Longer legs, multilaterals under study in Arkoma Woodford shale gas play

The most experienced operator in the Arkoma basin Woodford shale gas play is demonstrating that longer horizontal lateral drilling will lead to higher estimated ultimate recoveries and improved rates of return just as in the Barnett shale.

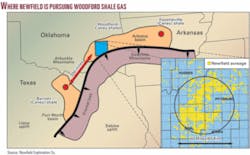

Newfield Exploration Co., Houston, said more drilling and recent 3D seismic will help determine where extended lateral completions can be used across its 165,000 net acres, said George Dunn, Midcontinent vice-president.

Dunn also looks forward to trying multilateral drilling later in 2008.

The company believes its Woodford acreage in southeastern Oklahoma could be as prolific as the Barnett shale has proven to be for other operators in North Texas.

Newfield plans to drill about 100 operated horizontal wells and participate in 60-70 nonoperated horizontal wells in the Arkoma Woodford this year with half those wells apt to involve extended laterals of more than 3,000 ft.

Dunn said more than half of the total wells Newfield will operate in 2008 will be extended laterals. More than half of the total wells will be drilled from multiwell pads, and 90% of the operated wells will be drilled based upon 3D seismic information.

“We continue to optimize development and completion, both from a standpoint of recovery and costs,” Dunn said. “Our target finding and development cost is $2/Mcf gas equivalent or less, and the extended laterals are looking like they will be able to do that.” The current F&D cost is $2.30-2.40/Mcf.

Newfield had drilled 14 laterals longer than 3,000 ft by mid-March. The last 10 lateral completions were drilled and completed for an average of $7 million gross, and the average EUR is at least 4.5 bcf of gas equivalent gross.

Standard lateral length is 2,500 ft. Newfield drilled 66 standard laterals with a 2,397-ft average and 12 extended laterals with an average of 3,864 ft.

Newfield’s total lateral footage drilled in the Woodford last year was 234,000 ft and it expects to drill more than 300,000 lateral feet in 2008 by utilizing extended laterals. The Houston independent produces 170 MMcfd from the Woodford, double its flow this time last year. Early this year, 10 operators ran 43 rigs in the play, spudding about 90 horizontal wells per quarter. Currently, Newfield has 11 operated rigs working in the play.

Dunn wants to develop new resource plays elsewhere in the Midcontinent although he could not elaborate yet on specifics.

“There are a couple of tests we will be doing this year to see if we can find some more areas other than just the Woodford,” Dunn said.

Development evolving

Newfield, first to drill horizontal wells in the Woodford, has drilled 170 of industry’s 460 horizontal wells in the play. The company remains the area’s most active driller.

“The play is a low-risk, long-life, large-reserve exposure play with foreseeable growth,” Dunn said. “Horizontal wells are providing good economic results, and that makes the Woodford an emphasis for Newfield.”

Newfield anticipates recovery factors of greater than 50% of original gas in place because of high total organic carbon content and high silica content. Silica, the primary constituent in glass, makes the Woodford shale brittle, which is an advantage in frac jobs and subsequent gas production.

Dunn is encouraged with improved efficiencies gained through extended laterals, including capital efficiencies and resulting cost reductions. Newfield is testing different completion techniques in the Woodford, which Dunn considers to be in its early development.

Extended laterals will help cut the Woodford finding and development cost.

“It’s not a cookie-cutter operation. It’s a very large area, about 2,000 sq miles, so the geology changes within it. There is some trial and error within different areas,” Dunn said, noting that technology and high commodity prices have accelerated drilling there.

He is hopeful the Woodford shalewhich stretches from Kansas to West Texaswill prove as successful as the Barnett shale. The Woodford is present in a variety of areas in the US (see map). The extent/prevalence of the Woodford is true as stated, but to date the formation is not “proven” to be highly productive except in eastern Oklahoma.

Dunn compares Newfield’s learning experiences in the emerging play with the learning curve that other operators already climbed in the Barnett shale.

Both the Barnett and the Woodford started with testing of vertical wells that commonly penetrated multiple productive zones, which then led to horizontal drilling. Wells in both the Barnett and Woodford are stimulated with large hydraulic fracs.

Newfield is working to improve frac effectiveness through the testing of various stimulation sizes, the number of stages involved, and perforation clusters. A frac stage is carried out about every 500 ft along a lateral.

“We’ve been optimizing fracture completion with proper spacing, number of perforations, and distances between the fracs,” Dunn said.

“Our focus is to reduce F&D costs and to increase our rate of return,” Dunn said. “This play is big enough that cost optimization is a never-ending process.”

Newfield is drilling as many as four wells per pad. The concentrated activity creates multiple efficiencies on completions and logistical savings.

“There is an efficiency and learning process to drill each well,” Dunn said. “We found ways to reduce total fluid volume, i.e. costs, and still get the same recoveries. We continue to work with fracture stimulations to cut costs.”

The company declined to give specifics, citing proprietary information.

Newfield expects large cost savings from using common pads. Pad size ranges from 1 to 2½ acres depending on the number of wells to be drilled.

In the Morris pilot, located in the Township 4 North Area, three wells were drilled from a common pad. Construction cost was expected to drop $100,000/well through the use of pads.

Fewer rig moves could save $80,000/well. Using a simultaneous frac (pumping a frac at two wells at the same time) could help cut costs. Newfield estimates a savings of $200,000-400,000 from all sources, and the efficiencies are believed possible in all areas, Dunn said.

Seismic information enables Newfield to define wells, identify the location of extended laterals, and reduce costs. The company now drills only in areas of the Woodford where 3D seismic information is available, he said.

More than 60% of Newfield’s Woodford acreage is now covered by 3D, and that is expected to rise to 95% by yearend 2008.

Dunn sees the drilling of longer laterals as key to Woodford drilling economics. The longer the lateral, the better its impact on F&D costs.

“We started with horizontal wells at 2,000-3,000 ft laterals,” Dunn said. “After testing different completion techniques, we moved to drilling 3,000-4,700 ft laterals where we can. The length of the lateral is predominately controlled by the geology and the location of faults.”

By drilling a 4,500-ft lateral instead of two 2,250-ft laterals, Newfield eliminates one vertical section, which reduces cost. True vertical depth of the Woodford is 8,000-11,000 ft.

Dunn foresees a limit to the length of extended laterals in the Woodford, although that limit has yet to be determined. Geology is one limit, and regulatory or unit issues are another limit.

“There is nothing (mechanical) stopping us at 5,000 ft, and that is really the only answer I can give right now,” Dunn said. “Other companies in other geologic provinces have drilled farther than that. But nothing in the Woodford yet has told us how far we can go.”

Spacing for the Woodford shale to date is 640 acres. Oklahoma regulations limit a company to producing a lateral within that unit. Counting standoffs on either end, that means about 4,700 ft in terms of the portion being produced, which Newfield has done, Dunn said.

Multilateral testing planned

Newfield’s next major step will be to test multilateral technology, which it plans to do later this year. Multilateral drilling hasn’t been tried in the Woodford shale, but the technology has been tested in the Bakken shale in North Dakota and Montana.

“What we will test initially is just trying to get two laterals in,” Dunn said. “There is certainly the technical ability within the service industry to do more than that.”

For instance, in areas where Newfield cannot drill extended laterals, it might be able to drill two laterals at whatever spacing, 40-acres or 80-acres, apart down the same vertical well bore, Dunn said, adding that could have the same effect as drilling extended laterals.

Meanwhile, Newfield has several 40-acre and 80-acre pilot programs under way to determine its ultimate development well spacing.

Newfield has cut its drilling time for Woodford wells in the last 2½ years through using combined technology advances for both the vertical and horizontal sections.

Drilling time for vertical sections was cut by learning where to set casing strings and by using air drilling in some areas, he said.

“In certain areas, our horizontal sections have utilized things like rotary steerable,” Dunn said. “Just learning the geology helps us to design the well and cut time.”

Drilling time varies considerably depending on which Woodford area is involved, but the time to rig release has been reduced 5 to 10 days.