Extending Druzhba still makes sense for more Russian oil exports

Several export proposals have responded to recent and expected growth in Russian crude oil exports.

One proposal that should be considered was actually put forward several years ago and remains economically and environmentally advantageous: extending the Druzhba pipeline system to Wilhelmshaven (Fig. 1).

Stakeholders in the Russian oil industry have been recommending other high-profile projects for increasing export capacity, including:

- Expansion of the Baltic Pipeline System, proposed by Transneft.

- Construction of the Murmansk pipeline system, proposed by the Russian oil majors.

The Druzhba-to-Wilhelmshaven project was first proposed in the aftermath of the fall of the Berlin Wall in 1989 and reunification of Germany. But several recent events have given it an extra push to be considered by the Russian, European, and US oil industries.

Factors

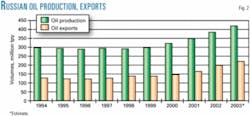

In the last 4 years, high crude oil prices, material benefits from devaluation of the Russian ruble, a relatively stable political situation, and additional use of advanced reservoir management and production technologies have resulted in a boom in Russian oil production that has put the Russian oil pipeline system at its export capacity limit (Fig. 2).

At the same time, increased geopolitical risks following Sept. 11, 2001, terrorist attacks in the US and the ensuing war on terrorism, the unresolved conflict in the Middle East, and the instability in Iraq have pushed energy issues and particularly security of oil supply issues to the highest level of priorities of the political agenda in oil importing countries.

The EU and US have started to cooperate with Russia on energy issues at a political level as shown by the creation of the EU-Russia Energy Partnership and the US-Russia Commercial Energy Summit.

On Oct. 3, 2000, the EU and Russia agreed to conduct regular energy-related dialogue.1 In May 2002, US President George W. Bush and Russian President Vladimir Putin established a new US-Russia dialogue.2

The European Commission in its new proposal for the Trans-European Energy Network has already included oil pipelines (previously only gas pipelines and power transmission lines were included) and in particular the interconnection above mentioned being realized by the extension of the Druzhba system to Wilhelmshaven.3

The catastrophic sinking of the oil tanker Prestige off the Galicia coast in northwestern Spain in November 2002 has focused the attention of politicians, especially in Europe, on the need to reduce environmental risks posed by oil tankers, particularly in the Baltic Sea and Black Sea, the main routes for Russian oil export.

Last October, the European Union banned single-hulled tankers carrying heavy oil grades from all EU ports and brought forward to 2010 the phasing-out of all single-hulled tankers, depending on a vessel's age.

Extending the Druzhba system to Wilhelmshaven means a new step in realizing the goals of cooperation with Russia, and EU and US with regard to energy, enhancing oil supply security, reduction of environmental risks, and making the supply of Russian oil to the EU and US more economically attractive.

Extending the Druzhba system to Wilhelmshaven would:

- Interconnect by pipeline the East European oil pipeline supply with northern and northwestern German refineries.

- Reduce tanker traffic in the Baltic Sea with subsequent reduction of environmental risks.

- Allow for loading of large crude cargos at Wilhelmshaven with US destination, thus giving Russian oil exports the possibility of by-passing the cargo-size restrictions of the Baltic and Black Sea routes because of Danish and Bosporus Straits constraints.

- Allow, through the throughput increase along the Druzhba system, for maintenance and development investments into the pipeline system needed for its rehabilitation and modernization. This also would improve the integrity of the pipeline system, thus reducing environmental risks and increasing security and the guarantee of oil supply

- Provide via the Transneft pipeline system a new export outlet for Caspian oil bypassing the Bosporus Straits through the Atyrau-Samara-Wilhelmshaven pipeline corridor.

- Create, with the now-idle Odessa-Brody pipeline (sidebar), via the construction of the Brody-Plock pipeline for another pipeline export outlet for Caspian oil to Wilhelmshaven for European and US destinations. This construction would reduce Caspian oil in transit through the already congested Bosporus Straits

Druzhba system

The Druzhba pipeline system originates at Samara, the Russian oil hub where oil production from West Siberia, Urals, and Caspian Sea is collected through numerous pipelines. From Samara the line runs westward to Unecha near the Belarus border where a pipeline branches off to run to the Baltic countries and marine terminals.

The Druzhba system divides in the Belarus town of Mozyr. The southern branch runs via Ukraine, Hungary, and Slovakia to the Czech Republic. The northern branch runs from Mozyr through Poland and on to the German city of Schwedt at the German-Polish border.

A lateral runs to the Polish port of Gdansk and the main pipeline continues from Schwedt to the refinery in Leuna in eastern Germany.

Total length of the northern arm of the Druzhba system between Samara and Schwedt is 2,730 km (about 1,695 miles) with 1,300 km in Russia, 730 km in Belarus, and an additional 700 km in Poland.

The Druzhba system in Belarus consists of two large-diameter mainlines with an estimated capacity of 100-120 million tonnes/year (tpy) up to the branch at Mozyr. The system up to Mozyr has plenty of available capacity; in 2002, 63 tonnes were transported through this line.

From Mozyr to the Polish-German border, however, the Druzhba line has no free capacity. From Mozyr to the Polish refinery in Plock, Druzhba is fully utilized at 40 million tpy.

From there to the Polish-German border, Druzhba is also fully utilized at 20 million tpy, corresponding with the supply needs of the Schwedt and Leuna refineries in the former East Germany.

The capacity of the northern arm of Druzhba would have to be expanded by some 20 million tpy that would be exported through the new Druzhba-Wilhelmshaven crude oil pipeline.

Capacity increase

In both Belarus and Poland, work is being initiated to increase the capacity of the pipeline system to transport more Russian and Caspian oil.

In Belarus, a project to upgrade the system has been initiated by the Belarus pipeline operator Gomeltransneft to increase its capacity from Mozyr to the Polish border by 20 million tpy. The system has three mains (32, 28, and 24 in.) with four pumping stations.

In Poland, the pipeline firm Pern has initiated a project to construct a new 32-in. mainline parallel to the existing 32 and 24 in. to Plock that will increase the capacity of the system by 25 million tpy.

The pipeline system from Plock to the German border consists of two mainlines, 32 and 20 in. Engineering investigation and analysis will have to determine whether additional pumping capacity or the construction of a new loop would be necessary.

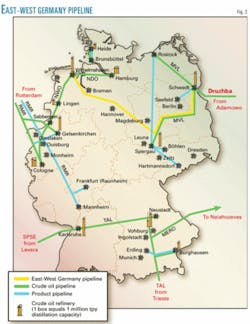

East-West Germany oil pipeline

The East-West Germany pipeline would run from the city of Schwedt at the Polish-German border to the port of Wilhelmshaven west of the Danish Straits.

Wilhelmshaven is the largest oil port in Germany with a maximum draught of 18.3 m to accommodate large crude carriers and is connected to tank storage of as much as 1.6 million cu m. It is also the starting point of the northwest German oil pipeline and north German oil pipeline that serve refineries around Hamburg, Düsseldorf, and Cologne.

In addition, facilities are connected to the German strategic oil underground storage facilities in Wilhelmshaven, namely Etzel and Epe.

There are basically two route alternatives for the Druzhba-Wilhelmshaven crude oil pipeline:

- A shorter route with a length of about 460 km. This route, however, would run near numerous water and natural protected areas.

- A longer route of 640 km would make use of existing corridors along the MVL pipeline (Druzhba extension to the Leuna refinery) and then along the corridor of the Wilhelmshaven-Leuna pipeline planned in the early 1990s.

This corridor was studied in detail at that time and obtained land-use approval. A full new detailed route survey and permit procedure would be required for only some 90 km of the corridor in the federal state of Saxony-Anhalt (Fig. 3).

A preliminary design of the pipeline system considering the longer route alternative and a pipeline throughput of 20 million tpy showed that the most economic solution would be a 30-in. pipeline with four pumping stations. Capital costs were estimated at around 600 million euros and operating costs at 28 million euros/year.

Competitiveness of corridor

The oil export corridor Druzhba-to-Wilhelmshaven would consist of a pipeline system through four countries in which investments would have to be made.

Utilization of the pipeline system for 15-20 years will have to be guaranteed by shippers in order to qualify for the financing. A fixed tariff for the entire corridor would have to be offered to shippers making throughput commitments.

This will require intergovernmental agreement among Russia, Belarus, Poland, and Germany, and related transportation agreement among the involved pipeline companies.

A unique tariff based on distance per unit moved could be proposed, as in the case of the Druzhba-Adria Integration Project when all countries involved agreed on a tariff of $0.64/tonne/100 km.

In principle, a similar value could well be applied to the Druzhba-Wilhelmshaven oil export corridor. This shall be a value acceptable for Transneft, as it was in the Druzhba-Adria Integration Project, and also for the Belarus and Polish parties, for whose pipelines results a tariff of $4.70/tonne and $4.50/tonne, respectively.

A preliminary economic analysis has shown that this tariff level in Belarus and Poland covers the respective capital and operating expenditures and provides an adequate return on the investment made to increase the capacity of the pipeline system.

The economic analysis also shows, however, that for the German part where a completely new pipeline system including new pumping stations would have to be constructed, an approximate 30% higher distance-specific tariff of $0.83/tonne/100 km would have to be applied to yield a tariff of $5.30/tonne to cover capital and operating expenditures and provide an adequate return on the investment on the East-West Germany pipeline.

The Druzhba-Wilhelmshaven export corridor would result in total transport costs of $22/tonne from Samara to Wilhelmshaven, making it competitive against such other proposed export routes as the expansion of the Baltic pipeline system or the Murmansk pipeline system for shipments to Europe or the US.

Transportation to northwest European markets through the Baltic pipeline system to the Primorsk tanker terminal has current transport costs close to $20/tonne, but this depends greatly on the highly volatile tanker charter market that has shown a trend of increasing cost.

In addition, the winter months' ice-class tankers are required to load in Primorsk, adding further costs and uncertainty to this route.

In 2002, ice in the Gulf of Finland reached 60-cm thickness and led to disruptions in exports from Primorsk due to a shortage of suitable ice-class tankers.

Additionally, the tanker size limit is 100,000 dwt due to Danish Straits constraints for shipments to the US and the environmental risks associated with tanker traffic in the Baltic Sea exacerbated under winter-ice conditions are further drawbacks of the expansion of the Baltic pipeline system.

The Murmansk pipeline system would allow for large crude shipments to the US from the deepwater year round ice-free port near Murmansk on the Kola Peninsula.

A massive initial investment estimated at $3.4-4.5 billion would be required to construct the 2,500-3,600 km pipeline (the shortest route would have to cross the White Sea) and the new tanker terminal.

In addition to the massive initial investment, the legal and commercial complexity of securing capacity rights, tariffs, and long-term throughput commitments for 60-80 million tpy that would be necessary to make the investment feasible might prove insuperable.

Even in the case that such investment proves viable, a resulting tariff of $18-25/tonne would make oil shipments to the US comparable to those from Wilhelmshaven. But whether in the coming years the US can consume 60-80 million tpy of Russian oil may prove very optimistic forcing large oil shipments to Europe at higher costs that the direct pipeline corridor.

References

1. http://europa.eu.int/comm/energy_transport/en/lpi_en_3.html.

2. http://www.usea.org/usrussia.html.

3. http://europa.eu.int/comm/energy/ten-e/consultation_2003_07_25/ priority_axes_and_projects_en.pdf.

The authors

Ernesto Soria ([email protected]) is an oil and gas consultant at ILF Consulting Engineers, Munich. He studied at the University of Saragossa in Spain, where he participated in a year-long exchange program with the University of Glasgow in Scotland during 1994-95, then received a MSc (1998) in industrial engineering. In 2000, Soria also received an MBA from the European University in Munich.

John Gray (John.Gray@ muc.ilf.com) completed a degree in civil engineering (1997) from the University of Hamilton, New Zealand, and worked in the civil and environmental sector. For the last 3 years he has worked in the oil industry as project engineer for ILF. He is also finishing a diploma in business management at the Open University of England.

Developments . . .

Editor's note: On Feb. 25, Ukrainian Energy Minister Sergei Ermilov announced that Kazakh oil would begin moving from the Ukraine port of Odessa to Polish refineries near Plock at the end of April or beginning of May, according to European Report.

The publication said the European Commission had received confirmation from Ukraine that contracts were in place for the country to buy Kazakh crude oil for the 414-mile Odessa-Brody pipeline that has lain idle since its completion more than 2 years ago. A Ukraine commission had earlier recommended the idle line be reversed to move Russian crude south to the new Black Sea terminal at Pivdenne near Odessa for shipment via tanker through the Turkish Straits (OGJ Online, Feb. 9, 2004; OGJ, Mar. 8, 2004, p. 64).

According to European Report, once the pipeline is filled with Kazakh crude, Ukraine's railways will begin moving as much as 1 million tpy from Brody to Polish refineries in Plock, under the terms of an agreement between Poland and Ukraine. Capacity may eventually be raised to 5 million tpy, said the report.