EIA: US renewable diesel capacity could more than double through 2025

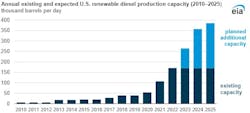

US production capacity for renewable diesel could more than double from current levels by end-2025, based on company reports on projects that are either under construction or could start development soon, the US Energy Information Administration (EIA) said.

Renewable diesel is a fuel that is chemically equivalent to petroleum diesel and nearly identical in its performance characteristics. Renewable diesel has some of the highest greenhouse gas (GHG) reduction scores among existing fuel pathways in programs such as the federal Renewable Fuel Standard (RFS), the California Low-Carbon Fuel Standard (LCFS), the Oregon Clean Fuels Program, and the Washington State Clean Fuels Program.

Investment in new renewable diesel production capacity in the US has grown significantly because of renewable diesel’s interchangeability with petroleum diesel in existing petroleum infrastructure and because of government incentives. In 2022 and early 2023, the following eight renewable diesel refineries began production:

- CVR Energy’s plant in Wynnewood, Okla.

- Diamond Green Diesel’s plant in Port Arthur, Tex.

- HollyFrontier’s plant in Artesia, NM.

- HollyFrontier’s plant in Cheyenne, Wyo.

- Montana Renewables’ plant in Great Falls, Mont.

- New Rise Renewables’ plant in Reno, Nev.

- Seaboard Energy’s plant in Hugoton, Kan.

- Shell’s plant in Norco, La.

An average of 520,000 b/d of distillate fuel oil was consumed on the West Coast in 2021. The region, which is also the largest renewable diesel importing region in the US, could soon meet the majority of its distillate fuel needs from renewable diesel by 2025 if domestic renewable diesel capacity does increase as scheduled, EIA said.