Integrated offshore production system simulation optimizes field layout

Lívia Paiva Fulchignoni

Marco Antonio Cardoso

Anderson Takehiro Oshiro

Thiago Duarte Fonseca dos Santos

Leandro de Assis Pinto

Djalene Maria Rocha

Petrobras

Rio de Janeiro

A new framework for the simulation of oil and gas production systems integrates reservoir, flow assurance, and economic discipline models in addition to optimizing subsea layout and FPU placement.

The framework reduced the time needed to evaluate project alternatives and improved interdisciplinary synergies, enhancing economic returns.

Background

Petrobras built a production model to integrate reservoir and flow assurance models with organizational economic premises. The model sought to determine net present value (NPV) of each offshore production-system alternative, among other operational and economic metrics. The framework also integrated the best reservoir drainage plan, floating production unit (FPU) location, and subsea layout for each alternative.

The integrated simulation framework can efficiently run a wide number of simulations and optimizations of the production systems under consideration and help select the most suitable one.

Risks include both technical uncertainties and constantly changing economic premises, especially given a volatile oil market. Faster decision-making provides a competitive advantage by reducing project-development life cycle.

Simulation often treats components of an oil and gas production asset as stand-alone systems.2 This approach makes combining the separate elements into an overall production simulation unnecessarily complex and time consuming and restricts understanding of the impact of macro constraints on cumulative production optimization. Bringing the results of separate simulations into conjunction also requires multiple iterations between groups, resulting in long process cycles and compromising potential synergy gains.

Improving the quality of analysis during project planning is an important part of making accurate production and income forecasts. Previous work on integrated oil and gas production simulations highlighted gains in oil recovery obtained by observing the effect of constraints on global-level optimization and building a fully integrated model for improved profitability while diminishing risk.3,4

This article presents a framework for the integrated simulation of offshore oil and gas production systems using coupled in-house and commercial software. Artificial intelligence was used in the optimization to efficiently test a wide number of scenarios. The resulting framework can be considered an integrated asset model (IAM). A case study demonstrates the beneficial effects of integrated simulation during project design.

Integrated simulation

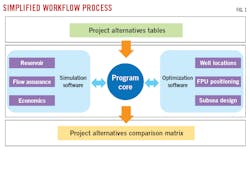

The framework for the simulated integrated offshore oil and gas production system coupled software from reservoir, flow assurance, and economic sources. Optimization was performed by a combination of specialist software and sensitivity analysis of key project-design parameters. A program core was designed to manage the data flow between the software (Fig. 1).

A table containing a range of reasonable alternatives proposed by the project team initialized the process of choosing the best production system design (Table 1). For each alternative, the program core sequentially performed the following operations:

- Generation of well and pipe vertical lift performance (VLP) for a range of flowline lengths.

- Determination of the optimal production and injection well locations.

- Determination of optimal FPU location and subsea layout.

- Generation of production and injection curves through the reservoir model simulation with the wells’ exact locations (and, therefore, exact VLPs).

- Calculation of the economic indicators.

By the time all the alternatives listed on the table were evaluated, a comparison matrix had been created, containing both production and economic data related to each production system scenario and allowing for a straight comparison between the identified alternatives.

Case study

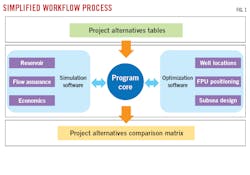

Planners applied the integrated simulation framework to a real field development project during its conceptual phase. The project consisted of three independent offshore reservoirs producing to the same production facility through subsea manifolds and long tie-backs. Each reservoir has singular characteristics: Reservoir A is highly saturated with oil while Reservoirs B and C are more water and gas saturated, respectively. Water, gas, and oil saturations (Sw, Sg, So, respectively) are indicated on the legend in Fig. 2.

The alternatives table proposed by the project team consisted of several production system designs. In general, the main differences between the concepts were the number of production and injection wells in each reservoir, tubing and pipe diameters, number of production and gas lift subsea manifolds, and artificial lift method.

Each reservoir had an associated representative production well and a representative injection well for which the VLPs were generated for a range of flowline distances. Using only two types of well completion per reservoir reduced multiphase-flow modeling time and processing time during VLP generation. It was a valid approach because the project was in the conceptual phase, when the need for alternative well completion schemes is not crucial.

A reservoir optimization program (OCTOPUS) proposed the location of a predetermined number of production and injection wells in each reservoir, based on genetic algorithm optimization techniques.5 The software relied on the geologically-based reservoir simulation model to seek regions most likely to have hydrocarbon accumulation.

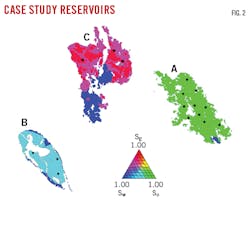

After the placement of the wells, an optimization program (OTIMROTA) positioned the FPU and determined the best subsea layout.6 The software also used genetic algorithms to solve optimization issues. Among several constraints discovered during optimization were the previously sited wellheads, since they were now obstacles to the FPU mooring lines and risers. Fig. 3 shows a subsea layout proposed by OTIMROTA for this case study.

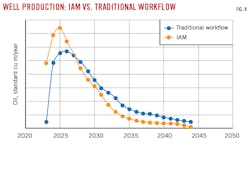

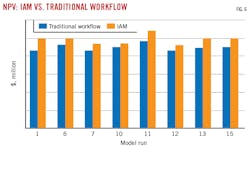

Definition of the production system design followed these optimization processes. The simulation of the reservoir model for the final configuration generated the production and injection curves for the field life cycle (Fig. 4). Long-term production was optimized (Fig. 5) and economic indicators such as NPV and capital expenditure (CAPEX) were calculated based on the company’s official datasheet of economic premises. The project alternatives comparison matrix displayed these economic results and allowed for easy graphic comparison (Fig. 6).

Results

Integrated simulation of the production system provided several benefits for evaluation of alternatives during the project-design phase. The simplified consideration of representative wells did not significantly impact the overall quality of the results, especially in terms of ranking. Since less information is known in the conceptual phase, higher deviations from the real incomes and costs were accepted.

Automation of the workflow process reduced the time required to evaluate alternatives by about 60%. Optimization tools also were highly efficient in the search for better production-system designs, increasing the project’s economic return. Integrated simulation increased the auditability of the field development study. Economic results obtained through the integrated simulation of each alternative were easily traced back to the inputs that were considered common premises, helping assure consistency in the comparison of alternatives results. The presence of a common source of information mitigated version management issues.

The simulation framework allowed for a quick and easy selection process of the production system alternative that optimized economic returns. NPV was chosen as the determining criteria between the alternatives. The alternative with higher NPV was not the one with lower CAPEX or higher cumulative oil production. The interaction between the disciplines permitted the identification of synergy gains, since all the constraints considered in the optimization process were visible on the same framework.

The use of integrated simulation is likely to continue increasing during both project and operation phases. Arguably, the robustness of the technique will also be developed in terms of convergence problems, disciplines embraced, optimization loops, etc. Indeed, the process itself of proposing and evaluating project alternatives during conceptual phase is expected to be automated in the short term, including the optimization of well completions.

References

- Fulchingnoni, L.P., Cardoso, M.A., Oshiro, A.T., dos Santos, T.D.F., Pinto, L.A., Rocha, D.M., “Integrated Simulation of Offshore Oil and Gas Production Systems During Project Design,” OTC 29733 MS, Offshore Technology Conference Brasil, Rio de Janeiro, Oct. 29-31, 2019.

- Shoaib, M., Selvaggio, P., Cominelli, A., Rossi, R., Thompson, A., Amoudruz, P., “Flexible Integrated Asset Models for Deep Water Developments,” Offshore Mediterranean Conference and Exhibition, Ravenna, Italy, Mar. 27-29, 2019.

- Ursini, F., Rossi, R., Pagliari, F., “Forecasting Reservoir Management Through Integrated Asset Modelling,” SPE 128165 MS, North Africa Technical Conference and Exhibition, Cairo, Feb. 14-17, 2010.

- Wiley, L., “Creating a Competitive Advantage Through Integrated Upstream Asset Management,” URTEC-2015-2147042, Unconventional Resources Technology Conference, San Antonio, July 20-22, 2015.

- Lima, R., Abreu, A.C., Pacheco, M.A., “Optimization of Reservoir Development Plan Using the System OCTOPUS,” OTC 26266 MS, Offshore Technology Conference Brasil, Rio de Janeiro, Oct. 27-29, 2015.

- Fonseca dos Santos, T.D., Rocha, D.M., Pereira, L.I., Baioco, J.S., Albrecht, C.H., Jacob, B.P., “OTIMROTA-Multiline: Computational Tool for the Conceptual Design of Subsea Production Systems,” OTC 280569 MS, Offshore Technology Conference Brasil, Rio de Janeiro, Oct. 24-26, 2017.

The authors

Lívia Fulchignoni ([email protected]) is a petroleum engineer at Petrobras, Rio de Janeiro. She holds a BSc (cum laude, 2012) in industrial engineering and MSc (2015) in ocean engineering from the Federal University of Rio de Janeiro (UFRJ). She is currently studying for a PhD in energy resources engineering at Stanford University, Palo Alto, Calif. She is a member of the Society of Petroleum Engineers.

Marco Antonio Cardoso ([email protected]) is technical advisor at Petrobras, Rio de Janeiro. He holds a Ph.D. (2009) from Stanford University.

Anderson Takehiro Oshiro ([email protected]) is naval architect at Petrobras, Rio de Janeiro. He has also served as research engineer at Numerical Offshore Tank. He holds a master’s degree (2012) in Mechanical Engineering from São Paulo University.

Thiago Duarte Fonseca dos Santos([email protected])] is Subsea conceptual project Coodinator at Petrobras, Rio de Janeiro. He holds a MBA degree (2019) from Getúlio Vargas Foundation, Master’s degree (2018) from UFRJ/Alberto Luiz Coimbra Institute of Graduate Studies and Research in Engineering (COPPA), and mechanical engineering degree (2014) from the State University of Rio de Janeiro (UERJ).

Leandro de Assis Pinto ([email protected]) is naval engineer at Petrobras, Rio de Janeiro. He holds a naval engineer degree (2012) from UFRJ.

Djalene Maria Rocha ([email protected]) is equipment engineer at Petrobras, Rio de Janeiro. She has also served as adjunct professor at UERJ. She holds Master´s and PhD degrees (1997, 2007) in civil engineering from UFRJ.