SPECIAL REPORT: Study expects 120-175 more floating production units during next 5 years

Jim McCaul

International Maritime Associates

Washington, DC

In its recent analysis of floating production systems, International Maritime Associates, Washington, forecast the petroleum industry will add 120-175 new units during the next 5 years.

The study found that currently there are 250 units in operation or available, more than double the number of units 10 years ago.

Included in the total are 12 units off field and being remarketed. Eleven of these are floating production, storage, and offloading (FPSO) vessels and one is a production semisubmersible. The overall utilization rate for available production floaters is 95.2%.

FPSOs account for 62% of the current production floater inventory. The balance consists of production semis 17%, tension leg platforms 9%, production spars 7%, and production barges and LNG storage-regasification vessels 5%.

Petroleo Brasileiro SA (Petrobras) clearly dominates, with 43 FPSOs in operation or on order, having a combined processing capacity of 5.1 million bo/d. China National Offshore Oil Corp. Ltd. (CNOOC), ExxonMobil Corp., Total SA, Chevron Corp, Eni SPA, BP PLC, Royal Dutch Shell PLC, and Malaysia's Petronas are next in line. These nine operators account for 61% of FPSOs and 72% of oil processing capacity installed on FPSOs. Fig. 1 breaks out by company the number of FPSOs in service and on order.

Orders

Order backlog on Mar. 31, 2011, stood at 47 units, of which there are 35 FPSOs, 6 production semis, 3 tension leg platforms, and 3 floating storage-regas units. Twenty-four of these units will have purpose-built hulls and the remainder will have converted tanker hulls. When delivered, new production floaters will increase operating inventory by 20% over the next several years.

Almost half of the units on order are for use off Brazil. Southeast Asia, West Africa, Northern Europe, and the Gulf of Mexico are other major destinations for units on order. Production floaters currently are being built or converted at 28 facilities worldwide. Asia is the major location for fabrication and conversion. But Brazil is becoming an increasingly larger player and is now the second largest fabrication center for floating production systems.

Planned projects

The study identified 194 projects in planning that likely will require a floating production system for development. Fifty-five of these projects are at bidding or final design, with equipment orders likely during the next 12 to 18 months. Another 139 projects are in planning or study, with orders likely in 2013-19.

Brazil is the most active region for new floater projects. The study identified 47 projects in planning in Brazil. Some of these projects involve multiple floating production systems of up to 6 units in one major project.

West Africa is the second largest region for planned projects, followed by Southeast Asia, Northern Europe, the Gulf of Mexico, and Australia-New Zealand. Fig. 2 shows where these units will be deployed.

Forecast

Overall, the study expects orders for production floaters to average 24-35 units/year during the next 5 years. About 80% of them will be FPSOs; redeployment of existing units will satisfy 15-20% of new FPSO projects.

The study expects about 30% of the FPSOs to be large units similar to CLOV off Angola, Skarv off Norway, and P-62 off Brazil. Another 30% will be midsize units such as Cidade de Sao Paulo off Brazil, Kwame Nkruma off Ghana, and Pyrenees Venture off Brazil. The balance will be small units such as Gimboa off Angola, Montara Venture off Australia, and Cidade de Santos off Brazil.

The capital expenditures required for these floater orders may total $80-115 billion between 2011 and 2016. The forecast range reflects three potential crude oil pricing scenarios. The base scenario assumes oil stays in the $90-110 range, a price range the futures market sees most likely over the foreseeable future.

Long-term outlook

Future growth indicators in the floating production sector are positive. Global demand for oil continues to grow, the market is again threatened by Middle East and North Africa supply disruptions, oil prices have pierced $100, and virtually every major field operator has announced plans to increase offshore exploration and development expenditures.

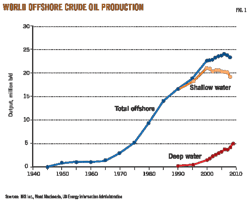

Deepwater fields are among the major sources of hydrocarbons yet to be found or developed. While no one knows the full extent of deepwater potential, the magnitude undoubtedly is huge.

In Brazil alone, estimates place deepwater presalt resources at 70 billion boe, a figure likely to grow as companies confirm more finds. Some estimates see deepwater resources offshore Brazil, West Africa, and elsewhere providing almost 14 million boe/d by 2030, more than double the current contribution to global supply. Importantly, drillships and semisubmersible drilling rigs now being built will add 38% to available deepwater drilling capacity.

A shortage of available rigs has constrained exploration and development. More rigs looking for oil result in greater number of finds and ultimately greater demand for additional floating production systems.

Overall, growth in the floating production sector has lots of room to run. There are no indications of the market slowing. Rather, demand for new systems is accelerating.

The author

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com