COMPANY NEWS: Shell to buy Pennzoil-Quaker State for $2.9 billion

Shell Oil Co., a wholly owned member of the Royal Dutch/Shell Group, has agreed to acquire Pennzoil-Quaker State Co. for $1.8 billion in cash and $1.1 billion in debt.

The deal is worth $22/share in cash for Pennzoil-Quaker State, which will be integrated into the Shell Oil Products US lubricants organization and will be based in Houston.

The Pennzoil-Quaker State board has approved the acquisition. Closing remains subject to approval by stockholders and regulatory reviews. The transaction is expected to be completed in the second half and is expected to be accretive to Shell's earnings and cash flow from the first full year after completion.

In other company news, Williams Cos. Inc., Tulsa, agreed to sell its Williams Pipe Line Co. unit to affiliate Williams Energy Partners LP for at least $900 million as the parent continues selling noncore assets in a company restructuring (OGJ Online, Feb. 4, 2002).

In upstream transactions, Santos Ltd., Adelaide, has entered into an agreement to acquire one company and is pondering the takeover of another.

Santos, through its Santos America & Europe Corp. unit, Mar. 18 offered to purchase all outstanding shares of Esenjay Exploration Inc., Houston, for $2.84/share in a deal valued at $153 million (Aus.) ($80 million), including net debt and working capital of about $46.2 million (Aus.) ($24.2 million). Both companies' boards have approved the deal.

In other recent transactions between energy companies:

- Energen Resources Corp., a unit of Energen Corp., Birmingham, Ala., said it would acquire from First Permian LLC, a partially owned unit of Midland, Tex.-based Parallel Petroleum Corp., properties in the Permian basin in West Texas containing 43 MMboe of reserves for $120 million in cash and $70 million in Energen common stock.

- Chesapeake Energy Corp. has proposed to acquire Canaan Energy Corp. for $12/share, valuing the deal at $55 million and at a 31% premium over Canaan's Mar. 11 closing price, Chesapeake said. Chesapeake also would assume about $42 million of Canaan's debt. Both companies are based in Oklahoma City.

- A consortium of France's Gaz de France SA, Russia's OAO Gazprom, and Germany's Ruhrgas AG has jointly bid for a 49% stake in Slovakia's gas company Slovensky Plynarensky Priepysel (SPP). The Slovak government currently holds 100% and would retain 51% interest if it accepts the consortium's offer.

- Finland's Fortum has acquired a 7% stake from Statoil ASA in Mikkel natural gas and condensate field in the Norwegian Sea.

Shell Oil-Pennzoil

Following announcement of the deal Mar. 25, Paul Skinner, managing director of Royal Dutch/Shell and CEO of the group's oil products business, said, "The combination of Shell and Pennzoil-Quaker State Co., the largest independent lubricants company in the world, will make Shell a leader in the US and global lubricants market."

Royal Dutch/Shell had indicated it was looking for an acquisition (OGJ Online, Dec. 17, 2001). But the market expectation was that it would be in the exploration and production segment, said Tyler Dann, analyst with Banc of America Securities LLC

"Our analysis indicates Shell can justify the premium that they paid for Pennzoil-Quaker," he added.

"It's a nice tuck-in acquisition in the US," Dann said, noting that Shell had an 18-month nonexclusive right to the Havoline lubricants brand after the merger of Chevron Corp. and Texaco Inc. forced the sale of some of the former Texaco's downstream assets to comply with federal antitrust rules.

Shell last year bought the former Texaco's share of Equilon Enterprises LLC, while Shell and Saudi Refining Inc. bought Texaco's share of Motiva Enterprises LLC (OGJ Online, Oct. 9, 2001). As a result of those transactions, Shell now owns a 100% interest in Equilon, and Shell and SRI now each own a 50% interest in Motiva.

Motiva refines 800,000 b/d of crude at four refineries and markets branded products through a network of products terminals and nearly 4,800 Shell-branded gasoline stations and almost 8,200 Texaco-branded stations. In July 1998, Shell's eastern and Gulf Coast refining and marketing businesses were combined with similar operations owned by Star Enterprise, a joint venture of Texaco and SRI, through the formation of Motiva.

Equilon operates primarily in the western US and has almost 4,500 Shell-branded gasoline stations and nearly 4,500 Texaco-branded gasoline stations, four refineries, a lubricants business, and an extensive pipeline and terminal network. Equilon was formed in January 1998, when Shell's western and midwestern refining, marketing, trading, transportation, and lubricants businesses were combined with similar operations of Texaco.

Fitch Ratings placed on rating watch positive Pennzoil-Quaker State's BB+ rated senior secured notes and secured bank revolver as well as its B- rated senior unsecured notes following the Shell-Pennozil Quaker State announcement.

Fitch rates Royal Dutch/Shell's long-term debt at AAA and its commercial paper at F1+. The rating outlook on Royal Dutch/Shell is stable.

Meanwhile, Moody's Investors Service placed the ratings of Pennzoil-Quaker State under review for possible upgrade.

Rob Routs, president and CEO of Shell Oil Products US, said the addition of Pennzoil and Quaker State brands of US passenger car motor oil "will ultimately more than replace our use of the Havoline brand and complement Shell's brand strength in diesel engine lubricants."

He also said combining Shell's networks and infrastructure and Pennzoil-Quaker State's oil brands and other businesses, including its network of more than 2,000 Jiffy Lube stores, will position Shell as a leader in the US lubricants and car care business.

Routs pegged pretax benefits from the transaction at $140 million/year by 2004 and costs related to the transaction and to achieving the pretax benefits at $100 million.

Pennzoil-Quaker State CEO Jim Postl said, "Pennzoil-Quaker State will benefit significantly from being part of an enterprise with the geographic scope, operational scale, breadth of products and services, and financial resources necessary to compete in a consolidating industry. This transaction makes the combined Shell and Pennzoil-Quaker State Co. a stronger competitor in the lubricants and car care industry."

Pennzoil Co. and Quaker State merged 4 years ago (OGJ, Apr. 20, 1998, Newsletter), and the upstream portion of Pennzoil changed its name to PennzEnergy Co. (OGJ, Jan. 11, 1999, p. 38). Devon Energy Co. and PennzEnergy merged a year later (OGJ, May 24, 1999, Newsletter).

Williams Pipe Line sale

Williams Pipe Line consists of 6,747 miles of pipeline delivering petroleum products to 11 Midwestern states. Last year, the system transported 260 million bbl. The deal includes 39 storage and distribution terminals having an aggregate storage capacity of 26.5 million bbl.

Williams Cos. originally purchased the pipeline from Great Lakes Pipe Line Co. in 1966 for $287.6 million.

Williams Pres. and CEO Steve Malcolm said the transaction "will add immediate cash, strengthen our balance sheet, and allow us to continue to share in the profitability of the pipeline because of our general and limited partner interests in Williams Energy Partners."

Last month, Williams Cos. announced plans to sell the unit, saying Williams Energy Partners was the likely buyer (OGJ, Feb. 11, 2002, p. 36). The sale is expected to close by the end of the second quarter. Williams Energy Partners is a master limited partnership holding marine and land terminals as well as an ammonia pipeline.

In another recent transaction, Williams announced Mar. 7 that it planned to sell its Kern River Gas Transmission Co. for $960 million in cash and debt to Berkshire Hathaway Inc. unit MidAmerican Energy Holdings Co., Des Moines, Iowa (OGJ, Mar. 18, 2002, p. 43).

Santos-Esenjay deal

Santos's offer for Esenjay was a 4.4% premium to its Mar. 15 closing price, Santos said. Subject to the usual approvals, the companies expect the merger to be completed at the end of the second quarter.

"The United States, with a 23 tcf/year gas market, provides world competitive opportunities and attractive gas market fundamentals," noted John Ellice-Flint, Santos managing director. "In particular, US gas margins are generally better than in Australia," he added.

The deal is expected to add to Santos's portfolio:

- More than 40,000 net acres of prospective leases in Texas and Louisiana, including the Frio, Wilcox, Yegua, and deep Vicksburg trends and the Hackberry embayment.

- 32 new exploration prospects, 22 of which are drill-ready.

- Access to 3,300 sq miles of 3D seismic.

- Reserves of 47.3 bcf of gas and 1 million bbl of oil at yearend 2001.

- Production of 16 MMcfed at yearend 2001.

On a pro forma basis, the deal will increase Santos's yearend 2001 proved and probable reserves in the US to 107 bcf of gas and 2.25 million bbl of oil and liquids. Total US production, meanwhile, is expected to reach 3 MMboe in 2002, Santos said.

Energen's acquisition

Energen said it expects to spend an additional $100 million to develop the West Texas properties, bringing its all-in reserve cost to $6.70/boe or $1.12/ Mcfe. More than 95% of the reserves being acquired are oil.

"We look for long-lived reserves; these reserves have a 27-year life," said Mike Warren, chairman and CEO of Energen. "We want to operate the properties we acquire; more than 90% of the value of these reserves is operated."

Warren added, "While Energen Resources's preference has been and continues to be natural gas, we have consistently stated that we would not shy away from predominantly oil properties that otherwise meet our acquisition criteria."

Chesapeake-Canaan offer

Chesapeake-which says "it would prefer to negotiate a mutually acceptable business combination" with Canaan-has taken its offer directly to Canaan's shareholders, because it has received numerous rejections of its offers for the firm.

"Canaan's small size, poor operating performance since becoming a public company, noncompetitive cost structure (including high general and administrative expenses), and limited access to capital make any internal growth plan virtually impossible to execute," wrote Aubrey K. McClendon, Chesapeake chairman and CEO, in a letter to Canaan shareholders.

Chesapeake on Mar. 15 deferred commencement of the tender, pending talks with Canaan management.

Early last year, Chesapeake completed a $345 million acquisition of Tulsa-based Gothic Energy Corp. (OGJ Online, Jan. 17, 2001).

Consortium's SPP bid

If it accepts the consortium's offer, the Slovak government would retain 51% interest of SPP. The consortium was the only bidder for a stake in SPP. A privatization committee has recommended that the government accept the bid.

SPP is integrated across the natural gas chain and owns a pipeline linking Russian gas producers with European gas distribution companies.

The three consortium partners have cooperated for years in Slovakia's gas industry. Gazprom supplies natural gas to SPP. GdF and Ruhrgas, together with Italian integrated company ENI SPA, are the main buyers of Russian gas and have collaborated with SPP on projects in Slovakia's gas sector.

GdF said the acquisition will bolster its presence in Slovakia, where the company already holds a 30% stake in Pozagas, a developer of underground gas storage facilities.

Fortum acquisition

In February, Mikkel operator Statoil farmed out a 7.9% interest in the field to Italy's Agip SPA (OGJ Online, Feb. 8, 2002).

"These farm-outs are part of [Statoil's] strategy to align interests in the Halten Bank area," said Thor Haakon Helgesen, senior vice-president for the firm's Halten-Nordland business cluster.

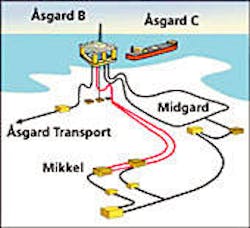

Plans call for Mikkel to come on stream in fall of 2003, Statoil said, with gas from the field will be processed on the Åsgard B gas floater.

Statoil holds 41.62% of Mikkel and serves as field operator; other field partners include ExxonMobil Corp. 33.48% and Norsk Hydro AS 10%.