Chevron hikes Tengiz project cost to $45.2 billion

Update: In a February 2022 report, Tengizchevroil (TCO) said that at end 2021, the Future Growth Project and Wellhead Pressure Management Project (FGP/WPMP) at Kazakhstan's Tengiz oil field was 89% complete.

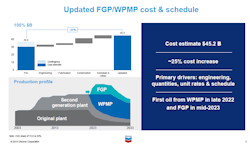

Chevron Corp. has increased the cost estimate of its Future Growth Project and Wellhead Pressure Management Project (FGP-WPMP) at Kazakhstan’s Tengiz oil field to $45.2 billion from $36.8 billion following a detailed cost and schedule review conducted in this year’s third quarter. An updated estimate has been submitted by affiliate Tengizchevroil (TCO) for shareholder approval.

In 2016, Chevron said TCO would proceed with the project designed to increase crude oil production at the field by 260,000 b/d (OGJ Online, July 5, 2016). The FGP will use state-of-the-art sour gas injection technology, developed and proven during TCO’s previous expansion in 2008, to increase daily crude oil production while the WPMP will extend the production plateau and keep existing plants producing at full capacity.

Overall, the increase in total cost, including $1.3 billion in contingency, is about 25%, the company said in an earnings call Nov. 1.

“Higher engineering costs and engineering’s impact on fabrication consumed about two thirds of the original contingency,” said Jay Johnson, Chevron executive vice-president, upstream.

“Additional construction costs represent the largest category of the revised estimate. More than half of the increase in construction cost is due to higher quantities than originally estimated—including significant increases for electrical and instrumentation, which was one of the last scopes of the engineering work to be completed. The balance is primarily driven by higher unit construction rates, due to higher market rates and more complex work than originally anticipated,” Johnson said.

Timeline

A schedule change also changes costs. “The expected start-up of FGP has shifted to mid-2023 and will now follow WPMP, which remains on schedule for start-up in late 2022,” Johnson said.

The project hit peak spending in 2018 and 2019 and engineering, fabrication, procurement, logistics, drilling and completion, and Tengiz infrastructure is 75% complete, the company said.

“Detailed engineering and procurement are essentially complete, mitigating the risk of further impact on fabrication or construction,” Johnson said. “Work at three of the four fabrication yards is finished. The logistics system is working well, and the 2019 sealift has successfully concluded. Modules are being delivered, restacked, and set on foundations as planned. Drilling is ahead of schedule with 40 of the 55 wells drilled and completed.”

Spending is expected to begin to ramp-down in 2020, Johnson said, and much of the remaining work will be on construction and start-up activities. “Given the work completed, including two full years of on-site construction experience, we believe we’re on track to deliver the project in line with the updated estimate,” he said.

Capital guidance has not changed. “Our 2020 capital, to be announced in December, will be in the range of $18 to $20 billion, and we’re reaffirming our capital guidance of $19 to $22 billion for 2021 through 2023,” Johnson said.

A reduction in activity elsewhere may help keep Chevron within range, Cowen analysts said.

Chevron “does not expect to absorb the incremental costs from moving from the low to high end of its capital range, but rather by reducing spend in other places in the portfolio, specifically short-cycle gas. [Chevron] also cited increased capital efficiencies,” the analysts said in an investor note Nov. 1.

Chevron owns 50% of TCO, which operates Tengiz field. TCO joint venture partners are ExxonMobil Corp. 25%, KazMunayGas 20%, and LukArco 5%.

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.