US NGL pipelines expand to match liquids growth

Estimates place the amount of Y-grade NGL flowing into the Mont Belvieu, Tex., fractionation hub by 2013 at slightly more than 2.1 million b/d, a nearly threefold increase from 2006. Potential expansions could add more than 800,000 b/d to this total depending on market demand.1

NGL pipeline projects to meet this demand are moving forward. Whether from the Marcellus and Utica shales in the Northeast US or Midcontinent Bakken shale, a wide variety of plays in Oklahoma and West Texas, or the Eagle Ford shale in southern Texas, produced NGLs will find a path to market. Most plans ultimately bring liquids to Mont Belvieu, but at least one is progressing that will instead make Marcellus and Utica NGLs available both in Sarnia, Ont., and to potential overseas customers.

This article will address the state of the larger pipeline projects planned to move NGLs from US shale production to market.

Marcellus shale

Enterprise Products Partners LP, Houston, has received sufficient transportation commitments to support development of its 1,230-mile Appalachia to Texas pipeline (ATEX Express), delivering ethane production from the Marcellus-Utica shale of Pennsylvania, West Virginia, and Ohio to the US Gulf Coast. ATEX Express will transport up to 190,000 b/d from Appalachian production to EPP's storage and distribution in Texas.

Originating in Washington County, Pa., the system's first leg would involve construction of about 595 miles of new pipeline extending to Cape Girardeau, Mo., closely paralleling an existing Enterprise pipeline. At Cape Girardeau, Enterprise will reverse a 16-in. OD pipeline and place it into ethane service.

At the southern end of the ATEX Express pipeline, Enterprise will build a 55-mile, 16-in. OD pipeline providing access to NGL storage at Mont Belvieu.

Enterprise is conducting surveys and negotiating right-of-way agreements and expects ATEX Express to begin commercial operations in first-quarter 2014.

US Gulf Coast petrochemical demand for price-advantaged ethane feedstock over crude oil-based derivatives is about 955,000 b/d and continues to increase, Enterprise said.

Chesapeake Energy Corp., Oklahoma City, signed a long-term contract as anchor shipper on ATEX Express in November 2011. The pipeline would have an initial capacity of 125,000 b/d but could be expanded through a combination of additional pumping horsepower and pipeline looping. Chesapeake committed to supply 75,000 b/d for the pipeline's 5-year ramp-up and can secure additional capacity in the project.

ATEX committed shipper transportation rate would range between 14.5 and 15.5¢/gal.

Mariner West, a 75,000-b/d pipeline project jointly developed by MarkWest Liberty Midstream & Resources LLC and Sunoco Logistics LP is to deliver Marcellus ethane to petrochemical markets in Sarnia by third-quarter 2013.

Range Resources Corp. executed an ethane sales contract for its Marcellus shale production with Nova Chemicals Corp. following a binding open season for Mariner West (OGJ, June 6, 2011, p. 88). Under the contract, initial deliveries of ethane are to begin in late 2013 with full delivery starting early 2014. The Mariner West project is to have an initial capacity of up to 50,000 b/d and can be scaled to support higher volumes as needed.

Sunoco Logistics will move the ethane through Mariner West from the Houston complex in southwest Pennsylvania to the international border near Marysville, Mich., for further delivery into Sarnia's petrochemical market.

MarkWest is also this year building pipelines between its Sherwood, Mobley, and Majorsville, W.Va., gas processing centers, all of which will feed into its Houston, Pa., processing and fractionation complex for potential shipment on Mariner West. The pipeline to Houston from Majorsville will deliver ethane produced via de-ethanization capacity being built in Majorsville.2

MarkWest has similar projects under way linking Utica shale processing plants in Monroe and Harrison counties, Ohio, to its Houston, Pa., facilities. The Harrison site will also include fractionation.2

MarkWest's pipeline and de-ethanization processing will also serve other ethane transportation projects, said the company, including Mariner East and Enterprise's ATEX Express. (See article on p. 88 for more details on the growth of gas processing and fractionation in response to shale development in the US.)

Mariner East is proposed to move ethane by pipeline to Philadelphia and from there via ship to either the US Gulf Coast or Europe. The combined Mariner projects would use primarily existing Sunoco pipeline, with an estimated 85 miles of newbuild pipe required. Mariner will have access to ethane storage near Sarnia and would construct new storage at Philadelphia and near Nederland, Tex. MarkWest says the capacity of Sunoco's existing 8-in. OD pipeline to Philadelphia could be increased as demand for Mariner East warrants.

Bakken, Midcontinent

Oneok Partners LP has expanded its NGL projects in the Cana-Woodford shale and Granite Wash plays, adding 75,000-80,000 b/d of raw, unfractionated NGL to its existing gathering systems. Oneok's investments include building more than 230 miles of 10-in. and 12-in. OD NGL pipelines that will expand its existing gathering by connecting to three new third-party natural gas processing plants being constructed with total capacity of 510 MMcfd and to three existing third-party natural gas processing plants undergoing expansion.

Oneok also installed additional pump stations on the Arbuckle Pipeline to increase its capacity to 240,000 b/d. Arbuckle is a 440-mile NGL pipeline running from southern Oklahoma through the Barnett shale of North Texas to the partnership's fractionation and storage at Mont Belvieu on the Texas Gulf Coast.

Oneok expects these projects to be completed during the first half of this year.

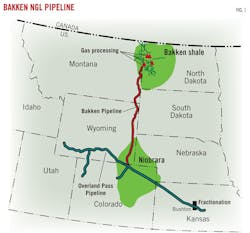

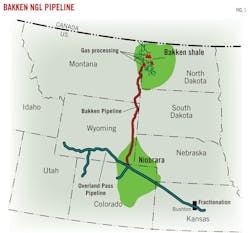

Oneok's construction of a 525- to 615-mile NGL pipeline (the Bakken NGL Pipeline) to transport unfractionated NGL produced in the Bakken to the Overland Pass Pipeline, a 760-mile NGL pipeline extending from southwestern Wyoming to Conway, is now set for 2013 completion (Fig. 1). The company also plans to expand capacity on Overland Pass and at its Bushton, Kan., fractionator to accommodate the additional Bakken volumes. The fractionator's expansion will add 60,000 b/d.

Onoek is also building the 193,000-b/d Sterling III pipeline from the partnership's NGL infrastructure at Medford, Okla., to storage and fractionation at Mont Belvieu. Once completed, it will double the partnership's current pipeline capacity between Medford and Mont Belvieu.

The project also includes reconfiguring the existing Sterling I and II pipelines, which currently distribute NGL purity products between the Midcontinent and Gulf Coast NGL markets, to transport both unfractionated NGLs and NGL purity products.

Construction will begin in early 2013, following receipt of necessary permits and the acquisition of right-of-way. The partnership anticipates using a portion of the existing right-of-way on the Sterling I and II pipelines. Completion is set for late 2013.

With additional pump stations, Sterling III's capacity can be expanded to 250,000 b/d, said the company. It will cross the Woodford shale as well as provide transportation for NGL production from the growing Cana-Woodford shale and Granite Wash, where it can gather unfractionated NGLs from new gas processing plants being built in response to increased drilling in these areas.

DCP Midstream acquired the Seaway Products Pipeline Co. from ConocoPhillips, renamed it the Southern Hills Pipeline, and is in the process of converting it from refined products service to NGL service covering the more than 700 miles between NGL hubs at Conway, Kan., and Mont Belvieu. Southern Hills will offer NGL transportation for Conway, western Oklahoma, and the Granite Wash.

DCP Midstream will add a 130-mile extension from the pipeline's current northern end to Conway and a 30-mile extension to Mont Belvieu, as well as pumping capacity and associated gathering to the current 580-mile pipeline. The pipeline will have a capacity of roughly 150,000 b/d of Y-grade NGL and be connected to several DCP Midstream processing plants and anticipated third-party NGL producers.

DCP Midstream will operate Southern Hills as a common carrier. The company expects it to enter service as early as mid-2013. Acquisition and conversion will cost $750-850 million.

Plains All American Pipeline LP's unit Plains Gas Solutions plans to build a cryogenic gas plant with deep cut ethane-plus recoveries and specification-product fractionation capability at its multiproduct complex near Ross, ND, including rail loading and storage. The NGL portion and the first phase of the crude oil portion of the rail facility were recently commissioned with a design capacity to load 8,500 b/d of NGLs and 20,000 b/d of crude oil.

Ethane will also flow north from Bakken, Canada's National Energy Board having granted Vantage Pipeline Canada ULC approval of its Vantage ethane pipeline in January. It will carry 45,000 b/d of liquid ethane from Hess Corp.'s gas plant near Tioga, ND, through Saskatchewan to interconnect with the Alberta Ethane Gathering System (AEGS) near Empress for use in Alberta's petrochemical industry.

The Canadian portion of the 700-km (435-mile) project will involve building and operating a new 273-mm (10-in.) OD, high-vapor pressure pipeline from the Canada-US border near Beaubier, Sask., to the AEGS, crossing 573.8 km in Saskatchewan and 4.5 km in Alberta. Vantage has routed the pipeline so it will lie within or alongside existing pipeline and road right-of-way for 503.7 km of its route. Vantage will also include 129 km in North Dakota.

Vantage's capacity will be expandable to 60,000 b/d if warranted by production expansion in the Williston basin. Vantage expects to complete construction by yearend.

Texas

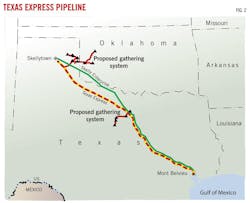

Enterprise Products Partners LP, Enbridge Energy Partners LP, and Anadarko Petroleum Corp. are advancing their Texas Express NGL pipeline, having executed long-term contracts for 232,000 b/d of its capacity. Starting near Skellytown in Carson County, Tex., the 20-in. OD TEP mainline will extend about 580 miles to Enterprise's NGL fractionation and storage at Mont Belvieu, also providing access to third parties in the area (Fig. 2).

Production from the Rockies, Permian basin, and Midcontinent will be delivered into TEP through Enterprise's existing Mid-America Pipeline System, running north through Oklahoma into Conway, Kan., and south into the Permian basin. Enterprise described the project as a bolt-on expansion, enhancing the value of its midstream assets.

The joint venture also includes two new NGL gathering systems. The first will connect TEP to gas plants in the Anadarko-Granite Wash producing area in the Texas Panhandle and western Oklahoma. The second will connect the new pipeline to Barnett shale gas processing in central Texas.

Enterprise will build and operate the pipeline, while Enbridge will build and operate the new gathering. TEP's contracted shippers, including unaffiliated shippers, have tendered 15-year, ship-or-pay transportation agreements for the 232,000 b/d. The contracts include an option allowing shippers to increase their volume commitment.

Enterprise expects the pipeline and related gathering to begin service second-quarter 2013, subject to regulatory approvals.

EPP shippers that last year executed 10-year, firm NGL transportation agreements on its Mid-America Pipeline Rocky Mountain expansion exercised options increasing total commitments by roughly 115%, to 82,500 b/d. The expansion will loop the existing system with 263 miles of 16-in. OD pipeline, as well as modifying pump stations. Capacity will be filled by new gas processing being constructed in the Uinta, Piceance, and Greater Green River basins. EPP described the expansion as complementing TEP.

The US Federal Energy Regulatory Commission approved the MAPL expansion in August 2011. EPP expects to place it in service third-quarter 2014. MAPL's committed shipper transportation rate to Mont Belvieu, subject to annual escalation, is 15.1¢/gal.

Lone Star NGL LLC, a joint venture of Energy Transfer Partners LP and Regency Energy Partners LP, will build the roughly 530-mile West Texas Gateway NGL pipeline from Winkler County to processing in Jackson County, Tex., moving Permian basin production eastward. Lone Star has also secured capacity on ETP's recently announced Justice NGL pipeline from Jackson County to Mont Belvieu.

The new pipeline will have a minimum capacity of 130,000 b/d, with the potential to enlarge depending on demand. The project currently has more than 65% of capacity subscribed under 15-year agreements.

Lone Star expects the pipeline to be completed by first-quarter 2013 at an estimated $700 million, of which Energy Transfer will pay 70% and Regency 30%.

DCP Midstream is developing the new 720-mile Sand Hills pipeline system, which will transport Y-grade NGL from gas plants in the Permian basin and South Texas to various fractionation facilities along the Gulf Coast, including Mont Belvieu. Sand Hills will have an initial capacity of 200,000 b/d, expandable to 350,000 b/d with additional pumping stations.

DCP entered into agreements with Occidental Petroleum Corp. for Oxy's subsidiary Occidental Chemical Corp. to provide right-of-way for Sand Hills and for DCP to provide a supply option for a proposed new Oxy NGL fractionator in Ingleside, Tex.

The agreement with OxyChem will provide the Sand Hills Pipeline with about 14 miles of right-of-way and access to Mont Belvieu fractionation. It also will help keep the West Texas portion of the Sand Hills Pipeline on track for a first-half 2013 start-up, DCP Midstream said. DCP reached a long-term anchor agreement with Targa Resource Partners LLC in May 2011 for capacity at Targa's 100,000-b/d fractionation expansion at Mont Belvieu.

DCP also purchased about 60 miles of existing 20-in. OD pipeline in Andrews and Ector counties, Tex., from Odessa Fuels LLC. DCP will connect the acquired line to the Sand Hills Pipeline, providing incremental NGL transportation to the Mont Belvieu market for Permian basin producers.

DCP expects the newly acquired segment to enter service second-quarter 2013. DCP is building a 75-MMcfd gas plant in Glasscock County, Tex., along with associated low-pressure gathering to handle Wolfberry production in the Permian basin.

DCP expects Sand Hills segments serving Eagle Ford shale producers to enter service third-quarter 2012, shipping gas liquids from DCP's new 200-MMcfd Eagle gas plant. DCP is also securing long-term commitments from third-party shippers and has completed agreements with West Texas LPG Pipeline LP to provide long-term NGL gathering services for Sand Hills through two interconnect points with WTLPG.

Teak Midstream LLC will build a 3-mile, 12-in. OD NGL pipeline to move liquids recovered at its planned Silver Oak processing plant near Pettus, Tex., to Sand Hills.

Enterprise Products Partners increased the size of its planned 127-mile Eagle Ford NGL Y-grade pipeline running between its Eagle Ford shale Yoakum, Tex., gas plant and its fractionation complex at Mont Belvieu to 24-in. from 20-in. to handle additional NGLs from the cryogenic plant. EPP put a fifth NGL fractionator at Mont Belvieu into service in October 2011, bringing total capacity to 380,000 b/d with a sixth under construction, and seventh and eighth announced.

EPP entered into a long-term agreement with Anadarko Energy Services in March 2012 supporting construction of a 173-mile extension of the Eagle Ford NGL pipeline from near Yoakum to Western Gas Partners LP's gas processing in LaSalle County, Tex. EPP expects the 16-in. OD, 140,000 b/d extension to enter service second-quarter 2013.

Crosstex Energy LP is building its Cajun-Sibon extension, a 130-mile, 12-in. OD NGL pipeline. The pipeline will extend Crosstex's existing 440-mile Cajun-Sibon NGL system, connecting its NGL fractionation in south central Louisiana to Mont Belvieu supply pipelines in East Texas.

A long-term ethane sales agreement with Williams Olefins LLC, a subsidiary of Williams Cos., provides a secure market for the project's key product, Crosstex said. Crosstex is negotiating additional long-term agreements for remaining capacity and expects the new pipeline will begin operations at or near its initial capacity of 70,000 b/d.

Crosstex will begin construction third-quarter 2012, with an additional supply connection added to initial plans. The company expects to put the extension into service first-half 2013. The partnership is also expanding its Eunice NGL fractionation to 55,000 b/d from 15,000 b/d, increasing its interconnected fractionation capacity in Louisiana to about 97,000 b/d.

Crosstex estimates the pipeline extension's cost at $230 million.

Export terminals

Enterprise and Targa Resources are among those expanding capacity for export of international grade propane ex-USGC, with Targa bringing 2,500 bbl/hr of semi-ref HD-5 propane capacity on line at its Galena Park, Tex., terminal this quarter and another 5,000 bbl/hr for fully ref low-ethane propane on line there third-quarter 2013. Targa also plans to add an HD-5 de-ethanizer for low-ethane propane at Mont Belvieu third-quarter 2013.

Enterprise will expand its NGLs import-export terminal on the Houston Ship Channel. The expansion will nearly double the fully refrigerated export loading capacity for propane and other NGLs at the terminal to more than 10,000 bbl/hr, while enhancing its ability to load multiple vessels simultaneously. The expansion is to be completed second-half 2012.

Coastal Caverns Inc. (CCI), a unit of the Vitol Group, plans to develop new propane export in conjunction with its LPG storage under development in Beaumont, Tex. The new project will include storage capacity for up to 6 million bbl of domestic and international-grade propane as well as processing capable of handling as much as 100,000 b/d. The first phase of the project will treat and export up to 3 million tons/year of propone starting first-quarter 2013, with a potential second phase allowing for up to 6 million tons/year.

ConocoPhillips, Occidental Energy Ventures Corp., and TransMontaigne Product Services last year signed an agreement to develop an LPG terminal along the Houston Ship Channel. The companies expect the terminal to become operational in 2014, offering import-export capacity for propane and butane to both project partners and third parties. The terminal, on TransMontaigne property, will load refrigerated very large gas carriers at 15,000-20,000 bbl/hr and will be connected to Mont Belvieu storage via an Occidental pipeline.

References

1. Battle, H., "Targa Resources Midstream Update," Purvin & Gertz 25th Annual International LPG Seminar, The Woodlands, Tex., Mar. 6, 2012.

2. Nickerson, R., "The Outlook for NGLs from Marcellus Shale and Mariner Project," Purvin & Gertz 25th Annual International LPG Seminar, The Woodlands, Tex., Mar. 6, 2012.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.