Eclipse, Blue Ridge Mountain agree to merge

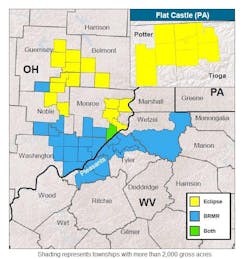

Eclipse Resources Corp., State College, Pa., and Blue Ridge Mountain Resources Inc., Irving, Tex., have agreed to merge in an all-stock transaction. The combine, with an enterprise value of $1.4 billion, will create a large, top-tier Appalachian energy company with 227,000 net effective undeveloped core acres across its Utica and Marcellus footprint with liquids-rich and dry gas optionality with added “stacked pay” development opportunities.

Blue Ridge’s second-quarter reporting showed 99,000 net effective undeveloped core acres in Ohio and West Virginia, 122 MMcfed (81% natural gas, 19% liquids) production, and 4,888 bcfe of total resource potential. Yearend 2017 proved reserves were 357 bcfe (22% liquids). For its second quarter report, Eclipse noted 128,000 net effective undeveloped core acres (54% held by production) and 306 MMcfed (72% natural gas) production (OGJ Online, Jan. 23, 2018).

The merger “checks all the boxes” upon first glance, said Seaport Global Securities analysts in an Aug. 27 note. “The combo solves a lot of issues for [Eclipse]—meaningfully improves leverage, accelerates organic growth, cuts unit costs, and adds higher-quality acreage that steps up inventory years.”

Combined, the company expects 735 net locations, an 94% increase for Eclipse and a 106% increase for Blue Ridge.

Pro forma production is expected to increase to 500-560 MMcfed from second-quarter production of 427 MMcfed. The combine plans a self-funded 2-3 rig development program concentrated on highest returning, low risk, Marcellus and Utica core acreage with capital allocation 85-90% focused on growth-oriented drilling and completion activities. Delineation of Southeast Ohio Marcellus, North Central Pennsylvania Utica, and West Virginia Utica will continue, the companies said, as the combine targets 20% annual production growth and positive 2020 cash flow.

Shared midstream providers along with an expanded production base allow for increased optionality and optimization of midstream and downstream commitments, producer netbacks, and decreasing weighted average transportation costs due to growth in uncommitted combined natural gas volumes, the companies said.

Across the combined asset base, the companies expect $15 million in annual corporate general and administrative savings.

Under the terms deal, a newly formed subsidiary of Eclipse Resources will be merged into Blue Ridge, with Blue Ridge surviving as a wholly owned subsidiary of Eclipse Resources. Eclipse will issue 230 million shares to Blue Ridge shareholders. Eclipse will own 57.5% of the combined company and Blue Ridge will own 42.5%. With Blue Ridge’s $40-million net cash position, the deal is priced at $345 million, Seaport analysts said.

Subject to regulatory approvals, customary conditions, and approval by a majority of Blue Ridge stockholders, the deal is expected to close in this year’s fourth quarter. John Reinhart, president and chief executive officer of Blue Ridge would become president and chief executive officer of the combine.

Contact Mikaila Adams at [email protected].