IEA: World oil supply, demand to rebalance by 2020

The global oil market is expected to rebalance at $80/bbl by 2020, with further increases in price thereafter, as excess oil supplies are shed and demand picks up, according to the central scenario of the International Energy Agency’s 2015 World Energy Outlook, released Nov. 10.

According to IEA, demand will pick up to 2020, adding an average of 900,000 b/d/year, but the subsequent rise to 103.5 million b/d in 2040 is moderated by higher prices, efforts to phase out efficiency policies, and switching to alternative fuels.

On the supply side, the decline in current upstream spending, estimated at more than 20% in 2015, results in the combined production from non-members of the Organization of Petroleum Exporting Countries peaking before 2020 at just above 55 million b/d, IEA forecasts.

Output growth among OPEC countries is led by Iraq and Iran, but both countries face major challenges, namely the risk of instability in Iraq, alongside weaknesses in infrastructure and institutions; and the need in Iran (assuming the path to sanctions relief is followed successfully) to secure the technology and large-scale investment required.

“An annual $630 billion in worldwide upstream oil and gas investment—the total amount the industry spent on average each year for the past 5 years—is required just to compensate for declining production at existing fields and to keep future output flat at today’s levels,” IEA said. “The current overhang in supply should give no cause for complacency about oil market security,” the agency said.

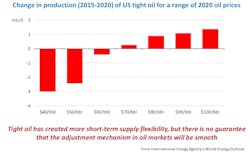

IEA also expects that rising costs will ultimately constrain US tight oil’s rise, as operators deplete the “sweet spots” and move to less-productive acreage. US tight oil output will reach a plateau in the early 2020s, just above 5 million b/d, before starting a gradual decline.

In its outlook, IEA also examines a low oil price scenario where the oil price remains close to $50/bbl until the end of this decade, based on assumptions of lower near-term growth in the global economy, a more stable Middle East, and a lasting switch in OPEC production strategy in favor of securing a higher share of the oil market, and more resilient non-OPEC supply, notably from US tight oil.

“The durability of this scenario depends on the ability and willingness of the large low-cost resource-holders to produce at much higher levels than in our central scenario,” IEA said. In the low oil price scenario, the Middle East’s share in the oil market ends up higher than at any time in the last 40 years.

However, the agency believes that “the likelihood of the oil market evolving in this way over the long term is undercut by the effect on producer revenues: OPEC oil export revenue falls by a quarter relative to our central scenario, despite the higher output.”