SPECIAL REPORT: Growth of floating production systems accelerates

Floating production systems continue to grow in number as the oil and gas industry finds fields that without these systems would not be technically or commercially feasible to develop.

In just over 3 decades, floating production systems have evolved from relatively simple units producing from a single well in 100 m of water to massive facilities capable of handling 250,000 bo/d of production from a complex subsea network of wells in water deeper than 1,000 m.

Floating production technology has enabled such countries as Angola, Nigeria, and Brazil to become major global oil producers and has kept alive production in the North Sea and Gulf of Mexico.

In its latest floating production system update, March 2008, International Maritime Associates (IMA) lists information on the floating production systems and storage vessels currently in service, the backlog orders for these systems, and the many floater projects being planned or studied.

The report continues a series of reports on the floater market that IMA began in the mid 1990s.

Current situation

Currently in operations are 212 production floaters or 2½ times the number 10 years ago. The current inventory includes 131 floating production storage and offloading vessels (FPSOs), 40 production semisubmersibles, 21 tension leg platforms (TLPs), 15 production spars, and 5 production barges (Fig. 1).

These systems are on producing fields off West Africa, Northern Europe, US Gulf Coast, Brazil, Southeast Asia, China, Australia, and New Zealand.

Also in operation are 86 floating storage offloading vessels (FSOs) on fields in Southeast Asia, West Africa, and the North Sea.

Production floater orders

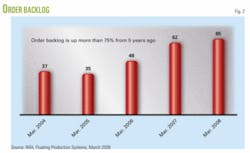

The construction backlog of production floaters continues to grow. With 65 units now on order, the current backlog is 40% greater than 2 years ago and 75% greater than 5 years ago (Fig. 2).

The backlog consists of 46 FPSOs, 9 production semis, 1 TLP, 3 spars, 2 floating production units without storage, and 4 floating LNG storage-regasification units.

In addition, the industry is building or converting 10 FSOs.

Shipyards in Asia have developed a strong presence as suppliers of purpose built or converted production floaters. Of the 38 facilities, 20 facilities now involved in fabricating or converting floating production and storage units are in Asia.

Singapore repair yards dominate FPSO conversions.

Yards in Singapore, Malaysia, and Korea build most of the hulls for production semis.

Korean yards have a strong presence in the construction of purpose built, high-end VLCC-size FPSOs.

Chinese yards have established leading position in building cylindrical FPSOs and are increasingly the preferred source for new Suezmax-size FPSOs and FSOs.

Dubai also has become a major site for FPSO conversions.

Production floater price

As the construction backlog has grown, cost pressures from suppliers have caused the price of floating production units to increase dramatically. Pricing pressures are everywhere in the production floater fabrication and conversion sector.

Two recently ordered FPSOs have contracted prices not seen before in the industry. The 160,000 b/d Usan FPSO being built at Hyundai Heavy Industries Co. Ltd. for Total SA has a $1.6 billion engineering-procurement-construction (EPC) contract. Even higher is the price of the 200,000-b/d Pazflor FPSO being built by Daewoo Shipbuilding and Marine Engineering Co. Ltd., also for Total. The Pazflor EPC contract exceeds $2 billion.

These prices are substantially greater than the previous record for the 250,000 b/d Agbami FPSO, which had a $1.2 billion price tag.

Floating production outlook

While the growth of floating production has been impressive, the future looks even brighter. IMA sees floating production in an accelerating stage of growth during the next 5-10 years.

The underlying fundamentals driving the sector are strong and indications of a robust future market are easy to spot. Global oil demand is growing at more than 2%/year, oil supply is tight, and threat of supply disruptions overhangs the market.

Oil companies have accepted that high oil prices will continue and have adjusted upward investment oil price assumptions, helping to justify the huge expenditures needed to explore and develop fields in increasingly deeper water.

Rig constraints, which have limited deepwater exploration and development, will ease with the delivery of almost 80 new drillships or drilling semisubmersibles during the next 2-3 years.

A variety of small companies hoping for a quick return from +$100/bbl oil have been drawn into developing marginal fields, including fields where production was shut-in but producible reserves remain.

Speculators, who until recently did not have a big presence in floating production, now have 14 production floaters on order and plan to have the equipment ready to ride the tide of requirements for new systems.

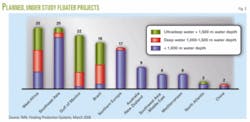

IMA’s recent study describes 134 offshore projects in the planning stages that potentially will require floating production systems, with some projects requiring multiple systems (Fig. 3). About 29% of these projects are at the bidding or final design stage and 71% are in the concept development or study phase.

IMA believes there is a very strong likelihood that 50-75% of these projects will actually materialize into equipment fabrication contracts within the next 3-5 years. It also believes another large number of floater projects will undoubtedly surface during the next several years that are not currently on the radar screen.

Order forecast

IMA’s 5-year forecast expects 130-158 production floater orders between 2008 and 2013, as well as orders for another 40-50 FSOs. These systems will entail capital expenditures of $65-81 billion.

FPSOs will remain the most popular type of production floater, accounting for around 80% of the orders and capital expenditures.

The author

James R. McCaul ([email protected]) is president of International Maritime Associates Inc. He established IMA in 1973. Before forming IMA, he was member of the faculty of Webb Institute of Naval Architecture. McCaul holds a PhD in economics from the University of Maryland, an MS in business administration from Pennsylvania State University, and a BS in marine science from the State University of New York.