US Tenth District energy activity showed moderate growth in first quarter

The Federal Reserve Bank of Kansas City’s first-quarter energy survey showed moderately accelerated growth in energy activity in the Tenth District.

The survey monitors oil and gas-related firms located or headquartered in the Tenth District. Survey results reveal changes in several indicators of energy activity, including drilling, capital spending, and employment. Firms also indicate projections for oil and gas prices.

“Regional energy firms reported stronger growth in the first quarter,” said Chad Wilkerson, Oklahoma City branch executive and economist at the Federal Reserve Bank of Kansas City, “They expect only moderate negative effects from announced tariffs.”

According to the survey, all quarterly indexes increased in this year’s first quarter compared with fourth-quarter 2017. The drilling and business activity index increased to 37 from 13. The supplier delivery time index jumped back to positive territory, and total profits, wages, and benefits also increased considerably. The revenues index improved moderately, and the employee hours and employment indexes were marginally higher. The access to credit index inches up to 3 from 0.

Meantime, most year-over-year indexes strengthened and expectations about future indexes continued to improve, as the survey indicated.

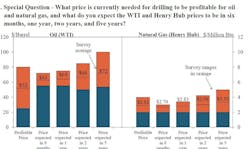

This quarter firms were asked what oil and natural gas prices were needed to be profitable in the areas in which they were active. The average oil price needed was $52/bbl with a range of $25-80/bbl. The average natural gas price needed was $2.92/MMbtu, with responses ranging $2-4/MMbtu.

Firms were again asked what they expected oil and natural gas prices to be in 6 months, 1 year, 2 years, and 5 years. Expected oil prices were up slightly since the last quarter. The average expected West Texas Intermediate prices were $63/bbl, $64/bbl, $66/bbl, and $72/bbl, respectively.

Meanwhile, gas price expectations continued to deteriorate due to the sizable US oversupply and LNG export constraints. The average expected Henry Hub gas prices were $2.70/MMbtu, $2.83/MMbtu, $2.98/MMbtu, and $3.33/MMbtu, respectively.