Pakistan targets exploration growth

Saud Khawaja

Oil & Gas Development Co. Ltd.

Karachi, Pakistan

Mansoor Ghayur

United Energy Pakistan

Islamabad, Pakistan

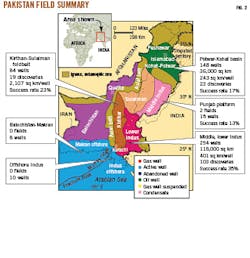

Pakistan has opportunities for exploration and production (E&P) throughout the country, both on and offshore. Safety and security have improved, and areas which before were inaccessible can now host the large crews and heavy equipment needed for seismic surveys and exploratory drilling. The country is divided into four zones based on degree of geological risk, availability of energy infrastructure, closeness to consumption centers, and degree of costs involved in undertaking exploration work (Fig. 1). Pakistan’s four onshore zones and one offshore zone are:

- Zone 0, offshore.

- Zone IF, frontier basins Kharan, Pishin, and areas merged into Khyber Pakhtunkhwa.

- Zone I, southern Balochistan (Makran) and Potwar basins.

- Zone II, Kirthar, East Balochistan, Punjab platform, and Suleman basins.

- Zone III, lower Indus basin.

Pakistan’s Ministry of Petroleum and Natural Resources has conducted road shows and meetings to educate international E&P companies in Canada, the US, Russia, China, and the UAE about opportunities in Pakistan. This article provides a summary of the status of Pakistan oil and gas resources and activities.

Reservoir resources

Pakistan has a sedimentary basin comprising 827,268 sq km, about 70% of which is untapped (Fig. 2). Overall, 90 oil and 310 gas-condensate discoveries have been identified.

Lower, Middle, and Upper Indus basins along with Kirthar and Sulaiman Fold belts have proven commercial volumes of hydrocarbons. Oil is in Badin (Thar slope), Potwar, and the Kohat plateau. Recently, oil also was discovered in the western Suliaman fold belt near Quetta and Kalat plateaus in Balochistan. However, Pakistan’s resources are primarily gas, with significant discoveries at Sui, Uch, Pirkoh,Dhodak, Kandhkot, Mari, Bhit, Kandawari, Zamzama, and Gambat South.

While the petroleum system in the lower, middle. and upper Indus basins and fold belts is well established, exploratory efforts have not found commercial volumes of hydrocarbon in offshore Indus and Baluchistan basins targeting Miocene sands and carbonate buildups. Additionally, hydrocarbon potential in Balochistan, Katwaz basin (northwest of Quetta) has remained unexplored primarily due to poor security.

Shelfal carbonates (reefs), Sui main limestone, Habib Rahi, and Dughan limestone are main reservoirs at Sui, Uch, Kandkot, Qadirpur and Mari fields (Fig. 3). These hold in excess of 30 tcf gas. The deltaic prograding sands of Cretaceous age (lower Goru, middle, and basal sands) are main reservoirs at Miano, Sawan, Kadanwari, and in Gambat south, Mirpurkhas, Khipo, Kotri north gas fields.

Additionally, gas discoveries were made in Pab and lower Ranikot (Paleocene upper Cretaceous) at gas condensate fields Dhodak and Pirkoh, Suliman fold belt, and at Zamzama and Bhit fields, Kirthar fold belt, Sindh Province.

Zamzama is a gas discovery made by BHP Billiton in 1998 by drilling exploration well Zamzama-1 at a depth of 4,000 m. Zamzama original recoverable 2P reserves are 1.731 tcf which are mostly produced, and the field is near its end. Bhit was discovered by Lasmo Oil (now Eni) in 1997 with original recoverable 2P reserves of 1.735 tcf. About 1.652 tcf have been produced up to December 2019.

Oil and gas in Potwar-Kohat basin is in tight, naturally fractured Sakessar and Lochart carbonate reservoirs. The 36,000 sq km depression in northern Pakistan has more than 5,000 m of Precambrian to Eocene marine deposition, with a major break during Ordovician to Carboniferous. More than 10,000 m of Miocene to Pleistocene alluvial sediments overlay the marine sequence. The tectonic depression formed as a result of continent-to-continent collision at the northwestern margin of the Indian plate.

Hydrocarbons are also found in Jurassic Datta sands and Cambrian rocks. Other major fields are Dhurnal, Meyal, Fimkasaar, Toot, Misakeswal, Chanda, Nashpa, and Makori (Samansuk, Hangu, and Lumsiwal formations).

The low-matrix porosity, naturally fractured Chitan formation of Jurassic age is producing at Rodho (SafedKoh, Suliman fold belt) and in Kalat Plateau with recently discovered gas and condensate. Though not targeted, no discovery is reported in basement rocks or in Cambrian salt.

Formation temperatures and pressures are in normal ranges for most fields. However, some central Indus basin temperatures reach 350° F. Kadanwari, Miano, Sawan, Qadirpur deep, and Sui deep fields are in a hotspot trend.

Unconventional reservoirs

Clastic and carbonate tight gas reservoirs with 1-md permeability are found in the Rehman gas field, Pab formation (Kirthar Range), Zarghun field, and Dunghan carbonate (Baluchistan).

No shale gas discoveries have been reported. But Oil & Gas Development Co. Ltd. (OGDCL) is drilling a well in southern Indus basin to explore shale gas potential.

Production, reserves

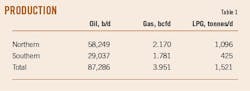

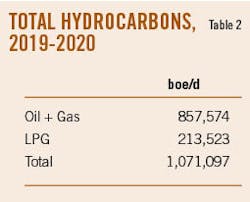

Oil production was 87,286 b/d on June 30, 2019 (Table 1). Two-thirds of this is from northern Pakistan with the remaining third from the country’s south. Propane and butane LPG also is centered in the north, which hosts two-thirds of Pakistan’s 1,521 tonnes/day. Gas production is slightly below 4 bcfd, with a nearly even split between north and south. Table 2 lists total production in boe/d.

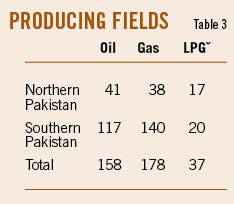

Although most oil is produced in the north, just one-quarter of 158 oil fields are in northern Pakistan and three-quarters are in the south. There is a nearly equal north-south split among thirty-seven LPG-producing fields (Table 3). About one-fifth of 178 gas fields are north with the rest south, despite a 50-50 production split.

Supply, demand

Pakistan is a net importer of oil and gas with current domestic production around 800,000 boe/d (oil, natural gas, and LPG) and consumption around 2 million boe/d. Pakistan’s total domestic natural gas production is 4 bcfd with consumption around 6 bcfd.

Fig. 4 shows production vs. consumption trends since 2016. The gap widened 2019-20 due to a sharp increase in consumption. This is expected to continue for the next 5 years. Pakistan’s reserves are shown in Fig. 5. Without an active exploration program, known gas reserves are expected to decline from 2020-34.

Well, rig count

Pakistan has a well density of about 3 wells/1,000 sq km. To date, 1,100 exploratory and 1,450 development wells have been drilled. Pakistan’s two largest domestic E&P companies, OGDCL and Pakistan Petroleum Ltd. (PPL), expected to double well-count in 2020 (pre-pandemic), including exploratory drilling, development drilling, and work over of existing wells.

Other E&Ps also expect to increase well and rig count. Rig count rose to 35 active rigs from 26 between January 2019 and January 2020, a 35% increase. A 2019 survey showed a combined 50 drilling and workover rigs in country, with hydraulic horsepower ranging from 300 to 3,500. This indicates rigs are available.

E&P company involvement

Eight domestic and eight international E&P companies actively operate in Pakistan. These include:

Domestic

- OGDCL

- PPL

- Mari Petroleum Co. Ltd.

- Pakistan Oilfields Ltd.

- Pakistan Exploration Private Ltd.

- Orient Petroleum Private Ltd.

- Dewan Petroleum Ltd.

- Al-Haj Enterprises Ltd.

International

- Eni SPA, Italy

- Magyar Olaj-es Gazipari (MOL), Hungary

- Polskie Gornictwo Naftowe i Gazowinctwo (PGNiG)

Poland

- United Energy Pakistan Ltd., China

- Kuwait Foreign Petroleum Exploration Co., Kuwait

- Spud Energy Pty Ltd.

- Tallahassee Resources Ltd.

- Hycarbex American Energy Inc.

The authors

Saud Khawaja ([email protected]) is on the board of directors and chairman of the transformation committee at the Oil & Gas Development Co. Ltd., Pakistan. He holds an associate of science in engineering from Bergen Community College, Paramus, NJ (1980) and a BS in petroleum engineering from the University of Oklahoma (1983).

Mansoor Ghayur ([email protected]) is senior manager for regulatory affairs and business development at United Energy Pakistan. He holds a Masters in international business, University of Wollongong, NSW (2002) and a MS in petroleum engineering, West Virginia University (1995).