EIA counts 5,000 DUC wells in major US producing regions

Estimates by the US Energy Information Administration indicate the August count of drilled but uncompleted (DUC) wells in the seven major US tight oil and shale gas producing regions totaled 5,031, down slightly from the 5,065 counted in July.

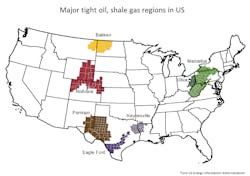

The new supplement to EIA’s monthly Drilling Productivity Report (DPR) covers inventories in the Bakken, Eagle Ford, Haynesville, Marcellus, Niobrara, Permian, and Utica regions, where 92% of US crude oil production increases and all US natural gas production increases occurred during 2011-14.

The oil-dominant Bakken, Eagle Ford, Niobrara, and Permian regions altogether tallied 4,117 DUC wells, while the gas-dominant Haynesville, Marcellus, and Utica regions counted the remaining 914. In the oil regions, the estimated DUC well count increased during 2014-15, but declined by about 400 over the last 5 months. The DUC well count in the gas regions has generally been in decline since December 2013.

In the Permian, where the Baker Hughes Inc. tally of active drilling rigs has risen by 66 since May 13, the DUC well inventory recorded the only August increase of the seven regions, gaining 38 from its July total to 1,348. EIA also projects the basin’s crude production to rise 22,000 b/d in October from its September total to just fewer than 2 million b/d.

Consistent with its recent oil output projections, the Eagle Ford’s DUC well inventory is estimated to have posted the largest decline of the major producing regions in August, dropping 36 to 1,261. For October, oil production is seen falling 46,000 b/d month-over-month and gas production is expected to lose 198 MMcfd month-over-month.

At 701, the Niobrara had an estimated 11 fewer DUC wells in August compared with its July tally. A monthly decline of 8,000 b/d in oil production and 60 MMcfd of gas production is expected for October. The Bakken’s DUC well inventory for August was down 4 from its July total to 807. For October, EIA projects a 28,000-b/d drop in oil output and 25 MMcfd drop in gas output.

Using its own data, Oslo-based oil and gas consulting service Rystad Energy separately projects a likely decline in US DUC wells over the next 8-12 months, reflecting the commerciality of DUC horizontal oil wells in a steady $40-50/bbl crude oil price environment (OGJ, Sept. 6, 2016, p. 67).

In the Marcellus, 642 DUC wells in August were down 16 compared with the July count. Gas output from the shale play is expected to drop 22 MMcfd month-over-month in October to 17.78 bcfd. The Hayneville’s DUC well inventory fell by 2 in August to 143, and its gas output is projected to drop 34 MMcfd in October to 5.81 bcfd. The Utica recorded a 3-DUC well drop in its August count to 129, but its gas production is forecast to rise 2 MMcfd in October to 3.6 bcfd.

Contact Matt Zborowski at [email protected].