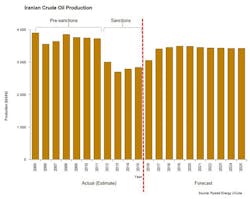

Problems seen for full recovery of Iranian oil production

Iranian oil production is rising after relaxation of international sanctions last month but remains unlikely to return to presanction rates soon, analysts say.

Based on a new analysis, Rystad Energy said it expects Iranian output of crude oil to climb to 3.4 million b/d next year from 2.8 million b/d in 2015.

For the Islamic republic, the analyst said, that would represent “the largest growth in oil production for almost a decade.”

But the projected rate would fall below the Iranian government’s expressed hope for a return to presanction output above 3.7 million b/d.

Rystad cited the country’s “lack of new investment and declining production rate from maturing fields.”

Separately, Moody’s Investors Service said it believes Iran can add more than 500,000 b/d to global oil markets this year—beyond the 1.2 million b/d it exported in 2015—but little more before mid-2017.

The Iranian increment, Moody’s said, probably will offset the decline in US production this year.

The investment rating firm noted that Iran faces problems recapturing markets for its medium-sulfur, 29°-36° gravity oil, declines in mature fields needing investment, and political risk that includes but isn’t limited to durability of the nuclear agreement that allowed the lifting of international sanctions last month.

Recapturing markets

The European Union’s ban on imports of Iranian crude helped Russia increase exports of Urals crude, which is similar to Iran’s main export blend, by more than 400,000 b/d last year to former customers of Iran in Europe, according to Moody’s.

Imports by EU members of Iranian crude averaged about 600,000 b/d before sanctions.

In Greece, formerly the largest EU importer of Iranian crude at 120,000 b/d, Hellenic Petroleum, the country’s largest refiner, last month said it had agreed to buy oil from National Iranian Oil Co., Moody’s said.

Iran also will try to regain market share from other buyers of Russian oil, including refiners in Spain and Italy, and to increase exports to Asia, especially China.

“Iran cannot depend on China alone,” Moody’s said, citing rivalry between the Islamic republic and Saudi Arabia, an important supplier with which China will want to retain strong ties.

Without technology and expertise from international oil and gas companies, Moody’s further said, Iran probably can’t raise production by much more than 500,000 b/d.

While Total and Statoil have expressed interest in Iranian opportunities, other major producers, including Royal Dutch Shell, have warned discussion about potential projects in Iran is premature.

US companies remain subject to unilateral sanctions against the Islamic republic.

Investment needs

Moody’s cites industry estimates that Iran needs capital investment of $150-200 billion for modernization of the oil industry, about half in the upstream business. But the firm expressed doubt.

“Integrated oil companies seem highly unlikely to begin projects in Iran in today’s market climate because low oil prices have constrained their ability to invest in new projects,” it said.

The firm added that the Iranian government’s contract “does not encourage foreign investment.” Although improved from the buy-back contract it replaced, the new “Iran petroleum contract” (IPC), details of which remain murky, still precludes foreign ownership of reserves.

Political risk remains high for foreign investors contemplating Iranian investment, Moody’s said.

Sanctions might be reimposed if the government doesn’t comply with the nuclear agreement, for example. And elections Feb. 26 for Iran’s parliament and Assembly of Experts, which would select a successor to 77-year-old Supreme Leader Ali Khamenei if necessary, will set the country’s political tone.

“These political risks cast further uncertainty over Iran’s ability to ramp up its production and upgrade its role in global oil markets and imply large risks for any oil companies that would sign long-term IPC contracts with Iran,” Moody’s said.