Rystad Energy: Three trends will sway shale growth in 2019

With US shale activity in 2019 beset by uncertainty, Rystad Energy identifies three trends for US light tight oil production that will have a profound impact on the evolution of the industry in 2019 and 2020.

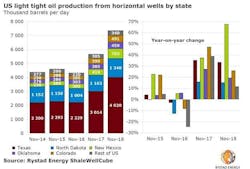

First, New Mexico will have the fastest growth rate in the US. New Mexico has quietly emerged as the new core area of unconventional liquid development in the US. Light, tight oil production in New Mexico has increased by about 70% year-on-year, from 419,000 b/d in November 2017 to 703,000 b/d in November 2018.

“This is the fastest growth rate among all major states with significant shale activity. While New Mexico was not even one of the top three states in terms of completion numbers in 2018, it left all other major states behind on average oil productivity per horizontal well,” said Rystad Energy partner Artem Abramov.

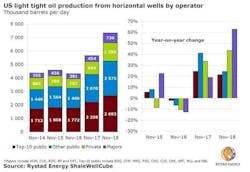

Second, private and major firms will be the “cream of the crop.” Majors and private operators outperformed pure-shale exploration and production firms in 2018. Majors achieved a staggering 64% year-on-year average production expansion as of November 2018 while private operators increased their combined unconventional output by 44% in the same period, twice as much as pure-shale public E&P managed.

“The recent oil price slump is likely to bring about an immediate slowdown in activity among private operators, especially eliminating those who do not have access to core acreage. On the other hand, activity among majors will not be driven by shale-related cash flow balances,” Abramov said. “We expect to see strong resiliency of activity from Chevron [Corp.], ExxonMobil [Corp.], [Occidental Petroleum Corp.], and other majors regardless of degradation in shale-related cash flow balances.”

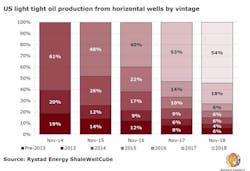

And third, the base-case decline will be steeper and faster. Base decline is the pace at which production falls if no new wells are completed. According to Rystad Energy’s forecast, if no new wells are completed in 2019-20, light, tight oil production is projected to decline by 62%, or 4.5 million b/d.

“It is evident that without an increase in activity levels in terms of new completions, or further increases in well productivity, the pace of growth will decelerate in 2019-20. In fact, if the activity and productivity levels seen in the fourth quarter of 2018 prevail, US light oil production will increase by less than 1.5 million b/d between the fourth quarter of 2018 and the fourth quarter of 2020. This corresponds to a 50% lower growth rate than what was achieved over 2018,” Abramov remarked.