Some Canadian companies post record 3Q profits

A number of Canadian oil and gas companies have posted record earnings for the third quarter.

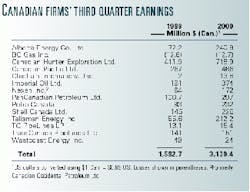

Imperial Oil Ltd., Alberta Energy Co. Ltd., and PanCanadian Petroleum Ltd. were among those Canadian firms reporting record earnings in the third quarter. Other integrated firms, independent producers, and pipeline companies also unveiled strong financial results for the period.

All financial results in this article are in Canadian dollars unless indicated otherwise.

Record earnings

Imperial, the Canadian unit of ExxonMobil Corp., reported a doubling of third quarter profits over 1999 to $374 million from $191 million. The Toronto-based integrated company, which could attain profits of more than of $1 billion for the year, attributed the gains to higher oil and gas prices and improved refinery margins.

Imperial's earnings for the first 9 months of 2000 were $928 million. Analysts estimate the company could earn $1.3 billion this year. Its best previous earnings year was 1997, with $847 million.

Imperial CEO Bob Peterson said strong international markets for crude oil and natural gas, improved industry refining margins, and a solid operating performance were responsible for the gains.

Imperial said third quarter cash flow increased to $433 million from $270 million and revenue rose 31% to $4.59 billion in the quarter. The company said earnings from its Calgary-based resource division rose 69% to $336 million in the third quarter over the same period in 1999.

The company reported natural gas production rose 12% to 516 MMcfd in the third quarter, but oil production fell 16% to 227,000 b/d because of problems at some oil projects in western Canada.

AEC, Calgary, reported third quarter earnings of $241 million, a 225% increase over the same period in 1999.

AEC said earnings for the first 9 months of 2000 were $478.8 million. The company attributed its success to high commodity prices and strategic investments at a time of low commodity prices and inadequate industry returns.

The company said third quarter natural gas production increased 27% to 1.1 bcfd, and production of oil and natural gas liquids rose 10% to 120,000 b/d.

Cash flow increased 107% in the third quarter to $566 million from $273 million for the same period in 1999. Net revenue rose 71% to $1.31 billion.

PanCanadian, Calgary, reported a 194% increase in third quarter profits over the same period in 1999 to $297 million, as well as a doubling of cash flow to $654 million. The company has allocated $2.2 billion for capital spending this year. Pres. and CEO David Tuer said PanCanadian is benefiting from higher production and capital spending at a time when commodity prices for oil and gas are high.

Other strong performances

Petro-Canada, Calgary, reported third quarter profits more than doubled over the same period in 1999, to $232 million from $93 million. The company said profits jumped to $185 million from $83 million, while production fell 3% during the quarter to an average 203,000 boe/d. Profit from refining and retail operations rose 85% to $74 million compared with the same period in 1999. Petro-Canada said it will seek approval from the Toronto Stock Exchange to buy back about 10% of its shares. The purchase of 22 million shares would cost about $713 million based on a recent closing price of $32.40 per share.

Nova Chemical Corp., Calgary, reported a third quarter increase in profits of almost 75% over the same period last year, to $92 million (US). Revenues increased 35% to $988 million (US), compared with $734 million for the same period in 1999. The company said it achieved the strong results despite rising costs for feedstocks and relatively soft demand. Nova said a natural gas hedging program and a price advantage for the feedstock it buys in Alberta helped to increase earnings. There were strong improvements in its ethylene and polyethylene units, where operating earnings rose 47% to $84 million (US).

Husky Energy Inc., Calgary, reported third quarter earnings of $158 million, triple the earnings for the same period in 1999. Husky CEO John Lau attributed earnings gains to high commodity prices, increased production, and the Renaissance Energy Ltd. takeover. Husky said the integration of the two companies is now substantially complete. Husky said net income for the third quarter increased 562% to $139 million and cash flow rose 155% over the same period in 1999 to $388 million. Revenue was $1.35 billion, up from $786 million in third quarter 1999.

Talisman Energy Inc., Calgary, reported a 282% increase in third quarter earnings over the same period last year to $212.2 million. Net income for the first 9 months was $621.2 million, compared with $76.9 million for the first 9 months of 1999. The company said it plans a capital budget of $1.75 billion in 2001 and will also use profits to continue a share buy-back program. Talisman said third quarter production averaged 397,000 boe/d, up 25% from third quarter 1999. It forecast production will increase to about 444,000 boe/d in 2001 and 488,000 boe/d in 2002.

Pipelines

Canadian pipelines fared well in third quarter financial performance as well.

Pipeliner Enbridge Inc., Calgary, logged a 25% increase in third quarter profits to $45.8 million compared with $36.5 million in the same period a year ago. The company operates Canada's largest crude oil pipeline system and a major natural gas utility in Ontario. Enbridge reported a 13% increase in earnings to $322 million for the first 9 months on revenues of $2.4 billion. CEO Brian MacNeill said the company is on track for double-digit earnings per share growth for a second consecutive year.

TransCanada PipeLines Ltd., Calgary, reported a 7% increase in third quarter 2000 earnings to $151 million and says it has achieved a successful turnaround of its operations. The company has sold more than $3 billion in noncore assets in the past year and is focusing on operating gas pipelines and power generation plants. The latter accounted for most of the increase in company earnings in the third quarter. TransCanada reported a decline to date for 2000 on deliveries in its Alberta pipeline system to 12.2 bcfd and said deliveries on its mainline to Eastern Canada and the US were unchanged at 7.3 bcfd.