Rystad Energy: Large-scale projects a factor for profitable shale drilling

As US crude oil production is set to rise substantially over the next decade, analysts still debate whether shale drilling is an actual profitable endeavor. Some skeptics claim operators overstate their well production profiles, while others say operational cash flow from shale wells will never be enough to cover corporate costs and old debt.

Analysts and investors are now waiting to see fourth quarter earnings as an acid test on profitable growth in the Permian basin at lower oil prices. Quarterly results have already been published by ExxonMobil Corp., Chevron Corp., and Anadarko Petroleum Corp., of which only Chevron appeared to generate positive cash flow from operations in the Permian. ExxonMobil and Anadarko, meanwhile, seemed to still be in investment mode in the play. Rystad Energy believes net cash is now likely in the red for many smaller oil companies that focus entirely or predominantly on the Permian.

Having taken a closer look at the detailed economics of the most recent 1,000 wells drilled in the most popular shale hotspot—the Wolfcamp A zone of the Permian Delaware basin—Rystad Energy can see a clear pattern emerging that favors large players.

“Our conclusion is that the average well completed during 2017 and 2018, which mirrors the most likely production profile and costs, appears very profitable even at local oil prices of $45/bbl,” said Per Magnus Nysveen, Rystad Energy senior partner.

“However, there are also many wells that will not be profitable at this price level, and drilling needs to be conducted on a large scale in order to secure robust cash flows even in the hottest play. Betting on a low number of wells could give more uncertain returns than rolling the dice at the nearest casino.”

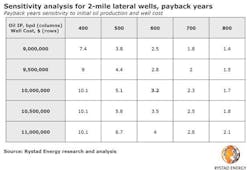

Operators with scaled operations and large acreage positions exposed to Wolfcamp A in the Permian Delaware should see average returns of 20%, and 3 years’ payback from new wells, even with West Texas Intermediate Midland oil prices at $45/bbl. Smaller operators, meanwhile, would face higher costs for drilling, completion, operation, and transport, and also lower realized oil prices.

“These operators might struggle in the current price environment, and their best opportunity to monetize their investment could be to sell their acreage to larger operators with more efficient logistics, better infrastructure, and more negotiating power through the value chain,” Nysveen said. “Size matters, even more so when drilling for shale oil in the Permian basin.”