Permian basin operators improve cube development well planning

Some Permian basin operators are working to improve tight oil production at reduced costs through cube development strategies that drill wells simultaneously for full sections instead of individual wells as in traditional row development.

Cube development is a three-dimensional approach targeting multiple stacked pay zones from large multiwell pads. Cube development involves advanced completion designs and detailed planning.

Ryan Duman, principal analyst for Wood Mackenzie Ltd. Lower 48 upstream, said, “Cubes won’t work for every company. That said, they offer big benefits if executed to plan.”

If operators using cube development can achieve at least 10% cost savings per well, WoodMac research suggests improved net present value (NPV) of more than 70%. Capital efficiency can increase by 15%.

“Total capex spend per section is less for cubes than row development because of the scale and speed benefits,” Duman said.

The risks are that cube development concentrates spending at the beginning of a project and decreases flexibility.

“If well spacing on a cube is wrong, cash flow can actually be impaired,” Duman said.

Production is hindered if wells are spaced too densely, which can make cube development more costly on a unit basis. But if successful, cube development can reduce costs with a faster spud-to-sales cycle time for multiple wells at a time.

Encana Corp., Devon Energy, Concho Resources Inc., and QEP were some of the first companies to test cube development, Duman said.

“The large upfront capital costs associated with cubes cannot be ignored, and this will screen out some companies,” Duman said. Recent high-profile cubes have shown there is no guarantee this development type will improve estimated ultimate recovery.

Drilling factories emerging

James Jang, a Westwood Global Energy Group analyst in Houston, said more operators are adopting multiwell pad drilling, which is most mature in the Niobrara within Denver-Julesburg basin of northwestern Colorado and the Bakken formation of North Dakota.

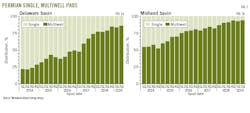

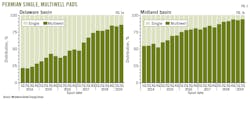

Cube development has gained momentum in the Permian since oil prices started dropping in late 2014. Westwood tracks the distribution of single wells vs multiwell pads in Delaware and Midland basins (Fig. 1).

Jang said some operators not only increase the number of wells drilled per pad but also implement factory-style drilling by constructing multiple pads in a giant pad complex. QEP Resources Inc. and Concho Resources both have used multiple pads.

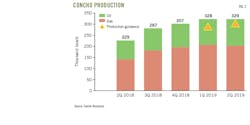

During a second-quarter earnings conference call, Concho Resources’ executives acknowledged the company’s 23-well Dominator pad in the northern Delaware basin failed to meet production expectations.

Concho Resources, a pure-play company based in Midland, operated seven rigs and five fracturing spreads within a 1-mile section. But production, which was 76% oil, declined after an average 60-day peak of 1,120 boe/d. The average 30-day peak was 1,355 boe/d.

“It’s clear it’s just too tight,” Tim Leach, Concho Resources president and chief executive officer (CEO), said, adding he still believes large-scale development is the best strategy.

“Projects will continue to test density and zones. The density will be smaller, both vertically and horizontally,” than Dominator, Leach said, adding he expects Conoco Resources’ optimal project size will prove to be 8 wells to a section.

Westwood’s Jang noted industry’s average Permian well spacing is 600 ft while wells were 300 ft apart in the Dominator pad.

Looking ahead, Concho Resources expects to produce 316,000-322,000 boe/d in third-quarter 2019 compared with second-quarter production of 329,000 boe/d. Concho Resources also plans to sell its interests in 100,000 acres in the New Mexico Shelf to an affiliate of Spur Energy Partners LLC for $925 million. Concho Resources will maintain a development program in southeastern New Mexico.

Separately, Encana’s second-quarter production in the Permian averaged a record 104,000 boe/d, of which 84% was oil and condensate. Encana plans to complete 2019 using four rigs in the Permian.

Executives reported efficiency gains with cube development. Encana brought on two cubes in the second quarter, including a 14-well pad (HNC248) in Martin County, Tex., which averaged 14,900 b/d after 90 days.

During first-quarter 2019, Encana reported full-scale cube development via the Abbie Laine pad from which the company targeted five different pay zones from 12 wells. Each well delivered average 30-day initial production (IP) rates of more than 1,000 boe/d.

Since 2014, Encana has successfully drilled more than 24 cubes in the Permian.

Executives said they can bring a well from spud to sale (cycle time) in less than 80 days in both the Permian and in Canada’s Montney shale, adding they plan to use cube development to improve returns in the Anadarko basin in Oklahoma. They said cube development means shorter cycles, lower drilling costs, and faster conversion of reserves to cash flow.

QEP, Devon upbeat

Timothy Cutt, QEP president and CEO, uses the term tank-style development instead of cube development. He said QEP’s average drilling cost in the Permian is below $6 million/well/10,000 ft lateral with fewer than 12 drilling days to reach true vertical depth.

“QEP remains confident that the tank-style development is the best method to develop our Midland basin acreage,” Cutt said, adding that industry continues to debate the best development approach.

Cutt said QEP believes its tank-style methodology is the most effective, efficient way to develop acreage using proper spacing assumptions and completion techniques. QEP has released one of its three rigs in the Permian and plans to move forward with a two-rig program going into 2020, he said.

Richard Doleshek, QEP executive vice-president and chief financial officer, said the company is cash flow positive with $50/bbl oil.

Tony Vaughn, Devon chief operating officer, said Delaware basin operations are driving Devon’s production growth. He credited Devon’s use of analytics for helping minimize downtime in the field.

Devon also increased productivity in its existing wells through gas lift and rod pump optimization while cutting maintenance cost.

During the first half of 2019, Devon brought more than 50 new wells on stream distributed among the Leonard, Bone Spring, and Wolfcamp formations. These wells achieved average 30-day IP rates of around 2,500 boe/d, Vaughn said.

He said Devon has “very good understanding of lateral and vertical connectivity” in the Wolfcamp.

“We have settled on a development spacing of about 4 to 8 wells per landing zone depending on the oil column, pressure connectivity, and the subsurface variability in southeast New Mexico,” Vaughn said.

Dave Hager, Devon president and CEO, said the Oklahoma City independent plans to allocate more capital to the Delaware.

“We have moved out of an era where we’re doing quite a bit of the appraisal work and moving into a much higher percentage that’s pure development work,” Hager said. “That leads to increased capital efficiency, lowering of the well cost, growing the best wells in the best zones, and higher rates.”

EOG’s conservative approach

EOG Resources Inc. executives have taken a more conservative approach to well pad size, citing concerns over costs and well performance.

EOG limits itself to pads containing 6-8 wells because executives believe the effect to returns is not clear cut without understanding well productivity and other operations costs.

Bill Thomas, EOG CEO, said EOG continues to reduce costs toward its goal of achieving earnings of at least 10% return on capital by 2022 at oil prices below $50/bbl.

“For two quarters in a row, we delivered more oil for less capital,” Thomas said.

Ezra Y. Yacob, EOG executive vice-president of exploration and producion, said EOG brought 65 net Delaware basin wells to sales in second-quarter 2019. EOG holds 416,000 acres in Delaware basin (Fig. 3).

“Our drilling performance continues to benefit from improved downhole motor designs and increased quality assurance,” Yacob said.

“Year-to-date, drilling days are down more than 20% compared to 2018. And we continue to utilize proprietary software to balance our drilling speed and steering to stay within our precision targets.”

Completions costs also are down, 10% compared with 2018, due to improved techniques as well as lower sand and water costs.

EOG’s well productivity rates improved through first-half 2019 across all five Delaware basin targets.

Wolfcamp wells exceeded EOG’s forecast, with 2019 year-to-date operating results being 10% better than 2018.

“Performance of our shallower reservoirs is also improving as we integrate geologic data collected as we develop the deeper targets along with our new completion technology,” Yacob said.

Occidental-Ecopetrol

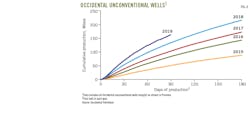

Occidental has customized section development and used next-generation well designs to improve its well performance (Fig. 4). Executives said Oxy uses 28% less proppant than its competitors to save $500 million.

Having acquired Anadarko Petroleum Corp., Occidental notes Anadarko’s acreage is in the middle of Oxy’s core development acres and on trend with Oxy’s Delaware basin geology. The newly acquired acreage will benefit from Oxy’s Aventine logistics supply hub, the company said.

Based on 6-month cumulative oil production, Oxy said it has 26 of industry’s top 100 performing wells in Delaware basin even though the company has drilled only 7% of total Delaware basin wells.

Oxy has entered a joint venture with Colombia’s state-run oil company Ecopetrol SA to develop 97,000 net acres in Midland basin. Oxy is the operator with 51% of the JV while Ecopetrol owns 49%.

The agreement, which is expected to be finalized by Dec. 31, calls for Ecopetrol to pay Oxy $750 million at closing plus an addition $750 million in carried capital. The JV provides Oxy with 51% of the JV production during the carry period while Ecopetrol will pay 75% of Oxy’s share of capital expenditures.

Oxy said the agreement will allow it to accelerate its Midland development plans.

In a second-quarter earnings call, Ecopetrol CEO Felipe Bayon said, “Our expectation is to book around 160 million boe of proved reserves by deal close, which we anticipate before the end of the current year.”

With anticipated continuing Midland basin development, Bayon envisages the joint venture will increase production with Ecopetrol’s share reaching 95,000 boe/d by 2027.

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.