Liza development integrates multiple disciplines

Liza field, in Stabroek block about 190 km offshore in the Guyana basin, is the first offshore development project to produce oil in Guyana. Esso Exploration and Production Guyana Ltd. (EEPGL), a subsidiary of ExxonMobil, is operator (45%) with partners Hess Guyana Exploration Ltd. (30%) and China National Offshore Oil Corp. (CNOOC, 25%).

Stabroek covers 6.6 million acres (26,800 sq km) and has reserves estimated at 10 billion boe (Fig. 1). The first Liza wildcat well (Liza-1) was spud in March 2015, and first oil produced on an accelerated schedule Dec. 20, 2019.

Achieving rapid first-oil deliverables required interface management between stakeholders and contractors, disciplined management of change, and contingency planning in what ExxonMobil describes as a “One Team” approach. EEPGL’s project management team and representatives from each relevant company regularly met to maintain project focus. The team defined areas of uncertainty, maintained high thresholds to justify changes to project plans and design, and developed contingency plans for higher-risk or uncertain areas.

During the operations phase, EEPGL organized the project with an integrated business unit which included logistics, operations, projects, procurement, regulatory, and government engagement.

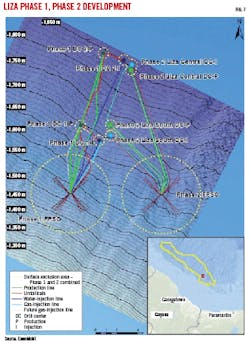

With this management in place, the number of drilling rigs increased from one in 2016 to four in 2020 with simultaneous subsea operations. Liza Phase 1 includes 17 wells in 1,500 to 1,900 m of water: eight production wells, six water injection wells, and three gas injection wells. Production is through Liza Destiny, a 120,000-b/d floating, production, storage, and offloading (FPSO) vessel converted from a tanker.

Liza Phase 2 is underway using lessons learned from Phase 1, implementing a new FPSO and an extensive fiber optic network for offshore communications to the onshore base. Phase 2 drilling has been ongoing and production is expected mid-2022.

Guyana Stabroek discovery

The first well drilled offshore Guyana was in 1960, and the first well drilled offshore in neighboring Suriname was in 1964. Both came up dry. Drilling throughout the 1970s, which included a 1,000-m deepwater well, also produced dry holes. Immature rich source rocks, however, were found and some were age-equivalent to Venezuela’s productive La Luna source rock. The basin lies next to the oil-rich Eastern Venezuela basin and was thought to connect to the Venezuelan and Trinidad petroleum systems. Without discovery of sufficient combinations of source rocks, traps, and hydrocarbons, however, further offshore drilling was halted.

The acreage lay open throughout the 1990s, and data available to ExxonMobil were limited to several seismic lines, about four offshore wells, and a Suriname onshore oil sample. The area was considered by the US Geological Survey to be the second least explored basin in the world, even though reserves were estimated at 15 billion boe including the entire offshore areas of Guyana and Suriname.

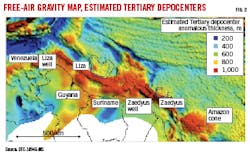

At this time, free-air gravity grid data from declassified US satellites entered public domain, and ExxonMobil used the data to update relevant plate tectonic models and generate a basin genetics analysis for working hydrocarbon systems throughout Mexico, Venezuela, and the Caribbean. These projects led to insights for a new plate tectonic model for offshore Guyana.

A bathymetric anomaly was identified offshore Guyana and Suriname and was postulated as thick crust (Fig. 2). The anomaly was consistent with newly developed plate tectonic models showing extension of the Central Atlantic-proto-Caribbean rift containing Triassic-Jurassic sediments into offshore Guyana. If the anomalous crust were Jurassic in age, it could contain Cenomanian-Turonian source rock, which was identified in the 1970s-era deepwater well as an immature high-quality source. Global gravity datasets typically observed strong high-gravity correlations to major Tertiary depocenter traps for source rock. Total sediment fill maps based on these data and smaller free-air anomalies offshore at the border between Guyana and Suriname guided subsequent hydrocarbon system and stratigraphy studies.

Using available data from the four offshore wells, constructed 1D basin models defined source rock maturity and oil generation timing. Maturity maps outlined locations for early and peak mature oil and mature gas. Biomarkers identified an onshore oil sample as a clastic type-II marine source, correlating the offshore system to onshore production. The source was genetically and age-similar with the prolific La Luna source in Venezuela. Additional seismic work identified stratigraphic La Luna-like features in Guyana-Suriname basin and interpreted widespread deepwater fan reservoirs for primary play exploitation.

Subsequent 2D seismic data aided interpretation of detailed stratigraphy from basement to water bottom. An integrated basin model was constructed to identify multiple plays and play fairways. The play assessment was completed by 2010. Additional 3D seismic in two areas imaged Maastrichtian Liza sands with clear differentiation from seals, leading to selection of Liza as the first prospect to be drilled on Stabroek block.

Liza Phase 1

The Liza-1 wildcat well discovered an active hydrocarbon system in the block in May 2015. It was safely drilled to 17,825 ft in 5,719 ft of water and included an original hole and sidetrack. It encountered more than 295 ft of high-quality oil-bearing Upper Cretaceous sandstone reservoirs. Encountered oil had 32°-36° API gravity with an 1,150 scf/bbl gas-oil ratio (GOR).

The original hole and sidetrack were cored for reservoir calibration. Based on the success of Liza-1, EEPGL conducted a blockwide 3D survey and identified locations for Liza-2 and Liza-3 appraisals. Liza-2 sidetrack evaluated flow performance and reservoir connectivity. Liza-3, drilled down dip of Liza-1 and Liza-2, confirmed static connectivity across the field. The results confirmed five high-quality oil bearing Upper Cretaceous deepwater reservoirs (A through E, from base to top) with 20%-30% porosity and 100-2,000 md permeability.

Based on these successes, EEPGL decided to develop the resource with targeted first oil within 5 years from discovery. Phase 1 was to develop D and E sands. With no in-country infrastructure capable of handling a large offshore project, EEPGL and partners had to assemble an integrated team to build a subsea template, acquire a FPSO, and build shore infrastructure.

Geotechnics, metocean

Limited site-specific geotechnical and metocean (wind, wave, and climate) data existed in the area. Due to time constraints, the team implemented phased data gathering while simultaneously defining project criteria. Initial project criteria were based on existing data. In 2016 the team started a new 2-year interim metocean criteria measurement campaign with survey buoy data pulled when needed to support key engineering and procurement decisions. The survey data showed that initial metocean criteria data had underestimated the magnitude and directionality of deep currents. Mooring and riser systems were subsequently upscaled to produce conservative designs for fabrication and procurement. These designs were verified through later data pulls.

Initial geotechnics were only understood from the single exploration well. Additional geotechnical data were obtained from a 2016 preliminary geotechnical criteria survey to characterize soils and geohazards. The survey raised questions about the suitability of the sand bed to accept mooring suction piles, but a subsequent 2017 survey helped mitigate these concerns. A spare mooring pile was constructed as a contingency in case of installation failure.

Logistics

The logistics project team provided drilling, project, and operation activities across the asset life cycle. Scope of work included shorebase operations, marine vessel supply and fuel, warehousing, mud and cement plants, helicopter transfers, and waste management. The group made an early study of supply bases in the area and determined that logistics support could best be achieved from Port of Spain, Trinidad, and Georgetown, Guyana, with key infrastructure upgrades to the latter. A warehouse, berths, and mud plant were constructed at the Guyana shore base and by 2019 all operations originated out of Georgetown, including satellite storage yards.

Risers

Risers are a particularly long-lead item in the procurement schedule. They are coupled to the FPSO, requiring collaboration with the FPSO design team. A steel lazy-wave riser (SLWR) was chosen to meet fatigue and production requirements. The SLWR suspends steel risers with buoyance modules to lower payload on the FPSO, making it more stable. The design was conservative to meet possible new metocean conditions derived from the interim metocean criteria project.

During early front-end engineering design (FEED), the SLWR design failed fatigue requirements when considering deep current profiles and anticipated vessel motions. Fatigue was mainly coming from vortex-induced vibrations (VIV) in the distributed buoyancy section of the riser. Buoyancy modules linked together suppressed VIV by limiting bending moments. Integrated VIV strakes on each module were arranged to form a uniform helical fin throughout the module train, stabilizing modules in the current. The design met performance, cost, and lead-time requirements. The number of buoyance modules was adjustable to accommodate changing metocean requirements, and this flexibility allowed riser pipe and weld qualification to proceed concurrently with module fabrication.

Drilling, completions

ExxonMobil used a geosteering workflow and Halliburton’s deep resistivity logging-while-drilling tool for reservoir drilling. Reservoir contacts were maintained within 30 m above and below the drilled interval.

Reservoir pore pressure and fracture pressure gradients made narrow-margin drilling difficult. Drilling fluid properties, hole size, drill string, and drilling parameters were optimized to reduce circulating pressure. A nonaqueous fluid (NAF) with ultrafine (particle size < 5 mm) micronized barite weighting material and fluid rheology optimization kept equivalent circulating pressures within the pore pressure-fracture pressure window.

Digital drilling technology automated weight-to-slips and slips-to-weight processes while drilling and when on bottom. An automated system optimized drilling parameters by minimizing mechanical specific energy while maximizing rate of penetration.

Coordination among wells, project, and installation teams was integrated. Subsea, umbilicals, risers, and flowlines (SURF) infrastructure was installed in coordination with drilling the initial set of wells for accelerated start-up. Also aiding project acceleration were multipurpose supply vessels (MPSVs) configured to perform subsea installation and well-commission activities, including Christmas tree installation, post start-up well jumper installation, preliminary well intervention testing and investigation, and positioning dynamic beacon and marker-bouy setting. The MPSVs provided flexibility to work these operations around drilling and completion.

Reservoir rock is unconsolidated and required sand control. The first six production wells were evenly split between open-hole gravel pack (OHGP) and stand-alone screen (SAS) completions with autonomous inflow control devices (AICDs). AICDs were selected for SAS completions to optimize conformance of producers directly offset from gas injectors. Injection wells were SAS completions with inflow control devices (ICDs).

Three key objectives were outlined for the start-up team:

- Ensure safe start-up and first oil by end-2019.

- Protect the equipment from solids production.

- Achieve gas injection as early as possible.

Production from select wells was ramped up to collect early interference data. OHGP wells provided rapid ramp-up while the less-expensive SAS wells ramped up over 3 weeks to allow formation sand to pack off the screens. This approach blended quick production time optimization (OHGP) with well-cost efficiency (SAS).

Liza-1 crude showed potential asphaltene flow assurance risk, and a OHGP well at the farthest drill center was produced first to warm the longest riser in the shortest time. This quick production start-up also performed an interference test across one portion of the reservoir. A second OHGP well was started in a different area of the field and ramped up. Additional well start-up was paused for data collection, topside gas handling, and dewatering commissioning. A third OHGP well was started and unloaded after a 2-week data collection term.

After unloading and topsides gas commissioning, produced gas was directed through the main gas and injection compressors to pack the subsea pipeline. The first gas-injection well received 25 MMscfd which was ramped up to 100 MMscfd until the second gas injection well was available and able to evenly share the task.

Production

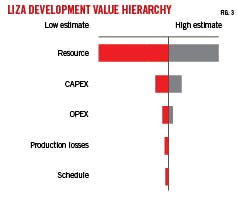

An integrated operating model defined workflows that managed activities between subsurface and process teams. The asset team initially conducted a study to determine which criteria had the largest impact on Liza lifecycle value. Oil and gas in place were the most critical, followed by expenditures. Production losses and schedule were of comparatively minor importance (Fig. 3). The integrated operating model defined roles and responsibilities that created workflows outlining data requirements based on this hierarchy. During production, measurement-based key performance indicators (KPI) compared realized values to workflow expectations. Workflow guidance documents evaluate and troubleshoot processes that do not meet expectations. The team defined 14 value-critical workflows that described activities required for successful start-up. These included understanding the process (start-up data gathering requirements and KPIs), protecting the asset (flow assurance and integrity), and recovering resource value (optimizing drilling and well reliability).

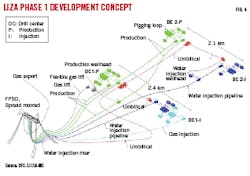

Production is through the Liza Destiny FPSO, which supports 14,000 tonnes of topside equipment capable of producing 120,000 b/d oil, injecting 190,000 b/d water, and injecting 160 MMcfd gas. It has 1.6 million bbl of storage with direct offloading ability. SURF infrastructure consists of five manifolds (two production, two water injection, and one gas injection), one dynamic umbilical, four infield umbilicals, and six lazy steel catenary risers (Fig. 4).

FPSO operations are divided between subsurface-subsea activities and production, and topsides separation including crude, water, and gas processing. For Liza Phase 1, subsurface and subsea production are operated by EEPGL, and topsides is contracted to SBM Offshore Inc.

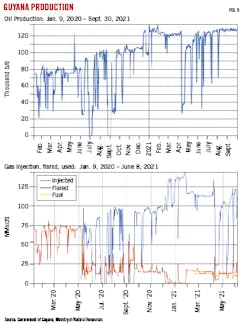

First oil was on Dec. 20, 2019, less than 5 years after spud of the Liza-1 wildcat. As of September 2021, Guyana was producing nearly 130,000 b/d with about 115 MMscfd gas injection (Fig. 5). EEPGL is the only offshore operator currently producing oil in Guyana. Early gas flaring was about 75 MMscfd, but this dropped to about 15 MMscfd as gas injection ramped up.

Reservoir management

Reservoir management relied upon multiphase flow meters and downhole pressure gauges for well performance and reservoir characterization. Producers and injectors were completed with triple downhole pressure and temperature gauges in the upper completion string, two gauges ported to the tubing string and the third to the annulus. The annular gauge monitored the wellbore while the tubing gauges monitored the reservoir and surveyed flow assurance.

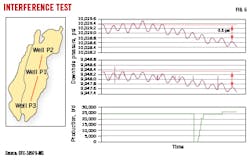

Interference test data addressed reservoir size, quality, and connectivity between producers and injectors, and individual well performance was determined through pressure transient analysis (Fig. 6). These tests required alignment between the subsurface team, well engineers, and the start-up team to determine which producer was to be brought online and define ramp-up schedules.

Liza Phase 2

Liza Phase 2, 200 km offshore in 1,850 m of water, was approved in May 2019. It will cost about $6 billion and develop about 600 MMboe gross estimated ultimate recovery (EUR). Up to six rigs support Phase 2 with shifting duties between production and exploration wells. A second FPSO, the Liza Unity, will process up to 220,000 b/d. It has 400-MMcfd gas treatment capacity and 250,000 b/d water injection capacity (OGJ Online, Sept. 9, 2021). The FPSO will be spread moored in 1,600 m of water and will be able to store about 2 million bbl crude oil.

The development is like Phase 1 but with a total of six drill centers for 30 wells, including 15 oil producing wells, nine water injection wells, and six gas injection wells (Fig. 7). A water alternating gas (WAG) injection scheme, not present in Phase 1, will maximize recovery. All injection wells will be able to switch from water to gas injection, improving EUR by enabling miscible gas recovery to contact larger volume.

SURF equipment leveraged Phase 1 design standards, and Phase 2 achieved 40% reduction in lead time for subsea tree systems over previous delivery benchmarks. Some Phase 2 subsea trees, however, were modified to include intelligent well and downhole fiber optic monitoring. The design team was able to incorporate feed-through of these features into the existing master valve block and tubing hanger forgings, minimizing impact to existing subsea tree system components and specifications.

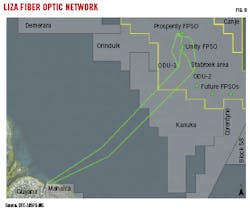

A fiber optic cable infrastructure was built for communications with FPSOs and to provide advanced reservoir monitoring through instrumented and intelligent wells. It will also send data to shore to optimize field management. The network includes 500 km of cable, including redundancy, to connect FPSOs to an integrated operations center at the onshore Ogle complex. Bandwidth is 300 Gbps per FPSO with the ability to connect 12 FPSOs (Fig. 8). The FPSOs have Wi-Fi and 4G-LTE capabilities, as well as microwave to support enhanced communications with nearby drillships and vessels.

The operation base in Georgetown evolved from the Phase 1 campaign and now houses drilling and completion fluids, directional drilling equipment, drilling contractors, and subsea equipment.

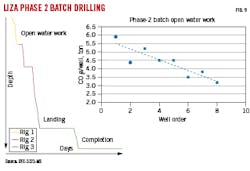

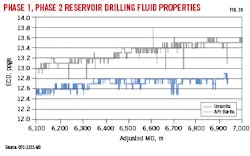

Drilling is by batch operations, which reduced open water work days by 25% and completion days by 50% (Fig. 9). Changes to the reservoir drilling fluid for Phase 2 included switching the weighting material in the NAF from barite to ilmenite clay. Ilmenite retains low mud equivalent circulation density (ECD) properties but, unlike barite, is soluble in acid and can be dissolved to minimize near-well bore damage. ECD reductions of > 0.7 pound/gal equivalent have been observed in Liza Phase 2 8 ½-in. hole sections compared with analog wells drilled with the Phase 1 micronized barite systems (Fig. 10).

Phase 2 startup is expected mid-2022. Breakeven Brent prices are $35/bbl and $25/bbl for Phase 1 and Phase 2, respectively. Overall, 20 Stabroek discoveries are identified to date and further phases are in advanced planning.

Bibliography

Adeola, O., Burmaster, K., Phi, M., Arnold, S., Robinson, A., and Klein, J., “Drilling Execution and Completion Advancements Continue to Deliver for Guyana,” OTC-31230-MS, Offshore Technology Conference, Houston, Tex., Aug. 16-19, 2021.

Austin, N., Das, M., Oyerinde, A., and Elkington, E., “The Liza field: From Discovery to Development,” OTC-31084-MS, Offshore Technology Conference, Houston, Tex., Aug. 16-19, 2021.

bnamericas, “Hess forecasts 2022 Guyana development spend at US$1bn,” Oct. 27, 2021.

Burns, L., Allen, T., Karlik, J., Ding, J., Cauthen, R., Das, M., Ashley, G., and Szafranski, R., “Guyana: Liza Phase 2 Novel Execution to Accelerate Field Development,” OTC-20948-MS, Offshore Technology Conference, Houston, Tex., Aug. 16-19, 2021.

ExxonMobil Newsroom, “ExxonMobil increases Stabroek resource estimate to approximately 10 billion barrels,” Oct. 7, 2021.

Government of Guyana, Ministry of Natural Resources Data Centre. https://petroleum.gov.gy/data-visualization

HESS newsroom, “Hess Announces Oil Discovery at Pinktail, Offshore Guyana,” Sept. 9, 2021.

Ryan, M.F., Unietis, B., Kaverzin, A., Townson, T., Steves, J., Chew, C., Maggard, M., Jones, J., McGehee, B.R., and Minnaar, K., “Guyana Operations and First Oil,” OTC-30979-MS, Offshore Technology Conference, Houston, Tex., Aug. 16-19, 2021.

SBM Offshore Newsroom, “Liza Unity FPSO begins her voyage to Guyana and becomes world’s first FPSO to receive SUSTAIN-1 class notation,” Sept. 9, 2021.

Styslinger, S., Yost, D., Dickerson, G., Minois, A., and Wiwel, R., “Guyana: Liza Phase 1 Rapid Development in a Deepwater Frontier,” OTC-31158-MS, Offshore Technology Conference, Houston, Tex., Aug. 16-19, 2021.

Varga, A.L., Chandler, M.R., Cotton, W.B., Jackson, E.A., Markwort, R.J., Perkey, R.A., Renik, B., Riley, T., and Webb, S.I., “Innovation and Integration: Exploration History, ExxonMobil, and the Guyana-Suriname Basin,” OTC-30946-MS, Offshore Technology Conference, Houston, Tex., Aug. 16-19, 2021.

Yank, W. and Escalona, A., Techonostratigraphic evolution of the Guyana Basin,” American Association of Petroleum Geologies (AAPG) bulletin, Vol. 95, No. 8, August 2011, pp. 1339-1368.

About the Author

Alex Procyk

Upstream Editor

Alex Procyk is Upstream Editor at Oil & Gas Journal. He has also served as a principal technical professional at Halliburton and as a completion engineer at ConocoPhillips. He holds a BS in chemistry (1987) from Kent State University and a PhD in chemistry (1992) from Carnegie Mellon University. He is a member of the Society of Petroleum Engineers (SPE).