DTI details plans for implementing EOR in North Sea

The UK is urging North Sea developers, electric-power generators, and oil producers to implement a plan for capturing and sequestering CO2 in oil fields as a way to reduce greenhouse emissions while enhancing recovery.

To this end, the UK Department of Trade and Industry (DTI) recently released a white paper specifying interim actions for including EOR as a facet in developing an overall strategy for carbon capture and storage (CCS), which provides for a longer timeframe for the transition to energy sources with low to zero CO2 emissions.

Although North America has many active CO2-based EOR projects, DTI said it has not developed a full implementation plan in the North Sea because current oil producers have shown little interest in the process under present market conditions.

But the April 2004 report, "Implementing a demonstration of enhanced oil recovery using carbon dioxide," indicates that CO2 for EOR could play a significant role in future demonstrations of CCS.

A previous white paper "Our Energy Future—Creating a Low Carbon Economy," put the UK on a path that by 2050 would to reduce CO2 emissions by 60%.

Besides oil reservoirs, other options for geo-sequestrations for CO2 include storing it in depleted gas fields and saline aquifers.

The DTI study said EOR has the advantage of partially offsetting costs by providing financial benefits, and the CO2 injection into North Sea oil reservoirs is permissible under the London and Ospar Treaties controlling waste disposal in the North Sea.

Canvassing stakeholders

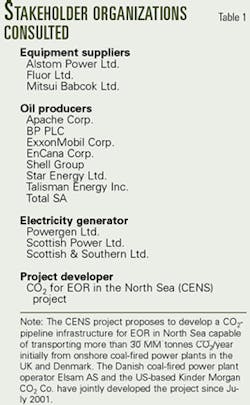

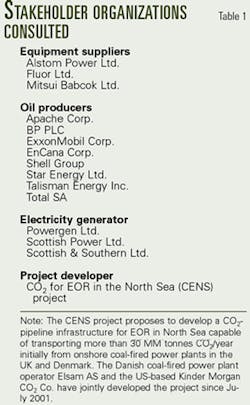

DTI canvassed the views of individual stakeholder organizations (Table 1) through a series of one-to-one meetings. It said these meetings involved oil producers (some also operated refineries), power-generation companies, equipment suppliers, and one broker of a CO2 delivery system.

The questions included:

*What are the barriers (technical, economic, contractual, regulatory, etc.) to CO2-based EOR in the UK North Sea?

*Would a demonstration project help give a better understanding of these barriers and uncertainties and how they can be reduced?

*What needs to be done to define the most appropriate UK-based CCS demonstration project?

*Under what conditions would your company be prepared to host an EOR demonstration scheme in the UK North Sea?

*Under what conditions would your company be prepared to take a stake in and operate a demonstration electricity-generation plant incorporating CO2 capture?

*Could CO2 emission credits enhance the prospects for EOR?

*Which international funding sources should be contacted to seek support for a UK EOR demonstration?

*What can government do to reduce investment uncertainties?

*What can government do to bring stakeholders together?

Results

The study said that oil producers regarded CO2-based EOR as a proven technique from experience with onshore applications and could apply it in North Sea fields without a need for a demonstration project. But under current market conditions, EOR with CO2 is not a commercial option for the UK North Sea.

Although support for bridging the economic gap and encouraging investment in EOR is low, the study found that the stakeholders thought it likely that carbon emission credits from the European Union Emissions Trading Scheme (EU ETS) would be insufficient to provide this bridge.

Consequently, the study expected that market changes would be needed for CO2 to be broadly deployed in the North Sea.

It said the main approach available to government is to adjust the tax system to reduce barriers to EOR investment.

Demonstration project

Consultations with potential stakeholders identified four options for implementing an EOR demonstration project (Table 2). Three options include full-scale demonstrations in offshore oil fields but are distinguished by the CO2 source, as follows:

1. CO2 produced from existing North Sea oil-gas production facilities.

2. CO2 captured from high concentration sources.

3. CO2 captured from power plant.

The study estimates that the capital investments required for these options is about £300-500 million ($540-900 million), with CO2 separated from natural gas likely to be the least costly option and CO2 capture from a power plants the most expensive.

The fourth option is a smaller-scale demonstration in an onshore oil field, which is the least expensive option but may not provide the appropriate experience.

The study said that the equipment suppliers canvassed were most interested in pursuing a near-term demonstration project but did not agree on the technology to demonstrate.

Also the power generators had interest in a demonstration project including capture to enhance their position as "informed buyers," but stressed that they had no plans for investing in new UK power plants.

Oil producers also were interested in EOR and CCS, but felt that their global operations provided other experience options rather than a demonstration project.

From these responses, the DTI study concluded "that it would be wrong to press ahead immediately with a full-scale demonstration of CO2-based EOR. Indeed, with the low level of interest shown by key stakeholders this may not be feasible. However, CO2-based EOR does have advantages as a base for demonstrating CCS, and therefore is worth further consideration over a longer time-scale."

The study suggested that this should be included as part of an overall strategy for the development of near to zero emission fossil fuel technologies, which DTI is developing through its carbon-abatement-technologies program.

Currently under review and revision at DTI's cleaner fossil fuels unit is a strategy with input from industry groups that DTI expects to finalize by summer 2004. It said this study would address a number of strategic issues that need to be considered before a decision on any CCS demonstration.

Norway projects

The study said that some stakeholders commented that the Norwegian North Sea sector had market conditions more favorable for CO2-based EOR and CO2 capture and storage. For example, the study cited Norway's Sleipner project that stores 1 million tonnes/year of CO2 in a saline geologic aquifer. Norway's carbon emission tax of 315 krone/tonne CO2 equivalent ($45/tonne) encourages this storage.

In Sleipner, the CO2 has to be removed from the natural gas stream in order for the gas to meet sales specifications. Sleipner could vent the CO2 but would then be liable for paying the carbon emission tax.

Snøhvit will be Norway's second planned CO2 capture and storage project. The DTI study said this stems again from the need to separate CO2 prior to natural gas sales and is not an EOR project. Snøhvit differs from Sleipner in that the entire gas stream is brought onshore before separation of the CO2.

Both Sleipner and Snøhvit have the additional CO2 sequestration cost limited to the compression and injection cost because removing the CO2 is essential for natural gas sales.

The DTI study said that Norway is examining CO2-based EOR for the Gullfaks oil field. It said the field suits a water-alternating-gas (WAG) EOR process with CO2, but the project has a low rate of return at the $16/bbl oil price used by most oil companies for project appraisal.

Norwegian oil producers have proposed a volume allowance for each additional barrel of oil produced to improve the attractiveness of EOR investments. It is estimated that this is worth about $2.15/bbl (15 krone/bbl) after tax, or $9.77/bbl before tax at current Norwegian petroleum production tax rates.

The allowance would increase the EOR project rate of return for producers, but also would reduce Norway's tax revenue when oil prices are low. At high oil prices, however, the tax revenue would be greater than without EOR.

The study further adds that the volume allowance means that the government carries some of the risk of oil prices being low, but without this proposed volume allowance or similar measure, it is unlikely that a Gullfaks EOR project will proceed.

The study estimated that the current cost of full-scale implementation of CO2-based EOR project in the North Sea was about £28-35/tonne of CO2 utilized ($50-63/tonne). This decreased to £4-10/tonne of CO2 when credit was taken for the additional oil produced.

By comparison, it estimated that the cost of CO2 storage by injection into an exhausted natural gas reservoir, with no recovery of additional hydrocarbons, was about £22-27/tonne of CO2.

The study added that "...there is a limited window of opportunity for initiating EOR in the UK North Sea since it needs to be implemented before cessation of conventional oil production." It estimated that this was 2010 for some of the larger more mature fields.