Uncertainty lingers about local content rules as Mexico prepares for competitive bid round

Natalie Regoli

Benjamín Torres-Barrón

Brian Polley

Baker & McKenzie LLP

Houston, Mexico City

The energy industry around the world has it eyes on Mexico as the country implements constitutional and legislative reforms that are set to open its energy industry up to private investment for the first time in 75 years. The Peña Nieto administration and Mexico's regulatory agencies face challenges as they begin to implement reform. Many questions remain, including fiscal conditions in the contracts, fees for the works, the quality of support infrastructure yet to be built, and local content requirements.1 For now, questions from potential investors center on local content requirements and the state's first competitive bid round, Round One.

Local content2

Oil and gas contractors will be required to source a portion of personnel and equipment from Mexico. For now, local content requirements are expected to apply only to contracts between the state and a state-owned corporation, like Pemex; the state and a private party; or a state-owned corporation and a private party. A portion of the local content requirement will be satisfied by vendors and subcontractors through flow-down obligations. Failure to comply will trigger penalties that will be determined by the National Hydrocarbons Commission.3 These local content requirements are specified only for exploration and production activities that are not considered deepwater or ultra-deepwater activities, although the Mexico's energy ministry, Secretaría de Energía (SENER), will be formulating local content requirements for these remaining activities as well.

As part of the public tender invitation process, SENER will release draft contracts that estimate the portion of local content that will be required by each contract.

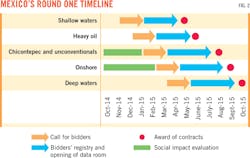

The local content required by each contract will be determined by criteria developed by SENER in conjunction with the economic ministry (see table). SENER intends to start the local content requirement at the prereform level of 25% and increase it to 35% over time. The requirements are expected to take into consideration the capacity of the country's existing industrial and business base.4 The ministries may initially issue some contracts with local content requirements below 25%; however, it is unclear how this would be supported by the postreform laws.

There are concerns about the government's level of influence on how local content requirements will be met. One Mexican member of Congress, who spoke at a conference in Houston in September under Chatham House Rules, sought to alleviate that concern by stating that investors and project developers would submit their expected local content percentage during the bidding stage, allowing the companies to run the numbers and understand the economics of a project before bidding. But predictability with respect to a certain contract is different from predictability between contracts. Similarly, the concern about discretion is not assuaged by SENER's statement that local content requirements will take market conditions into account.

Mexican government officials have stated that they do not want to mandate whom companies hire and what products companies buy. One Mexican congressman, also speaking at the same conference under Chatham House Rules, put it another way, stating that Mexico does not want protectionism to impede progress.

A transparent framework for local content requirements is needed to create confidence in the regulatory process, which will make Mexico's energy industry more attractive to international investors. To this end, the government has promised various transparency measures including publicly posting contract templates and requiring at least two National Hydrocarbons commissioners to be present at meetings between regulators and companies.

Bid rounds5

Mexico already assigned the majority of known reserves to Pemex in a noncompetitive bid round held in August 2014. In Round Zero, Pemex was awarded 83% of the country's proven and probable reserves and 21% of prospective resources. The award covers 64,489 sq km of conventional prospective resources and 8,408 sq km of unconventional prospective resources.6

In the first competitive bid round, Round One, SENER will award leases to domestic and international companies, as well as Pemex. It will offer 109 exploration blocks and 60 producing blocks covering a combined 28,000 sq km (Fig. 1).7 Some of these blocks could be combined, thereby reducing the total number of blocks if it turns out to be in the best interest of private industry, according to Edgar Rangel, commissioner of the National Hydrocarbons Commission.8 In any event, the blocks will include areas in shallow and deep water, mature fields, and heavy oil fields in the Perdido and Chicontepec areas, the Tampico Misantla basin, and unconventional plays in the Sabinas basin.9

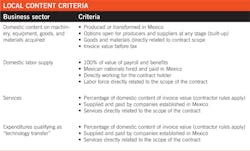

In November 2014, SENER will name the blocks to be tendered in Round One and draft bidding guidelines.10 Model contract forms will be released along with commercial and fiscal terms for each contract. Bidding guidelines should be available for purchase in early 2015. Bidders must purchase guidelines to become eligible to participate in the tender process and gain access to detailed field information in the online data room.

The first contracts for Round One are scheduled to be awarded in May 2015, and the first deepwater contracts are slated to be awarded by late September 2015 (Fig. 2).11 In the meantime, the Mexican government has hosted road shows in Houston, New York, and London for investment bankers, fund managers, and executives at international companies to promote the first bidding round and garner feedback on model contracts. Some observers suggest the success of Round One will depend on the number of companies other than Pemex that win contracts in prospective, undeveloped fields.12

There is cautious optimism that the reforms will yield international investment in Mexico's energy sector and raise oil and gas production. The Nieto administration has so far met key reform deadlines, and exploration and production companies have signaled interest in the country's oil and gas reserves. Postreform deal flow is beginning to materialize. BHP Billiton has signed a memorandum of understanding (MOU) that calls for sharing deepwater expertise with Pemex, and Petronas Oil & Natural Gas Corp., of Malaysia, has agreed to share expertise in deepwater, mature, and heavy oil fields with the state oil company.13

Private equity firms are also positioning themselves to capitalize on expected opportunities. Riverstone Holdings LLC and EnCap Investments, both of the US, recently partnered with Infraestructura Institucional, of Mexico, to form Mexico's first independent exploration and production company: Sierra Oil & Gas. The firms have pledged a combined $525 million to the venture.

Former Mexican President Vicente Fox visited Dallas recently to talk about his private equity firm, EIM Capital. EIM is working to raise $500 million to finance energy development in Mexico. It plans to focus on Mexico's shale resources, considered an extension of Texas' Eagle Ford formation. Fox is optimistic about his country's prospects for implementing reform. Mexico's labor costs are lower, the government will accept lower royalties than US landowners, and as for security, "Mexico is not hell," he stated.14 Indeed, if carried out as intended, Round One could trigger a Mexican energy renaissance and extend the North American energy boom into Latin America.

References

1. From El Economista, sent to BP from NLR at 2:56 pm on Oct. 22.

2. All of this section is adapted from NLR's notes at the Baker & McKenzie conference on Sept. 23.

3. Baker & McKenzie slides from conference.

4. http://www.brookings.edu/research/articles/2014/08/14-mexico-energy-law-negroponte.

5. Most of this section is adapted from an article by Greenberg Traurig lawyers dated Aug. 15, 2014.

6. SENER slides from conference (p. 7 in 127-page pdf).

7. SENER slides from conference, p. 3.

8. Universal, BM Mexican Energy Reform newsletter No. 25, Oct. 6-10, 2014.

9. SENER slides from conference, p. 4.

11. This paragraph is adapted from the Greenberg Traurig article dated Aug. 15, 2014

12. From El Economista, sent to BP from NLR at 2:56 pm on Oct. 22.

13. http://fuelfix.com/blog/2014/09/26/bhp-billiton-pemex-sign-agreement-to-share-deepwater-knowledge/.

The authors

Natalie Regoli ([email protected]) is a partner in Baker & McKenzie's Houston office and works with Baker & McKenzie's five Mexico offices to advise international companies in Mexico and Latin America. Regoli was named in the 2014 Houston Business Journal's List of Who's Who in Energy in Houston. She has experience with oil and gas projects along with petrochemical projects. Her project work focuses on development, financing, engineering procurement and construction, and claims and dispute resolution for energy and infrastructure construction projects. She has worked with governmental units, project sponsors, shareholders, investment bankers, credit rating agencies, commercial bankers, and corporate trustees.

Benjamín Torres-Barrón ([email protected]) leads Baker & McKenzie's Energy, Mining & Infrastructure Practice Group in Mexico. Torres-Barrón is listed as a recommended lawyer by Who's Who Legal for oil, gas, and project finance in Mexico and was named by Chambers Latin America as one of the country's leading lawyers in the energy and natural resources practice. He advises clients on the development of projects relating to oil, gas, water, waste, railroads, ports, airports, highways, LPG, LNG, biofuels, energy efficiency, electricity, and public bids called by Pemex, the Federal Electricity Commission (CFE), and other Mexican government agencies.

Brian Polley ([email protected]) is an associate in Baker & McKenzie's Houston office. Polley advises clients on energy mergers and acquisitions, along with private equity transactions and project development in the US, Latin America, and around the world. He also advises on LNG projects as well as national security reviews of foreign investments (CFIUS).