Southwestern refines Fayetteville shale completions

Rachael Seeley, Editor

Southwestern Energy Co. completed 7 of its 10 best-performing wells in the Mississippian Fayetteville shale during the second quarter as it continued to refine drilling and completion techniques in the Arkansas formation.

The best-performing well, the Allison Trust 7-16 4-15H11 in Conway County, Ark., achieved a peak, 24-hr initial production rate of 14.1 MMcfd, while three other wells yielded IP rates above 13 MMcfd.

"We had one of our best quarters in the company's history related to well performance and initial production rates," Bill Way, chief operating officer of Southwestern, told analysts during a presentation of second-quarter results.

Southwestern pioneered the Fayetteville and continues to gain familiarity with the rock throughout its leasehold.

Southwestern is one of the largest producers in the Arkansas shale play. Second-quarter output totaled 1.36 bcfd, up from 1.32 bcfd a year earlier. Other top Fayetteville producers include XTO Energy Inc., a subsidiary of ExxonMobil Corp., and BHP Billiton Petroleum (Fayetteville) LLC, which purchased Chesapeake Energy Corp.'s Fayetteville assets in 2011.

The Fayetteville produced 2.8 bcfd in the first 4 months of 2014, according to Arkansas Oil and Gas Commission data.

A study by the Bureau of Economic Geology at the University of Texas at Austin found the play holds 38 tcf in technically recoverable resources, of which 18 tcf is economically feasible at gas prices near $4/Mcf.

Improvement drivers

Southwestern drilled its first Fayetteville shale well in 2004 and now holds about 906,000 net acres in the play. Development is focused in Conway, Cleburne, Faulkner, and White counties in the northern part of the state.

In the second quarter, Southwestern placed 147 Fayetteville wells online with an average, 30-day initial production rate of 4.4 MMcfd/well (see table). Of these, 41 wells had initial production rates exceeding 4.0 MMcfd.

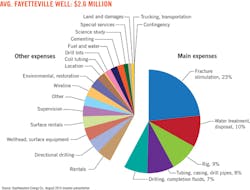

The average cost to drill and complete a Fayetteville well during the period was $2.5 million, and the company expects the average well cost for the full year will average $2.6 million.

Steve Mueller, chief executive officer of Southwestern, listed three factors in the improved Fayetteville results. The first is the debottlenecking of gas gathering pipelines and compression infrastructure that, in areas with higher pressures, is enabling wells to produce at higher rates without concern that the initial production surge will overwhelm pipeline capacity and knock wells downstream off the system. Southwestern's Fayetteville gathering system was moving about 2.3 bcfd of gas through 1,980 miles of pipeline in the second quarter.

Secondly, Mueller said, extended shut-ins are being used in parts of the field with higher water content. "Some of the field has more water than other parts of the field. Extended shut-in has decreased that water," he said.

And finally, the company is looking at smaller portions of its acreage in greater detail and finding some areas with good geology "that either we hadn't tested before or we hadn't tested correctly before with the procedures we're doing," Mueller said.

Staying in zone

One emerging focus for Southwestern is the Upper Fayetteville. In the first half of the year, Southwestern brought six Upper Fayetteville wells online with an average IP rate above 4.0 MMcfd. The best-performing well came online at 6.3 MMcfd.

The company has now drilled 45 wells targeting the Upper Fayetteville and expects to drill and complete five more before the end of the year.

Southwestern has become more fastidious at ensuring its horizontal laterals are positioned within the most brittle portions of the zone throughout the Upper Fayetteville, a feat made possible through technological advances and continuous monitoring of drilling.

"One of our chief objectives in drilling these Upper Fayetteville tests-and we've been working on them for some time-was the ability to stay in zone, in a more brittle zone of this particular part of the formation," Way told analysts. This has improved the quality of Southwestern's fracs throughout the Upper Fayetteville interval.

The company is also targeting narrower windows for its horizontal laterals in the Lower Fayetteville and in the Middle Devonian Marcellus shale of the Appalachian basin.

According to Mueller, "If you asked us a year and a half ago or 2 years ago to stay in zone, plus or minus 25-30 ft was staying in zone. Today, when [Way] says stay in zone, it's less than 10 ft, and in some cases we're trying to stay [within] 5 ft, and we're doing it very successfully in both the Fayetteville shale and Marcellus."

Upgrading rigs, results

The Fayetteville is receiving the largest portion of Southwestern's 2014 capital spending budget, at $900 million. The company also allocated $760 million to the Marcellus shale and $178 million to the Cretaceous Tuscaloosa Brown Dense formation in Louisiana. It reserved $190 million for exploration of emerging, new venture areas.

In the second quarter, the average horizontal Fayetteville well cost Southwestern $2.5 million to drill and complete, had an average horizontal lateral length of 5,390 ft, and took 6.7 days to drill. The use of new drilling rigs enabled the company to drill 26 operated wells in less than 5 days/well.

Southwestern has allocated $95 million to add seven new, more-efficient rigs to its Fayetteville drilling fleet this year. The AC-powered, dual rigs are part of a larger vertical integration effort that saved the company an average of $437,000/well, or 15% of total well cost, in the second quarter.

Too early for refracs

Even though Southwestern has been active in the Fayetteville for 10 years, Mueller said, there are no plans to begin refracturing older wells as this is not typically done until after production has fallen to a marginal rate. "We just haven't had that many wells that are marginal enough to talk about refracs," Mueller said.

The company did refrac a handful of some of its earliest Fayetteville wells several years ago, Mueller said, and the refracs increased their reserves by about 20%. However, he cautioned, those were some of the company's earliest Fayetteville wells and are not representative of the company's well base. "We don't have a good base there to say it's going to be good or bad. But physically, you can do it," Mueller said.