Oil from US shale on track to rise 16% in 2019

US shale operators are on course to increase oil production markedly in 2019. The growth in US onshore production from the first quarter through the fourth quarter could come in at around 1.1-1.2 million b/d, or 16% for the full year, according to Rystad Energy.

After a paltry first quarter, depressed by weather effects, US shale players over the past weeks have assured investors that they will achieve previously communicated production targets, as well as demonstrate excellent capital discipline and cost control.

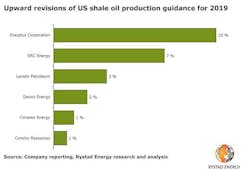

“Despite temporary challenges faced in the beginning of the year, E&P companies are set to deliver on their original production and capital targets, with some being well positioned to perform above initial expectations. US shale players can still be expected to deliver around 16% oil growth in 2019. Several operators have in fact raised their production guidance for the remainder of the year,” says Veronika Akulinitseva, senior analyst at Rystad Energy.

Rystad Energy has analyzed the first quarter results of about 50 US shale operators. The results indicate that US producers, on average, saw a slowdown in oil production growth in the first quarter. Output grew by 0.1% relative to the fourth quarter of 2018.

“The slow first quarter implies an even steeper expected growth curve for the remainder of the year. In fact, acceleration of oil production for many operators is already under way and oil additions are thus likely to increase notably already in the second quarter of 2019,” Akulinitseva said.

Canadian operator Enerplus was the player that raised its oil guidance the most, expecting 10% higher volumes than originally guided. It said growth is already under way and the company is aiming to generate a double-digit rise in production already in the second quarter. Likewise, SRC Energy, an independent operator in the Denver-Julesburg basin, raised its oil target by 7%, attributing the adjustment to overly conservative original guiding.