to diversify into petrochemicals to secure wider and higher-value markets for refinery products. Petrochemical producers will try to diversify into refining to secure a reliable source of feedstocks and markets for byproducts.

Dependence on the traded naphtha market for feedstocks exposes petrochemical producers to naphtha market volatility. Plants that feed mostly propylene will lean to catalytic cracking-based technologies and therefore look to increase propylene production from refinery catalytic crackers.

The major oil companies are investing directly, like the Shell 800,000-tpy and ExxonMobil 1 million tpy ethylene crackers in Singapore, and in the form of joint ventures with local partners, as in China. The Shell and ExxonMobil investments are integrated with existing refining and petrochemical operations.

Other than China, the majors are only investing in petrochemicals in Singapore, but they are not investing in primary distillation capacity. Investments by majors in Asian refining and petrochemicals are dwarfed by those of local and national oil companies. The majors prefer to invest in integrated refining and petrochemical developments and ethylene facilities on their own rather than in pure refining developments.

The major oil companies initially invested in China because the country’s large deficit in petrochemicals represented a huge market. This investment was even more attractive after China entered into the World Trade Organization.

Early investments in the petrochemical sector included Sinopec-BP in the Shanghai Secco ethylene-aromatics facility, Sinopec and BASF in the Yangzi ethylene-aromatics facility, the GS Caltex-led aromatics venture, and CNOOC-Shell in the Huizhou ethylene-aromatics facility. The Chinese government favored foreign investment and advanced technologies to advance the ethylene development program.

There are two cases in which joint ventures are made for the first time in China in integrated refining-petrochemical complexes. The first is the Sinopec-ExxonMobil-Saudi Aramco Fujian venture, which includes an 800,000-tpy ethylene cracker being built along with the 160,000-b/d Fujian refinery expansion. The second is the Sinopec-KPC Nansha-Guangzhou venture, which includes a 1 million tpy ethylene cracker being built in association with a grassroots refinery.

Table 3 shows China’s joint-venture partnerships, both existing and planned.

All of the Asian joint-venture petrochemical investments are in China. Besides the Fujian and Nansha refining-petrochemical investments, Sinopec and SABIC are building a 1 million tpy ethylene cracker in Tianjin.

Sinopec and BP are expanding the Secco Shanghai ethylene cracker by 190,000 tpy. This is in addition to the already-established CNOOC-Shell Huizhou venture, which will be linked into the CNOOC Huizhou refinery starting up in fourth-quarter 2008.

In addition to these joint-venture investments, Formosa is building a massive 1.2-million tpy ethylene cracker at Ningbo without a local partner.

There are four pure refining ventures with local partners. These ventures include the Sinopec-Saudi Aramco 200,000-b/d Qingdao refinery, the Chevron investment in Reliance, the International Petroleum Investment Co.-PakArab Refinery Ltd. 250,000-b/d refinery in Pakistan starting up in 2013, and the Idemitsu-KPC-Mitsui partnership with Petrovietnam in the 200,000-b/d Nghi Son refinery in Vietnam.

Condensate splitters

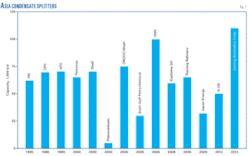

Asia has a well-developed and growing condensate-splitting industry mostly serving the petrochemical sector. Condensate splitters are built in Asia to provide feedstock flexibility between condensate and naphtha to downstream ethylene crackers and aromatics complexes.

Two Asian condensate splitters started up in 2006. Five more condensate splitters are scheduled to commission during 2008-12 (Fig. 7).

In China, the CNOOC-Shell consortium started up its $4.2-billion project in early 2006 at Daya Bay in Huizhou. It included a 75,000-b/d condensate splitter and condensate or naphtha cracker. The heart of the complex is a world-scale cracker producing 800,000 tpy of ethylene and 430,000 tpy of propylene.

It is designed to feed naphtha as well as condensate, the first of its kind in China. The project may be integrated with the CNOOC Huizhou refinery, starting up in fourth-quarter 2008. The refinery will process Bohai Bay crude, which could provide naphtha feedstock to the Shell-CNOOC complex.

In Indonesia, the Tuban condensate splitter, owned by Trans Pacific Petrochemical Industries, also started up in 2006. Construction started in the 1990s but was suspended at two thirds of completion due to the Asian financial crisis in 1998. The aromatics complex was completed after a consortium of Japanese banks granted financing.

Splitter output includes middle distillates, toluene, and xylenes. It does not have ethylene cracking and is not linked to a refinery.

In Thailand, the PTT-Aromatics (Thailand) Public Co. Ltd. (ATC) Rayong complex will be transformed into a world-class condensate splitting facility serving a downstream petrochemical complex. The complex will become the third-largest aromatics facility in Asia.

The ATC condensate splitter in Rayong, Thailand, was built in 1999 to supply downstream aromatics because the PTT refining system could not manufacture enough naphtha. Paraffinic naphtha is sold to other PTT ethylene crackers nearby.

A second condensate splitter is being constructed as part of a new arrangement that will integrate the PTT Rayong refinery with ATC. This integration also creates benefits for the refinery, as well as creating links between the new ATC condensate splitter and new downstream aromatics complex.

The project, scheduled to start up in third-quarter 2008, includes $387 million for a reforming complex, including the condensate splitter and a catalytic reformer to manufacture BTX for the new aromatics complex. This complex is a truly integrated refinery-petrochemical operation linking refining, condensate splitting, and aromatics, and providing feedstock for PTT ethylene crackers.

In Japan, a new 60,000-b/d condensate splitter was added to the Kashima refinery in 2008. Kashima Oil (a group company under Nippon Mining Holdings Inc., which is affiliated with Japan Energy) owns the splitter. The condensate splitter is part of the joint-venture project between Japan Energy Corp., Mitsubishi Chemical Corp., and Mitsubishi Corp.

Through the joint-venture company, Kashima Aromatics Co., the three firms constructed a petrochemical complex, which consists of paraxylene production facilities (420,000 tpy), a 20,000-b/d catalytic reformer, and the condensate splitter. The Mizushima condensate splitter is part of the integration project with Nippon Oil. One of the key goals is to increase further the level of integration in the Mizushima region.

The start-up date for the 34,000-b/d Mizushima condensate splitter in the Okayama prefecture is second-quarter 2009. This is a venture with Mitsubishi Chemical Holdings Corp. and Asahi Kasei Corp. to produce naphtha.

In South Korea, S-Oil will spend $1.5 billion to build an aromatics complex, including a 50,000-b/d condensate splitter, scheduled for start-up in 2011-12. The aromatics complex will have 900,000 tpy of paraxylene capacity and 280,000 tpy of benzene capacity. This will be South Korea’s first condensate splitter even though it is the largest consumer of condensate in Asia.

In Singapore, Jurong Aromatics Corp. (JAC) plans to build a $2 billion petrochemical complex on Jurong Island by 2012 that will include a 110,000-b/d condensate splitter. Partners in the JAC project include Jurong Energy Corp., Continental Chemical, Glenore, SK Energy, Noor Financial Investment Co., and Jiangsu Sanfang-Xiang Industrial Group Corp.

JAC has signed a $10 billion feedstock contract with BP that includes condensate supplies from the Middle East. This will be the second condensate splitter in Singapore.

Naphtha demand

The massive growth in Asian petrochemicals means that the region will depend even more on naphtha supplies from outside the region, principally from the Middle East. Despite enormous volumes, a handful of countries in North Asia dominate this demand.

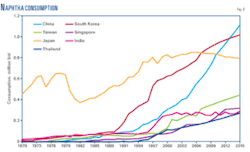

China is the key growth market of this decade and the next. Japan is a large but slowly declining consumer. South Korea will overtake Japan in 2008 and China will overtake South Korea in 2011.

Naphtha consumption in South Korea climbed steeply after 1989 as the petrochemical sector developed, but is now leveling off. In 2001, naphtha consumption in Taiwan followed a similar pattern as South Korea but the growth rate was not as rapid.

One of the most enduring features in the region’s demand has been the strength of naphtha. Even the financial crisis of 1997-98 did not affect naphtha demand.

Fig. 8 shows trends in Asia-Pacific naphtha consumption.

Total naphtha consumption in China was about 600,000 b/d in 2007, and it will increase to about 825,000 b/d by 2010 and exceed 1.1 million b/d by 2015. China intends to maximize chemical feedstocks from existing refineries, allowing more middle distillates to be used as petrochemical feedstocks. China will become the largest naphtha consumer in Asia by 2011. China was almost a net naphtha importer in 2007.

The developing South Korean petrochemical industry led Asian naphtha demand during the 1990s. Naphtha growth was strong during 2006-07 due to expansions in Yeocheon’s Naphtha Cracking Centre, LG Petrochemical Co. Ltd., and LG Daesan Petrochemical.

Demand growth is now falling due to slowing petrochemical construction. Total naphtha consumption in South Korea was around 850,000 b/d in 2007 and will increase to 930,000 b/d by 2010, making South Korea temporarily the largest naphtha consumer in Asia. After 2010, naphtha consumption in South Korea will grow at about 2.0%/year, reaching about 1.02 million b/d by 2015.

Japan remains the largest consumer of naphtha in Asia-Pacific. Demand, however, has grown only marginally in recent years. Total naphtha consumption in 2007 was about 850,000 b/d, and will decline to about 840,000 b/d by 2010 and 800,000 b/d by 2015

Asia-Pacific imports will increase to about 1.2 million b/d in 2010 and 1.38 million b/d in 2015 from 0.88 million b/d in 2007. India is the only significant naphtha exporter that still has a significant petrochemical industry, and is increasing exports as refining expansions outpace petrochemical expansions.

Asia will experience growth of about 4.0% in naphtha consumption during the next 5 years, mainly due to the expansion of ethylene capacity in China. Naphtha output in Asia will grow at about 2.8% during the same period.

China to a large extent, but particularly Japan, South Korea, and Taiwan, will always depend on naphtha feedstocks. They will feel the most pressure during periods of higher naphtha prices. Although naphtha prices will strengthen in the long run compared with current prices, there will be periods of weakness due to weaker gasoline and chemical prices and the availability of naphtha from west-of-Suez countries.

Producers in Australia, India, Indonesia, Thailand, and Malaysia may have easier access to large quantities of ethane recoverable from natural gas reserves. This will guarantee lower-cost ethylene production and sustainability as they switch feedstocks in future capacity expansions.

Malaysia and Thailand are already partly gas based. Thailand’s expansions are either gas based or have gas-naphtha flexibility.

Asian petrochemicals is undergoing profound change led by massive growth in Chinese and Middle East capacity and the prospect of intense competition for Asian markets from these Middle East producers. The growth in Asian capacity lends sustained support to naphtha prices, and competition from the Middle East will place margins under pressure.

Low-cost exports from the Middle East may force the cancellation of projects in consuming countries due to expensive gas or naphtha. Although this theory may prove correct in the long run, consumer countries may retaliate by imposing tariffs and dumping regulations to protect their own industries. It is clear, however, that the demand for naphtha in Asia-Pacific will outpace output in the next few years.

The author

Kevin McConnachie ([email protected]) is a senior consultant and Singapore team leader for FACTS Global Energy, Singapore. At FACTS, he specializes in oil refining planning, performance evaluation, and investment analysis. McConnachie has 22 years’ experience in the downstream oil business including LP modeling and clean fuel projects, and has worked in refineries in Australia, South Africa, Singapore, and the US. Before joining FACTS, he held various positions with the Singapore Refining Co., BP, UOP, Caltex Oil, and African Explosives and Chemical Industries. McConnachie holds a BSc in chemical engineering, a masters in applied finance and investment, and a graduate diploma in management from the University of Central Queensland and Securities Institute of Australia. He is an Associate of the Securities Industry of Australia.