Analysts: Oil industry dealing with downturn better than years past

Investment bankers and analysts entrenched in the oil and gas industry say companies have so far staved off the major negative impacts of the current industry downturn better than previous downturns by acting more proactively and aggressively.

“Companies are more active in dealing with cost and capital issues in the current environment,” explained Osmar Abib, global head of oil and gas at Credit Suisse, during a Mar. 24 media roundtable in Houston. “Capital that has been raised serves as a buffer for the downturn,” he said.

“Capital markets believe in the industry,” said Timothy Perry, co-head of oil and gas, Americas, at Credit Suisse, adding that there’s a belief over time that oil demand will increase and supply will decrease.

Perry said the oil and gas industry is durable because of hedging. Overall, companies now are better managed compared with previous downturns, compensating by taking costs out of services.

Abib noted that exploration and production firms in the US haven’t suffered as much thus far because they carry less variable cost and employ fewer people. However, workers out in the fields are impacted more than technical staff. Perry seconded Abib’s assessment, adding that companies’ fields are diffused around the world, reducing impacts on US E&P companies.

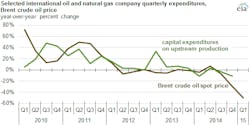

Crude oil prices began their precipitous decline from more than $100/bbl in June 2014 to about half that price this month. The US Energy Information Administration reported this week that, as a result, worldwide “spending on upstream investments was 12% lower in fourth-quarter 2014 compared to the same period in 2013.”

EIA explained, however, that “as oil prices and upstream investment spending fall, reduced demand for rigs and other oil field services will tend to reduce the price of those services. Lower costs for oil services can make upstream investment more attractive and partially offset the effect of reduced upstream budgets on the level of upstream activity.”

Additionally, Wood Mackenzie said this week in a report that global exploration budget cuts will average 30% in 2015, noting that “the industry is addressing a long-standing cost inflation issue,” and “that on average exploration costs will fall by a third, softening the blow of budget cuts.”

Tom Ellacott, vice-president, corporate upstream research at WoodMac, explained, “Cutting back on exploration spend has been a core element in the strategic response to low oil prices. The industry has moved more rapidly than it did during the previous, short-lived, price crash of 2008-09, with spend now expected to be down 30% year-on-year.”

Andrew Latham, vice-president, exploration research at WoodMac, said, “Rising costs are not a new problem for explorers. Over this decade, inflation has more than offset price gains and left much of the industry struggling to create value."

Latham said, “With costs having been a thorny issue for years, the industry has already had plenty of time to drive out inefficiencies, but lower prices will further focus minds and push operators to squeeze harder.”

Woodmac sees drilling activity as set to recover in 2016 “as many explorers seize their chance to drill at lower costs.”

M&A deals to accelerate

Abib expects an increase in announcements of mergers and acquisitions to occur during the second half once companies have finally adjusted to the depressed price environment.

“The asking price right now is too high,” Abib said, adding that current valuations simply haven’t caught up to the current oil price. WoodMac noted in another recent update that deal activity has declined dramatically this year, with associated spend in the first quarter 85% lower than last year’s fourth quarter.

Abib explained that M&A activity is driven by confidence and certainty. Companies right now are still uncomfortable making moves. Ultimately merging or buying is a long-term strategy, and opportunity only presents itself once the stars align. They haven’t so far in this environment.

WoodMac similarly expects the M&A market “to remain depressed until participants reach consensus on oil price and appropriate financial metrics.” It too sees activity picking up in the second half. “But, given the appetite for the best assets, bargain hunting will be difficult,” it observed.

Brian McCabe, co-head of oil and gas, Americas, at Credit Suisse, explained that “M&A activity is not just about company ‘A’ buying company ‘B’” but about putting the buyer in the best position for growth. Companies are generally targeting divisions of sellers.

“It’s a matter of scale,” Abib said. Most companies want a specific set of assets that aren’t for sale, and are forced to buy more of a company—more than they initially set out to acquire—to make a deal happen.

While buyers usually prefer not to buy a public company, Encana Corp.’s acquisition of Athlon Energy Inc. last fall serves as an example to the contrary (OGJ Online, Sept. 29, 2014). In that case, buying Athlon, which held 140,000 net acres in the heart of the oil-rich Midland basin of Texas and New Mexico, offered the best acreage.

Robert Santangelo, co-head of equity capital markets, Americas, at Credit Suisse, added that acreage in the Permian basin is most favored by investors at the moment because of the longer lifespans of its fields.

Despite its rig count nearly halving over the past 15 weeks, Permian production is still expected to rise in April by 21,000 b/d to nearly 2 million b/d (OGJ Online, Mar. 10, 2015). Production from each of the Eagle Ford, Bakken, and Niobrara, meanwhile, is expected to decline during that month.

Companies with capital could eventually swoop in and snatch up assets in those plays—likely during the second half.

Contact Matt Zborowski at [email protected].