Winter heating demands likely to rekindle tanker rates

An unusual conversion of forces in late summer was likely to extend the cooling of tanker rates, compared with activity typical for this time of the year, according to an analysis by shipping consultant Poten & Partners, New York.

But, with winter season imminent, such a lull in rates would probably be short-lived.

The apparent lull in fixture (vessel) activity in late summer, said the consultancy, the high price of crude as an inhibitor to vessel-inventory accumulation, and some progress in "reducing the anxiety level of those in the oil business" could spell an extension on the cooling of rates—but not for long.

Rate movements

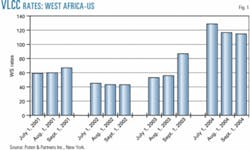

As the US Labor Day holiday approached at the beginning of September, the traditional end of summer in the US, rates for very large crude carriers were only just beginning to fall. And even then, they remained above historical averages, said the company.

Between Russian oil company Yukos' financial woes, Iraqi rebel habits of pipeline sabotage, and high worldwide oil production, VLCC rates had barely "time to catch their breath," to the benefit of owners.

Average daily earnings, said Poten, for VLCC voyages West Africa to the US were $79,414/day for July and $71,329 for August. Such rates were "not too hard to take" for ship owners, even if rates were beginning to cool (Fig. 1).

Poten reported that the International Energy Agency had predicted demand for oil would reach 82.5 million b/d in fourth-quarter 2004, the highest growth rate in 10 years.

IEA was forecasting oil demand to grow by an additional 700,000 b/d in 2005. OPEC's output was its highest since 1990 at 29 million b/d. Worldwide oil production was also up by about 1.2 million b/d.

What's happening

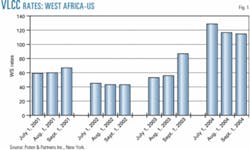

All the explanations for why rates were robust, said Poten, were not supported by fixture activity, which in general has been declining this year. Even the key Persian Gulf trade "lacks luster," the analysis stated (Fig. 2).

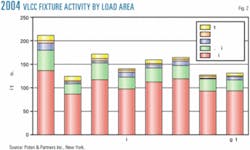

Fig. 3 compares the monthly number of fixtures between 2003 and 2004. Total fixtures through August 2004 were 1,235, up 7% from 1,154 for the same period in 2003.

"That is one reason why rates are up this year—a greater number of liftings," said the analysis.

Fixture activity, while up overall, had declined in the months leading up to September, on a month-to-month basis. "This is not a sign of an overly robust market," said Poten.