Lebanon closes in on first offshore bid round

Lebanese officials reported on plans to award four offshore blocks by Nov. 15 in the country’s first attempt at establishing its domestic oil and gas resources. Citing the 150-year history of oil and gas operations worldwide, Minister of Energy and Water Cesar Abi Khalil said, “We’re coming a bit late.” His remarks were made at a roadshow hosted by law firm Mayer Brown on July 6 in Houston.

Lebanon’s path to offshore licensing has been delayed for 3 years but is now coming to fruition with a deadline for bids set for Sept. 15 (OGJ Online, June 17, 2014). As of Apr. 28, the country’s second prequalification round has confirmed ONGC Videsh Ltd. as operator and nonoperators PJSC Lukoil, Sapurakencana Energy Sdn. Bhd., Sonatrach International Petroleum E&P Corp. (SIPEX BVI), Qatar Petroleum International Ltd., Petropars Ltd., JSC Novatek, and New Age (African Global Energy) Ltd.

According to the ministry, 51 companies to date have been qualified to bid in the 2017 round. The 2013 round had prequalified 12 operators to bid along with 34 nonoperating companies. Khalil told the Houston audience that prequalified companies in 2013 would be eligible to participate in the current round provided they still meet the country’s criteria and submit financial statements for 2014-15 (audited) and 2016 (unaudited).

East Mediterranean

Despite the prolonged postponement, Lebanon has worked to better prepare for the current round. “Our goal to strike a commercial discovery by 2019,” Khalil said. To this end, the Lebanese Petroleum Administration (LPA) has covered its offshore region by acquiring 2D seismic over 100% of the available acreage. “We’ve shot 3D seismic over 85% of the offshore territory,” Khalil added.

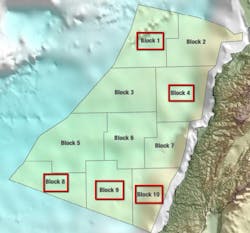

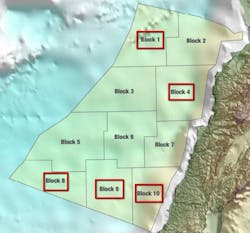

Blocks 3, 5, and 8 comprise the bulk of Lebanon’s deepwater prospects in 1,900 m of water. According to Wissam Chbat, LPA head of geology and geophysics, the southern area (Blocks 8-10) is most prospective for oil with gas and condensate likely in the northern and central sector (Blocks 1 and 4). The Lebanese round is offering five blocks of 10 delineated for the entire sector. The ministry said it will award no more than four blocks in the current round.

Further offshore, the Deep basin contains mainly biogenic hydrocarbons, Chbat said. The Levant margin runs close to shore and the prospective for oil and gas decreases as the water shallows. The northernmost Block 1 is believed to contain both structural and stratigraphic plays featuring Late Cretaceous anticlines in a multistack formation with potential hydrocarbons in Pliocene, Messinian, Oligocene reservoirs. Block 4 in the central offshore contains Late Miocene anticlines. LPA describes a medium-certainty seep in an area where gas chimneys are observed as the Messinian thins with velocity pull-downs.

The southern Block 9 shows large transpressive anticlines with overly deep-rooted structures and faults. Block 9 is believed to contain biogenic gas-filled reservoirs with possible migration of hydrocarbons from deep thermogenic source rocks. “Oil seeps are located above two structures very similar to nearby Karish field,” Chbat said.

Energean Oil & Gas SA plans to bring first gas from its Karish main development in 2020, and the Karish discovery is 6 km from Lebanon’s Block 9 maritime boundary (OGJ Online, June 20, 2017).

The Levant basin has been elevated in recent years after the discoveries of Tamar and Leviathan gas fields in 2009-10. The curve somewhat flattened as Aphrodite and Karish were added in 2011-13, but the giant Zohr gas discovery in 2015 has reinvigorated the exploration cycle in East Mediterranean. Compared with neighbors Israel to the south and Cyprus to west, Lebanon is pure frontier exploration play with a wealth of anologs and new discoveries to provide some confidence in the new acreage available this year.

Political stability

“In Lebanon, when a law is passed it remains unchanged for some time,” Khalil said, citing the difficulty of finally passing the country’s petroleum law in 2007. “Lebanon provides a stable working environment for foreign investors.”

With currently no domestic production of natural gas, Lebanon generates most of its electricity heavy fuel oil. “Energy security is the main pillar of our petroleum law, and we need to switch our power grid to utilize cheaper natural gas,” Khalil said. In the case of a discovery, Lebanon is expecting an increase in construction onshore as power plants will be updated and much of its industrial infrastructure will be updated to accommodate new domestic resources of natural gas.

Lebanon is one of the largest suppliers of concrete in the Middle East and Europe and Khalil cited a need for natural gas to supply the countries ceramic industry.

With nearly 4 years passed since Lebanon first attempted its introductory bid round, the country has paved the way to ease its offshore sector into production. “Lebanon has one of most modern contract structures in the world,” Khalil said, citing that the country’s up front engagement has simplified the bidding process and will prove to pave a smoother path for operators who enter the region to explore for oil and gas. “A large part of the exploration has already been done. It took 4 years but we are prepared,” Khalil said.

Lebanon’s bid round will end on Sept. 15. The awards will be announced on Nov. 15. Lebanon’s Council of Ministers sign exploration and production agreements with awarded companies in January 2018.

Contact Tayvis Dunnahoe at [email protected].