North Sea decommissioning booms as exploration lags

Ben Wilby

Douglas-Westwood

Faversham, UK

The North Sea presents an opportunity for companies involved in decommissioning, a segment which could see more than $80 billion of investment through 2040.

Until now North Sea decommissioning has moved slowly, with few removals ordered by platform operators. The protracted oil price collapse, however, is forcing operators to consider accelerating decommissioning.

Many of the platforms in the North Sea are late-life and have operated long past initial design expectations due to costly life extensions. These platforms require high oil prices just to break even: not an issue from 2010 to mid-2014, but a growing problem with oil prices near $30/bbl since the start of 2016.

Long-term predictions forecast oil price to remain below $100/bbl through 2020. When field operators consider the age of many North Sea assets, it doesn't make financial sense to keep running them.

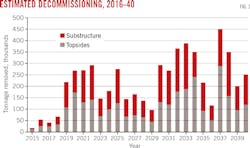

Douglas-Westwood (DW) expects a spate of abandonments by the end of the decade, with companies selecting decommissioning concepts then as well (Fig. 1).

Single-lift vessels

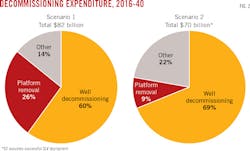

DW's North Sea Decommissioning Market Forecast 2016-40, which covers Denmark, Germany, Norway, and the UK, split decommissioning expenditure using two different scenarios. In Scenario 1 (S1) DW assumes that all decommissioning will be completed using current methods, mostly reverse installation. In Scenario 2 (S2) DW includes the potential impact single-lift vessels (SLV) could have on the market (Fig. 2).

The difference to overall spend is clear. DW anticipates a total S1 decommissioning cost for the four countries of $82 billion 2016-40. But this drops to $70 billion in S2 due to the smaller time required at the field when using an SLV such as Pioneering Spirit. S2, however, will only become a reality if early Pioneering Spirit jobs are completed successfully, the day rate is competitive, and operators, who have often been unwilling to try new techniques, fully embrace the SLV concept. If demand from operators emerges, DW anticipates SLV-fleet size will grow as additional vessel companies compete.

Well plug, abandonment

DW forecasts that more than 50% of North Sea wells-both surface and subsea-will need to be removed over the forecast period, accounting for more than 50% of total plug and abandonment spend in both scenarios. Subsea tree removal in Norway and the UK will be the primary expense, with the costs of subsea well plugging, abandonment, and removal being far higher than those for surface wells. The need for specialized vessels to work on subsea wells is what makes their decommissioning more expensive than surface wells. Well work is a niche area, with the limited number of companies in the market leading to potential bottlenecks and high costs.

Beyond well abandonment, the cost for essential decommissioning work varies between the scenarios. Removal of topsides and substructures will account for 26% of S1 expenditure but only 10% of the total in S2, demonstrating the cost savings created by SLVs, which can complete removal of the heaviest platforms with one lift rather than via reverse installation.

Onshore deconstruction will cost 38% more in S2 than S1, due to topside delivery as one large piece with much of S1's offshore work being completed onshore instead. The higher onshore deconstruction costs, however, are outweighed by time savings and increased safety.

UK dominates spend

Spending on removals will be greatest in the UK due to high amounts of installed infrastructure and the basin's maturity. DW anticipates removal of 285 platforms and more than 4,000 wells in the UK, 2016-40, leading to expenditures of $50 billion in S1 and $44 billion in S2, more than 50% of spend in both scenarios. Decommissioning work will start earlier in the UK than in other countries and DW forecasts 146 platform removals 2019-26, 51% of all UK removals for the forecast period. Companies that obtain a strong reputation in the UK will benefit when countries such as Norway accelerate decommissioning in the future.

Norway will see the second highest spend, concentrated at the end of the forecast period, its fields being less mature than those in the UK. It will account for 32% of all spend over the forecast with 79% coming in the last 10 years.

Having a much smaller offshore industry, Danish decommissioning will peak in two different periods: first with removal of the Dan and Halfdan hubs, then, in the mid-2030s, with decommissioning work on the Siri and Gorm hubs.

Downturn opportunity

The ramping up of the decommissioning industry represents an opportunity for the specialist companies that will remove the large tonnage installed in the North Sea over the past 50 years. Companies that can operate safely, efficiently, and establish strong, competitive reputations will be in an excellent position to capitalize.

For platform operators with decommissioning work to complete, the current downturn represents a chance to be rid of assets that were only commercial at high oil prices and of abandoned platforms that are current liabilities, requiring extensive maintenance work for no material return.

The Pioneering Spirit and other SLVs point towards a newer way of decommissioning that could be quicker, cheaper, and safer. The proof, however, will be in how early jobs completed by the vessel turn out. If both the Yme and Brent removals are completed with little incident and day rates are competitive, SLVs will be an ideal solution for removing the largest platforms in the North Sea.

The author

Ben Wilby ([email protected]) is an analyst at Douglas-Westwood. He earned his BA in history in 2012 from the University of Chichester, West Sussex.