SPECIAL REPORT: Shell developing heavy oil in deep water off Brazil

In its BC-10 integrated field development off Brazil, Shell is using new subsea technologies that incorporate caisson separation with electric submersible pumps, surface BOP with slim riser, and high-power umbilicals.

Paul Dorgant, Shell’s BC-10 venture manager, told OGJ that Shell anticipates being in Brazil for a long time.

The heavy oil field will be developed with deepwater, horizontal wells and openhole gravel pack completions and produced to an FPSO.

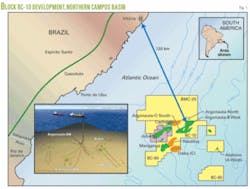

Shell has interests in 10 offshore exploration blocks in the Santos, Campos, and Espiritu Santo basins off Brazil.

Campos basin

Campos is one of five major basins off Brazil, located between the Espirito Santo basin to the north and the Santos basin to the south. Campos stretches from the State of Espirito Santo south to Cabo Frio, off the northern coast of Rio de Janeiro State.

Campos basin encompasses several major fields: Albacora, Albacora Leste, Barracuda Caratinga, Bijupira-Salema, Marlim, Marlim Sul, Marimba, Marimba Leste, Roncador, and Jubarte. Industry believed the basin held the largest oil reserves on the Brazilian shelf, until Petrobras’ recent discovery of giant Tupi oil field in Santos basin.

Shell operates the Bijupirá and Salema fields in the central Campos basin and has non-operating interests in two blocks in the northern Campos basin: BM-C-25 and BMC-31.

Key technologies

Shell will integrate proprietary technologies, in-house expertise, and third-party products to produce the heavy oil at BC-10. The key technologies include:

- Horizontal wells.

- Artificial liftwith all boosting at the seafloor and no jewelry downhole. All production will flow at natural reservoir pressure.

- Flow assurancehot oil circulation required to flow the high-viscosity oil.

- Slim, deepwater riser, electrical umbilicals.

- Heavy oil processing at surface (FPSO).

BC-10 control

Brazil’s National Petroleum Agency, ANP, granted the BC-10 exploration license on Aug. 6, 1998.

In May 2002, Shell purchased UK independent Enterprise Oil PLC for $700 million. This included Enterprise’s Brazilian subsidiary; Shell assumed Enterprise’s 35% ownership interest in Block BC-10 and inherited operatorship of the Bijupirá-Salema development project (OGJ, Dec. 16, 2002, p. 22). At that time, Petrobras held 35% of BC-10 and ExxonMobil Corp. unit Mobil Exploração Desenvolvimento Ltda. held 30%.

After drilling 13 wells and finding 17-24° gravity oil, Shell declared BC-10 commercial in December 2005 (OGJ, Oct. 2, 2006, p. 5).

In January 2006, ExxonMobil subsidiary Esso Exploracao Campos Ltda. began proceedings to sell its interest to ONGC Videsh Ltd. (OVL), but the transfer was challenged by Exxonmobil’s partners. Petrobras later agreed to waive its preemption rights, allowing OVL to acquire the 15% share it holds now. Shell assumed the other half of ExxonMobil’s participating interest.

John Haney, Shell E&P vice-president, said “The deepwater offshore Brazil is an important element of our global growth strategy. We believe that an increased interest in BC-10 is an attractive opportunity and reconfirms our commitment to growth in Brazil.”1

Shell now operates the BC-10 development and controls 50%. Marking its entry into Latin America, OVL officially announced its 15% share in April 2006.1

Shell Park

Shell has made six technical discoveries in four areas of BC-10: Abalone, Argonauta (paper nautilus), Ostra (oyster), and Nautilus, all named for local shells. The integrated field development in the northern Campos basin is known locally as Parque das Conchas, or Shell Park.

All four fields are low pressure and require boosting. Abalone and Ostra contain gas and require subsea separation. Argonauta has less gas and no need for the caisson separation.

The Abalone appraisal well produced surprisingly light oil42º APIcompared with the 16-24º API oil produced from the other fields.

Nautilus field lies in the southwest of the BC-10 block and a substantial portion continues into adjacent Block BC-60, where it is known as Manganga field. Dorgant said the unitization must be resolved with Petrobras. Block BC-60 also contains Jubarte and Cachalote fields.

Metocean

Shell’s metocean program is investigating full-depth currents and engaged Fugro for field work. The University of Sao Paulo interpreted the raw data. Despite concerns about high on-bottom currents, no evidence was found of scouring.

“The key,” Dorgant said, “was getting [subsurface current] data for modeling VIV performance. And we had the data in time for design.”

Shell will use a steel “lazy wave” for risers. Dorgant said this provides buoyancy and takes some of the load off the floating structure and the set-down point. Steel lazy wave was also used at NaKika in the Gulf of Mexico for umbilicals.

Geology, geophysics

There are six BC-10 reservoirs, all turbidite sands. The low-pressure reservoirs require equipment rated only to 10,000 psi and standard temperatures.

Shell’s Lee Stockwell said the Rio-based subsurface team is using Halliburton’s 3D DecisionSpace for visualization, Shell’s proprietary 123i seismic software for time and depth migrations, Petrel for inversions and 3D static models, CMG for reservoir engineering, French Teclog software for petrophysics, and Petroleum Experts’s GAP software to produce well diagrams.

Much of the work is done in Shell’s offices in Barra da Tijuca.

BC-10 falls under the “Bid Round Zero” rules, and although no local content is required, operators must provide equal opportunity to Brazilian companies. This includes issuing requests for bids in Portuguese and giving the responses fair consideration.

Some of the work is difficult to accomplish in the country. Cores cannot leave Brazil, and yet there are no commercial paleoservices and few petrology labs available to companies outside Petrobras’s private labs.

Rig operations can be monitored by Shell’s real-time operations centers, and Houston is the primary location monitoring the company’s Brazilian operations. The Arctic I has an RTO server running Halliburton’s INSITE Anywhere web delivery service. Using the RTOC system, the company can track and optimize performance, making the data accessible to experts around the world.

Drilling

The Stena Tay fifth-generation semisubmersible drilled the first 12 wells at BC-10 and the BS-4 wells in the Santos basin. Shell used Transocean’s Deepwater Navigator drillship to drill the 13th well at BC-10.

After deciding to use a surface blowout preventer (BOP) with a slim, high-pressure riser, instead of a BOP and heavy marine riser, Shell was able to step down to a smaller rig for development drilling. The company engaged the GSF Arctic I semisub (Fig. 2) in late 2006 for development drilling March 2008 to January 2011. Shell entered the 34-month, extendable contract with GlobalSantaFe Corp. for the Arctic I (now owned by Transocean Inc.) at $270,000/day, up from $265,000/day.

The rig is a third-generation semisub (Friede & Goldman L-907 Enhanced Pacesetter design), modified earlier this year at the Signal International yard, Pascagoula, Miss., before sailing to Brazil from the Gulf of Mexico. It was inspected by IBAMA, the federal environmental agency, before going to work.

In November 2007, anchor vessels installed the spacer templates and drove the 60 m by 48-in. diameter conductors (Fig. 4). Dorgant said the bottom is soft and the conductors could be driven, with no need to jet or drill.

The mooring system was preset before the Arctic I arrived to drill the topholes and instal 40 m by 42-in. diameter liners.

Shell will batch drill the wells with Schlumberger’s PowerDrive rotary steerable drilling system.

Development plan

The target shallow horizons (900-1,200 m below mud line) will require Shell to drill horizontal wells, building angle from the surface in order to minimize dogleg severity.

Phase 1 development includes drilling at Ostra, Abalone, and Argonauta-B West.

At Ostra, the reservoir lies only 900 m below the mudline and produces 24ºAPI oil. Shell will drill six horizontal wellsthree in each fault blockand one disposal well.

At Abalone, one reservoir lies about 1,700 m below mud line, and Shell will drill one deviated well. Abalone will be tied back to Ostra (Fig. 1, inset).

At Argonauta-B West, Shell will drill one appraisal well and two deviated horizontal wells.

Phase 2 will include drilling at Argonauta-O North, which will require water injection.

Phase 3 may involve wells at Argonauta-O South, and Phase 4 may include drilling at Nautilus, if the unitization is resolved.

Surface BOP

Surface blowout preventer (SBOP) technology extends the capability of smaller offshore rigs that do not have the space to store large-diameter, heavy marine riser. Using SBOPS can reduce deepwater exploration and development costs because of lower dayrates for the smaller rigs and the use of slimmer riser (16-in. in place of 21-in. diameter) and casing strings.

Unocal Corp. was the first to use SBOPs, in Indonesia’s Makassar Strait; it drilled 138 wells from 1996-2000 (OGJ, Dec. 16, 2002, p. 37).

Shell made some modifications to hoisting equipment on the Arctic I to allow movement of the new surface BOP (SBOP) system between the tensioner wires once the wires are connected to the tension ring and supporting the riser.

The new hoisting system had to be able to move the SBOP from its parked position at the edge of the forward moon pool area to the well center (through the tensioner wires). The system that was finally selected has a “U”-shaped rail that can carry four traveling hoists.2

Shell tested a prototype hoist system to validate the design before it was implemented on the Arctic I. A new lifting frame was installed for the SBOP that interfaces with the four hoists.

The new riser system is probably the most significant change to the SBOP system for the BC-10 project, according to Shell’s Brian Tarr and Tor Taklo.2

Key features of the slim, high-pressure risers include:

- Seamless, 16-in. OD, X80 tubulars with ¾-in. WT to meet pressure capacity requirements.

- New Merlin-style connector design.

- 32-in. OD buoyancy, based on the 2,285 m future water depth requirement and available rig tensioner system capacity.

To prevent VIV (vortex-induced vibration), 10 joints of 24-in. OD strake-equipped riser joints will be run above the buoyancy-equipped section of the riser.

Tubulars

According to a press release in March, Shell Brasil Ltda. awarded BJ Tubular Services a 3-year extension of its current contract to provide casing and tubing running services off Brazil through 2011. BJ will provide services at BC-10 from its operations base in Macae.

BJ will use a fully mechanized running system, including its Leadhand tong technology with hydraulic casing and backup tongs. BJ will also install its Derrickman system (remotely operated mechanical arm) on the Arctic I rig.

Coatings and pipe for the subsea flowlines are made in Brazil, supplied by Valourec and Mannesman’s subcontractor, Bredero Shaw, in Belo Horizonte. Tubulars are shipped by rail to the CPVV support base in Vitoria.

Subsea trees—EVDT

FMC has three facilities in Braziltwo in Rio de Janeiro and one in Macae. The company builds subsea manifolds, trees, wellheads, pipeline, and control systems.

FMC has increased its local subsea tree manufacturing capacity to 350 trees in 2007-08 from 250 in 2006, 200 in 2005, and 175 in 2004. The expansion was driven by three contracts: Shell’s BC-10, Chevron’s Frade, and Petrobras’s Mexilhao.

Phase 1 of the BC-10 project requires 10 subsea trees, 2 production manifolds, 2 artificial lift manifolds, and 6 ESP boosting manifold modules.

Shell’s new subsea tree standard is the EVDTenhanced vertical deepwater treerated to 10,000 psi for 3,000 m water depth. These are 5-in. by 2-in. tree systems with concentric production bores and retrievable choke modules with multiphase flowmeter capability.FMC will exhibit an EVDT at the Offshore Technology Conference in Houston, May 5-8, 2008.

After the Phase 1 trees are installed at BC-10, Shell will have a total of 25 subsea trees among its operated assets off Brazil. Petrobras, by comparison, is the world’s leader in implementing this technology, with more than 500 subsea trees installed.

Manifolds

FMC has built two artificial lift manifolds (Figs. 4 and 5) with slots for modules of boosting (MOBO) for Phase 1 of BC-10: ALM1 (4 MOBO slots) and ALM2 (two MOBO slots). Each ALM has about 50,000 individual parts, according to FMC’s technical director, Paulo Couto.

The company uses SolidWorks software for design and did some rapid prototyping during the qualification process (for products not field-tested). Hundreds of qualifications were required, and about 75% were completed by March 2008. Couto said that the use of CAD systems has reduced mistakes.

The 4-m by 4-m MOBO boosts oil and separates oil and gas so that only oil passes through the electrical submersible pump. The separation is based on gas-liquid cylindrical cyclone (GLCC); there is no helix in the caisson. In the GLCC system, fluid enters the caisson tangentially, gas goes to the center and rises to the top, and liquid falls down the annulus to the ESP.

The caisson below the MOBO extends about 100 m into the seabed.

ESP caisson

Petrobras championed vertical annular separation and pumping systems (VASPS) in the early 2000s; one is still working in the Campos basin.3

Dorgant said Shell will flow multiple wells into single caissons, using new ESP caissons to separate commingled gas and oil. “ESP caisson technology seems to be working extremely well,” he said. “Considering the range of outcomes that we could expect, we’re doing well.”

The 1,500-hp electric submersible pumps require high-power electric umbilicals.

Shell is also investigating twin-screw pump technology.

With the base manifold already installed, oriented, leveled, and conductors driven, the liners can be drilled over the next few months.

In October 2008, Shell will install the artificial lift manifolds at Argonauta field using Subsea 7’s new state-of-the-art deepwater rigid pipelay vessel Seven Oceans. In December, Shell will install the MOBO, caisson, and ESP assembly using the Arctic I.

FPSO

The Shell-led consortium will lease an FPSO for BC-10 from SBM Offshore NV. Shell said SBM Holdings Inc. will use “industry-standard” solutions for Brazil and design, build, own, and operate the FPSO. The lease contract is for 15 years, with options to extend or purchase.

Keppel FELS Shipyard in Singapore is converting the very large crude carrier Domy, an FSO previously operated off Africa, into the 100,000-b/d FPSO Espirito Santo for SBM with storage for 1.4 million bbl of oil and capacity to hang nine risers (Fig. 6).

The original hull, built in the early 1970s of “mild” steel, had a 30-year design life.

Modifications include a new moon pool for the 21-slot turret, covered sponsons to provide protection from collisions, and processing modules.

Bijupira-Salema

Shell’s first sole production operation was the Bijupira-Salema project, one of the first major Brazilian fields developed by a foreign operator, and Brazil’s first turnkey subsea project. Shell owns 80% of the project and Petrobas 20%. Shell became the first foreign oil company with oil production in Brazil (OGJ, Nov. 7, 2005, p. 20).

Bijupirá and Salema fields were discovered by Petrobras in 1990, about 250 km (150 miles) east of Rio de Janeiro. The fields are about 20 km apart and the water depth ranges from 480 to 880 m (1,580 to 2,900 ft). Bijupira-Salema has combined estimated recoverable reserves of about 170 million bbl of oil, with a 13-15 year field life.

Bijupirá is the larger field, with eight wells drilled in 2001-02 (six production, two water-injection, and two subsea manifolds). First oil came in August 2003. The gravity of the light oil produced ranges 28-31º.

Salema is the smaller field, with first production from a single well in October 2003. Shell drilled a second well in 2006.

FMC Technologies do Brasil Ltda. and MODEC International supplied the FPSO vessel and turret, flowlines, riser system, controls, manifolds, and tie-in systems for the Bijupira-Salema development.

The Fluminense FPSO was converted in Singapore from an ultralarge crude carrier (Sahara ULCC) and arrived in Brazil early 2003. The ship is 400 m long, can process 81,000 b/d, and store 1.2 million bbl of oil.

FMC SOFEC supplied an external cantilevered bow turret mooring system.

Subsea field equipment includes:

- Fifteen vertical trees rated to 5,000 psi.

- Vertical connection system, 10 hydraulic connectors, 20 light mechanical connectors.

- Five subsea manifoldsthree for production and two for water injection.

- Five subsea control modules.

- Pipeline and pipeline end termination (PLET) systems.

The project delivered first oil in August 2004; Shell’s Dorgant said in March 2008 that average daily production is about 35,000 bo/d. Gas is exported to Petrobras’s P-15 platform.

Shell in Brazil

Brazil represents a relatively small portion of Shell’s global E&P portfolio, but the company’s objectives are to “deliver new material oil and build a sustained presence.” Shell has interest in 10 exploration blocks off Brazil and Dorgant said the company hopes to realize the subsalt potential.

Shell is one of the first independent oil companies to assume sole operatorship, first at Bijupira-Salema, and now at BC-10.

“The progress on BC-10 is exceeding my expectations,” Dorgant said, “We’ve had remarkable schedule control and cost control on Phase 1. Staying on schedule and on budget is the key to maintaining our strategy in Brazil.”

References

- “OVL’s first foray in Latin America-15% stake in Brazilian deepwater block,” Apr. 26, 2006, www.ongcvidesh.com.

- Tarr, Brian A., Taklo, Tor, Hudson, A., Olijnik, L.A., Shu, H., and Greff, R., “Surface BOP System for Subsea Development Offshore Brazil in 1,900 m of Water,” SPE 112788, IADC/SPE Drilling Conference, Orlando, Mar. 4-6, 2008.

- Vale, O.R. do, Garcia, J.E., and Villa, M., “VASPS Installation and Operation at Campos Basin,” OTC14003, Offshore Technology Conference, Houston, May 6-9, 2002.