Apache fracs Wolfcamp wells without fresh water in dry Barnhart project area

Rachael Seeley, Editor

IRION COUNTY, Tex.—At a site in drought-stricken West Texas, Apache Corp. has devised a system to hydraulically fracture wells in the prolific Wolfcamp shale without using fresh water.

Greg Hicks, a West Texas rancher and production engineering manager for Apache, says the company has a closed-loop system that uses only brackish and recycled water at its 35,000 acre Barnhart project area in Irion County west of San Angelo. The nonpotable water, from the Santa Rosa aquifer, is treated to remove sulfates, magnesium, iron, bacteria, and large solids that can damage pipelines and pumping equipment. Then it is moved to large, lined retention ponds from which it can be pumped to the company's numerous pad drilling sites in the area.

Apache's operations play into larger concerns about water usage in Texas and exemplify one way that producers are addressing a shortage of fresh water in some counties through various water recycling and desalination programs.

Hicks said it makes sense to reuse the water that is produced and recovered from hydraulically fractured wells. Doing so conserves fresh water for local residents and ranchers and benefits Apache—it saves the cost of trucking water in and out, reduces wear on roads, and eliminates the need for a disposal facility.

"It's a win-win situation for the environment and for us," said Hicks. "I own land myself and I run cows, so having water is a very valuable thing to me." Hicks is no stranger to drought. When Texas was in the worst portion of its ongoing drought he said the acre-and-a-half lake on his property dried up. Without a water supply, he was forced to sell all his cattle. "It was tough," he said.

Two types of water emerge from hydraulically fractured wells—produced water from the formation and flowback water, the frac water pumped in. Both are collected by Apache when they emerge from the well and stored aboveground in giant bins lined with thick, waterproof plastic.

The Environmental Protection Agency says the fraction of hydraulic fracturing wastewater recovered varies widely by geologic formation and ranges from 10% to 70% of the injected fluid. For a hydraulic fracturing job that uses 5 million gal of fluid, this means that 500,000–3.5 million gal of fluid will be returned to the surface.

When a well is fraced, Hicks said, the pump has to be primed with treated brackish water from the Santa Rosa aquifier. Once well completion starts, more and more water emerges from the well that can be reused, and the need for brackish Santa Rosa water diminishes in subsequent jobs.

"By reusing that water I'm able to save money, and I'm able to keep trucks off the road—which eliminates a lot of hazards and doesn't tear the roads up," Hicks said. "It's good for everybody all around."

The cost of disposing water from Apache's Barnhart area ranges from $2/bbl to $2.50/bbl, while the cost of recycling water is around 29¢/bbl. "It's very inexpensive to reuse the water," Hicks said. "When you're looking at the cost of using trucks to haul the water off all day, every day, or the cost of putting pipe in the ground to transfer it over to a disposal facility—it just made sense for us to reuse the water."

Apache drilled and completed 55 horizontal Wolfcamp shale wells in the Barnhart area during the first 9 months of 2013 and planned to drill a further 20 before the year was up. Six rigs were active in the project area during the third quarter.

Apache holds 345,000 net acres across the broader Wolfcamp shale, which spans portions of the Permian basin in West Texas. The company figures its leasehold holds 347 million boe of resource potential from 971 identified drilling locations. In addition to the six rigs active in the Barnhart area in the third quarter, Apache also had one rig drilling Wolfcamp wells in Upton County, Tex., and another rig drilling into the Wolfcamp in Reagan County, Tex.

The Permian basin is a key operating region for Apache and accounted for 17% of the independent operator's worldwide production of 785,000 boe/d in the third quarter. Apache is the most active driller in the Permian basin, running an average of 45 rigs there in the third quarter and spudding 240 gross wells—of which 66 were horizontal. Permian production reached a company record of 131,700 boe/d (76% liquids) in the period, representing an 18% increase over year-earlier volumes.

The Wolfcamp is not the only Permian basin play Apache is developing. The company is also drilling wells in the Midland basin, the Central Basin Platform, the Delaware basin, the Yeso play in the Northwest Shelf, and the Cline shale. The Permian basin is characterized by multiple stacked pay intervals, which gives operators like Apache the opportunity to produce from several zones at many wells.

In the Barnhart area, Apache found the right combination of factors to make large-scale water treatment and reuse efforts a success. The company had a large acreage position with ready access to brackish water in the Santa Rosa aquifer and a high level of drilling activity that made building a large treating and recycling facility economic.

Barnhart is not the only area where Apache is conserving fresh water. The company also has frac water recycling operations elsewhere in Texas, at vertical wells drilled in its Garden City project area, about 45 miles southeast of Midland, and its Andrews project north of Odessa.

Texas battles drought

In November, Texas voters addressed the states's long-running drought by approving Proposition 6, which appropriates $2 billion from the state's Economic Stabilization Fund to the new State Water Implementation Fund for Texas (SWIFT).

"Texas has been in the midst of a statewide drought since the end of 2010," Dr. Robert Mace, deputy executive administrator of water science and conservation for the Texas Water Development Board, told UOGR.

The board will oversee the deployment of funds from SWIFT. The longstanding agency is tasked with regional water planning and prepares a State Water Plan every 5 years as part of an effort to secure the state's water supply.

Projects included in Texas' State Water Plan are eligible for the financing unlocked by Proposition 6. Funds are expected to be made available no sooner than 2015, after the water board has finalized rules for SWIFT.

The State Water Plan encompasses a wide range of projects, including water conservation in the agricultural, municipal, and industrial sectors; the treatment and reuse of wastewater for industrial and irrigation purposes; and measures geared toward creating surface water supplies—including building reservoirs, water wells, and the desalinization of ground water.

There are already roughly 200 desalinization plants in Texas—none of which draw from the Gulf of Mexico. Mace said the largest of these is a plant in El Paso, Tex., that is capable of treating 27.5 million gal/day of water and holds the distinction of being the largest inland municipal desalinization plant in the world.

Desalinization is just one way of dealing with the dry conditions that persist throughout parts of Texas. Even though the state-wide drought officially began in late 2010, Mace said, water supply reservoirs in West Texas started seeing their levels decline around 1999 and 2000, and the argument could be made that the drought started earlier for these areas.

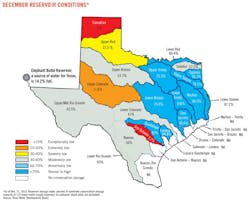

The apex of the current period was in 2011, when Texas experienced its hottest summer on record. Since then, Mace said, water supply levels have broadly improved in the Houston area, East Texas, and central Texas. Other areas are still in trouble. "There are haves and have-nots across the state," Mace said.

Some reservoirs in the Midland-Odessa area—like the O.H. Ivie and J.B. Thomas—are less than 2% full. "These numbers tell us that we have dwindling surface water supplies in parts of Texas," Mace said.

Texas Monitored Water Supply Reservoirs were 63% full in early December, 17 percentage points below their historic average of 80% for this time of year. "We're still quite a ways under on reservoir storage," Mace said.

And drought lingers. "We're in a cycle where we have a greater propensity for drought in Texas, and that cycle has another 5-15 years," Mace said.

Current drought conditions are related to a sea surface temperature anomaly, called the Atlantic Multidecadal Oscillation, affecting the North Atlantic Ocean. The phenomenon is similar to the better-known El Nino and La Nina patterns in the Pacific Ocean.

Figures from the Texas Railroad Commission show the largest consumer of water in Texas is irrigation, which accounts for more than 50% of consumption, followed by municipalities. Mining, which includes oil and gas, accounts for less than 1% of total water consumption in the state.

Water recycling pioneer

The first company to receive a permit to recycle flowback and produced water from hydraulically fractured wells in Texas was Fountain Quail Water Management, which today counts Apache as one of its customers. Chief Operating Officer Brent Halldorson said the Fort Worth-based company set up shop in 2004 in the shale play that kicked off the North American shale boom—the Barnett shale in North Texas.

Fountain Quail has since extended its reach into the Permian basin in West Texas. The company utilizes two types of semimobile water treatment units that can process produced and flowback water as well as brine on site for producers. The larger Nomad unit uses an evaporation process to produce distilled fresh water at a total cost of $3-4/bbl, while the company's Rover unit delivers clean salt water, removing dirt, clay, and polymers, at a cost below $1/bbl.

Though Fountain Quail got its start in the dry-gas rich Barnett shale, Halldorson said, much of the work is now migrating to the Permian basin, where producers are drilling for oil and natural gas liquids. The company recently opened an office in Kermit, Tex., just west of Odessa in Winkler County.

As of early December, Fountain Quail had four Nomads and one Rover running in the Permian basin, compared to two Nomads in the Barnett shale.

Halldorson said the Texas Railroad Commission recently removed some barriers to water recycling in Texas by eliminating the need to secure permits from the agency to perform work and enacting some common-sense rules.

One key piece of legislation is House Bill 2767, passed in May 2013. Halldorson, who also chairs the Texas Water Recycling Association, said the bill "Allows me to take produced water from company ‘A,' recycle it, and give it to company ‘B.'"

More importantly, the rules enabled producers to transfer ownership and liability of produced water to water recyclers like Fountain Quail that, in turn, pass it on to the company that purchases and uses the water.

Before the legislation was passed, Halldorson said, Texas companies were often hesitant to sell water because of cradle-to-grave liability rules.

"The new law says that if you're willing to have your wastewater recycled, you can transfer liability," Halldorson said. "I think it's something that's really helping to encourage recycling."

Halldorson spoke highly of Texas Railroad Commission's oversight. "What a lot of people don't realize is that here in Texas we have some of the best water-recycling rules in the world."

Also driving water recycling are the problems of supply and disposal. In drought-stricken parts of the Permian basin, operators unable to find a source of fresh water for frac jobs can approach companies like Fountain Quail to learn about options.

If brackish water is available, they can treat it, as Apache does at its Barnhart project area, or intercept produced and flowback water marked for disposal by other operators, clean it, and reuse it. The produced and flowback water can be recycled on site.

"People used to think of produced water as just wastewater, but it's really an asset in certain cases," Halldorson said.

While Fountain Quail's equipment can recycle and treat water, the company's partner Select Energy Services handles water sourcing, transportation, containment at the well site, and disposal once the frac job is complete.

Halldorson is excited about the prospects for the emerging oil and gas water recycling industry. "I feel like we've finally broken into the mainstream," he said.