Metgasco farms into Cooper basin well

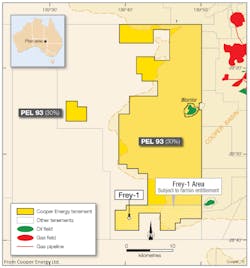

Metgasco Ltd., Sydney, has made an agreement with Adelaide companies Senex Energy Ltd. and Cooper Energy Ltd. to farm in to area surrounding the current Frey-1 wildcat within PEL93 of the South Australian Cooper basin for a 20% working interest.

The deal is dependent on the outcome of drilling and testing of the wildcat, which spudded last weekend. It has a proposed total depth of 1,502 m.

Metgasco says the Frey prospect has the potential for stacked pay in multiple formations. The large structure has been mapped as a 4-way dip closed anticline. 2D seismic interpretation indicates 30 m of closure within an area of 9.5 sq km at the lowest closing contour.

Several oil fields are nearby, enhancing the economics and potentially enabling a fast and cost-effective development of any discovery.

If the well is successful and Metgasco elects to proceed with the farm-in, it will join the combine as a 20% participant in registering a PRL over the Frey-1 area.

Metgasco will then be responsible for paying 30% of the aggregate costs associated with the Frey-1 drilling program up to a maximum aggregate cost of $2 million (i.e., Metgasco will pay as much as $600,000).

Frey-1 is regarded as a relatively high-risk, high-return oil exploration play with potential to trigger a revival of exploration in the southwest sector of the Cooper basin.

The farm-in deal marks a return to active petroleum work for Metgasco, which originally ran gas exploration programs in the Clarence-Morton basin of northern New South Wales. In December 2015 the company accepted $25 million (Aus.) offer from the New South Wales government to withdraw from its three permits in this region and from litigation against the New South Wales government following a concerted campaign from the anticoal seam gas lobby.