Study of pipeline SCADA spending reveals a mature industry

Research last year by the Newton-Evans Research Co., Ellicott City, Md., targeted the worldwide petroleum pipeline industry's use of and plans for supervisory control and data acquisition (SCADA) systems.

The study included information from surveys and use profiles of more than 165 transmission pipeline operations and gas utilities in 21 countries, said the company.

The picture

Following are some of the highlights of the findings:

- According to industry participants interviewed, about 75% of the world's operating pipelines of more than 25 km are controlled by a computer-based SCADA system. These systems include as many as 70,000 remote terminal units and programmable logic controllers installed to provide local data acquisition.

- Fewer than 200 pipeline-operating companies control the operations of more than 750 major world pipelines. An additional 8,000-11,000 oil and gas pipelines are owned and operated by 3,000-4,000 smaller companies (separate corporate identities). And the trend, in late 2003, found the study, is toward further consolidation among pipeline operations.

- SCADA systems' penetration in currently operating pipelines is significant. The market is "mature," said the company, at least to the extent of having basic controls, remote data acquisition, and centralized computer-based systems in place in 75-95% of important pipelines, and controlling and monitoring as much as 50-60% of smaller pipelines.

"This trend to already be operating with SCADA is without regard to geographic location of the pipeline. Developing nations are as likely as industrialized states to use SCADA technologies," said the company.

- Pipeline SCADA systems use multiple communications techniques and methods, radio and telephone being among the communications technologies used. For larger pipelines, microwave, satellite technologies, and fiber are important today. Internet and intranet-based technologies are becoming more "relevant" each year as a critical "method of data acquisition and reporting."

Newton-Evans estimates that the world inventory of operating pipelines includes about 355,000 km of crude oil pipelines, 380,000 km of petroleum product pipelines, and nearly 1 million km of natural gas transmission pipelines.

An additional 2.5-3 million km of natural gas distribution pipelines are operated by as many as 2,000 LDCs.

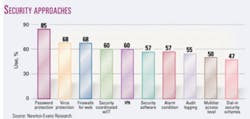

The study found that many pipeline operators have implemented several approaches for reducing vulnerability on their control networks.

The accompanying figure indicates that, on average, 5 of the 10 listed approaches have been adopted by pipeline control centers.

Password protection, virus protection, and firewalls have been implemented in more than two-thirds of the pipelines participating in the study.

More details

These findings are part of a three-volume set the company sells.

Reported in the first volume is the continuing slow-growth market for pipeline control systems spending. It suggests that many pipeline control center operations teams are "doing more with less, and simply adding required new applications and modifications to older, existing platforms."

Newton-Evans said pipeline operations centers are ahead of counterparts in the electric utility industry in terms of spending for cyber security safeguards.

The survey-based report includes findings on new purchase plans, RTU and PLC usage, warranty and service agreements, suppliers likely to be considered, cyber security threat reduction approaches, pipeline operational dependency on SCADA, type of compressors in use, and methods of billing for pipeline transportation services.

The second volume forecasts spending for pipeline control center-based systems and technology to increase at 5-10%/year between 2004-06. "Today's global market for pipeline SCADA in the oil and gas industry is approaching $220 million/year, exclusive of related spending on control center sites themselves, or related GIS systems or recurring SCADA telemetry costs," said the company.