Global reserves, oil production show increases for 2014

Conglin Xu

Senior Editor-Economics

Laura Bell

Statistics Editor

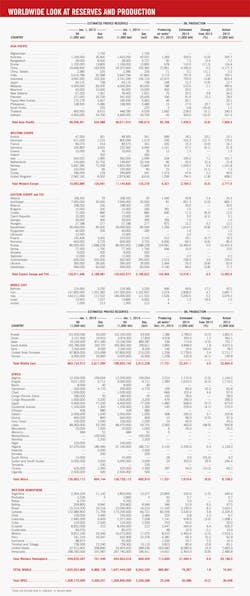

Oil & Gas Journal's annual look at worldwide proved reserves shows increases compared with a year ago. Reserves estimates for crude oil and lease condensate now total 1.656 trillion bbl, up from 1.647 trillion bbl reported in last year's survey (OGJ, Dec. 2, 2013, p. 30). Global natural gas reserves are 6.96 quadrillion cu ft, climbing from 6.94 quadrillion cu ft a year earlier.

In 2014, global oil production is projected to average 76 million b/d, up 1.8% from a year earlier, led by higher output from the US.

The published reserves figures rely on survey responses and official updates released by individual countries, which are not provided every year in many cases. OGJ changes its estimate for a particular country only when it receives evidence that a change is in order. Therefore, in a given reserves summary, a year-to-year change-or lack thereof-may not necessarily reflect a change that applies to the calendar year alone.

Reserves changes

Australia's proved crude oil and condensate reserves total 1.19 billion bbl, down from 1.43 billion in the previous survey, according to the most recent estimates from Geoscience Australia. The country's gas reserves are now 30.4 tcf, 29.4% lower. The reserve estimates are classified based on development status of Commercial Category I.

Thailand's Department of Mineral Fuels reported yearend 2013 proved reserves of 257 million bbl of crude and 204 million bbl of condensate. This compares with a combined 448.8 million bbl of crude and condensate recorded previously.

The newest oil reserves figure for China is 24.65 billion bbl, up from 24.38 billion bbl a year earlier. China's latest gas reserves stand 5.5% higher at 164 tcf.

India posted small increases in reserves for both oil and gas, while Bangladesh registered a sizable decline of 12.7% in its gas reserves.

In Western Europe, reported collective crude oil and lease condensate reserves slipped 5% to 10.6 billion bbl, as limited gains in Turkey and UK were more than offset by declines in the rest of the region. Gas reserves for this group of countries also fell 3.8%.

According to the Norwegian Petroleum Directorate, Norway's proved oil reserves declined 5.6% to 5.5 billion bbl, and gas reserves declined 2% to 72.3 tcf.

As a result of annual production and the relocation of probable reserves into the proved category, the UK's latest proved reserves have been estimated at 2.98 billion bbl of oil and 8.5 tcf of gas, according to the Department of Energy and Climate Change.

Since 2013, the Netherlands' resource reporting has been according to the Petroleum Resource Management System. Due to the introduction of PRMS, the Netherlands' reserves reported last year are now modified to 149.7 million bbl of oil and 33.7 tcf of gas. The latest estimates from the Ministry of Economic Affairs show declines in both categories.

Estimates of proved oil reserves for countries in the Western Hemisphere total 549.6 billion bbl compared with last year's 545 billion bbl. Gas reserves for the group now stand at 701 tcf, up from 669 tcf a year earlier.

Peru reported a large increase-17%-in oil reserves to 741 million bbl because of a revaluation of reserves on Block 64 at Situche Central and other production sites.

The most recent estimates released by the Argentine Petroleum and Gas Institute reveal declines of 16% in both categories. Lower estimates for both oil and gas reserves also have been reported by Mexico.

According to Houston-based Ryder Scott Petroleum Consultants, Trinidad and Tobago's proved natural gas reserves declined to 12.24 tcf in 2013 from 13.1 tcf in 2012, reflecting high production and low replacement.

OPEC reserves

According to the most recent estimates from the Organization of Petroleum Exporting Countries' annual statistical bulletin, total oil reserves held by its member countries are now 1,206 billion bbl, up 0.4% from a year ago. Gas reserves fell slightly by 0.1% to 3,356 tcf.

Since the previous edition of this report, OPEC has reported increases in oil reserves for Iran, Iraq, Qatar, Ecuador, and Venezuela.

Saudi Arabia's oil reserves are slightly down 61 million bbl to 265.79 billion bbl, while its gas reserves are up 3 tcf to 293.7 tcf.

As a comparison, nearly all member countries in Africa reported declines in both oil and gas reserves. Oil reserves of this subgroup have registered a loss of 226 million bbl since the previous survey, while gas reserves are now 1.8 tcf lower than a year ago.

The share of the world's oil reserves in OPEC is little changed, standing at 73%. OPEC controls 48% of total global natural gas reserves.

US, Canadian reserves

The US Energy Information Administration reported that, as of yearend 2012, US crude oil and condensate proved reserves increased year-over-year by 4.5 billion bbl, or 15.4%, to 33.4 billion bbl, because of a large volume of extensions to existing fields particularly in Texas and North Dakota as well as relatively constant oil prices during the report period.

Proved reserves in 2012 increased in three of the top five largest crude oil and lease condensate states, including Texas, the Gulf of Mexico federal offshore, and North Dakota.

Texas had the largest increase by a wide margin-about 3 billion bbl-which accounts for 67% of the net increase in 2012. The Texas increase is primarily from ongoing development in the Permian and Western Gulf basins in the western and south-central portions of the state.

North Dakota reported the second-largest increase of 1.1 billion bbl, contributing to 25% of the 2012 overall net increase, driven by development activity in the Williston basin.

Proved reserves of US dry natural gas decreased 7.8% to 308 tcf and wet natural gas reserves decreased 7.5% to 322.7 tcf in 2012. The average reference price of natural gas companies used to estimate reserves declined 34% between 2011 and 2012. This prompted large downward net revisions to the proved reserves of existing gas fields, canceling out almost all the gains from total discoveries in 2012.

EIA is scheduled this December to release the yearend 2013 estimates of US crude oil and natural gas proved reserves. As OGJ went to press, these new reserves figures are not accessible and the figures updated in this report are OGJ's own estimates.

OGJ estimates that, as of yearend 2013, US crude oil and lease condensate proved reserves totaled 38 billion bbl and dry gas reserves increased to 338.8 tcf.

The latest estimate reported by the Canadian Association of Petroleum Producers (CAPP) indicates a slight decline (0.4%) in Canadian oil reserves to 172.5 billion bbl. Oil sands reserves now total 167.2 billion bbl compared with 168 billion bbl last year.

According to CAPP, Canada's gas reserves are recently estimated at 71.8 tcf, up from 66.7 tcf a year ago.

Oil production

Combined crude oil and condensate output in the Western Hemisphere will increase 6.9% this year to 21.6 million b/d, led by strong increases in the US, Canada, and Brazil.

The US is the leading contributor to forecast regional and global supply growth, increasing 1.1 million b/d in 2014. Outputs in Canada and Brazil are projected to reach 3.5 million b/d and 2.2 million b/d, up 5.8% and 8.2%, respectively, from a year earlier.

Led by a reduction in Denmark, oil production in Western Europe is forecast to post a 0.5% decline this year.

In Africa, production is forecast to fall 6% in 2014 to 7.6 million b/d, with reduced output in Algeria, Angola, and Libya.

Nigeria's crude oil and condensate production averaged 2.19 million b/d in 2013, according to Nigerian National Petroleum Corp., and is expected to be roughly stable this year.

Preliminary estimates show slight growth of 0.3% in Eastern Europe and the former Soviet Union area. Russia oil output is estimated to increase to average 10.49 million b/d this year vs. an average of 10.42 million b/d last year.

In the Asia-Pacific region, the collective oil output this year will slide 0.8% due to declines in Indonesia, Thailand, Vietnam, and Brunei. Averaged oil production in China for 2014 will increase slightly to 4.18 million b/d from 4.17 million b/d a year earlier.

OGJ estimates that OPEC production averaged 30.6 million b/d in 2013 and expects a fall of 0.2% in 2014. Non-OPEC production, meanwhile, is expected to rise by 1.4 million b/d in 2014.